How Does Deflation Lead To A Vicious Cycle

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- How Does Deflation Lead To A Vicious Cycle

- Table of Contents

- How Deflation Leads to a Vicious Cycle: A Deep Dive into Economic Downturn

- The Seeds of Destruction: Understanding the Deflationary Spiral

- 1. Delayed Consumption and Reduced Demand:

- 2. Business Investment Plunge: Falling Profits and Debt Burden:

- 3. The Debt Deflation Trap: A Vicious Circle of Debt and Deflation:

- 4. The Wage-Price Spiral in Reverse: Deflationary Wage Cuts:

- 5. The Liquidity Trap: Monetary Policy Ineffectiveness:

- Breaking the Cycle: Strategies to Combat Deflation

- Fiscal Policy Interventions: Government Spending and Tax Cuts:

- Monetary Policy Adjustments: Beyond Lowering Interest Rates:

- Structural Reforms: Addressing Underlying Economic Issues:

- Conclusion: Preventing the Spiral Before It Begins

- Latest Posts

- Latest Posts

- Related Post

How Deflation Leads to a Vicious Cycle: A Deep Dive into Economic Downturn

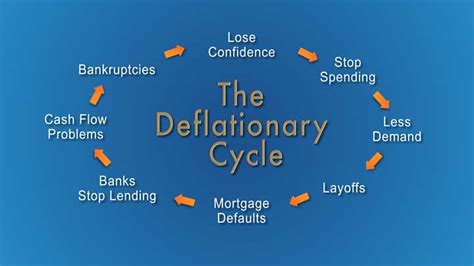

Deflation, a sustained decrease in the general price level of goods and services in an economy over a period of time, might seem like a positive phenomenon at first glance. Lower prices, after all, mean consumers can buy more with their money. However, the reality is far more complex and often devastating. Deflation can trigger a vicious cycle, a downward spiral that can cripple an economy, leading to prolonged recessions and significant economic hardship. This article will explore the mechanisms through which deflation creates this self-reinforcing negative feedback loop.

The Seeds of Destruction: Understanding the Deflationary Spiral

The deflationary spiral isn't a sudden collapse; it's a gradual erosion of economic activity fueled by a series of interconnected factors. The core of the problem lies in the interplay between falling prices, consumer behavior, business decisions, and investor sentiment.

1. Delayed Consumption and Reduced Demand:

The most immediate impact of deflation is on consumer behavior. When prices are falling, consumers delay purchases, anticipating even lower prices in the future. This postponement of spending reduces overall demand for goods and services. This is a crucial element because aggregate demand is a primary driver of economic growth. The logic is simple: if fewer goods and services are being purchased, businesses produce less, leading to job losses and further reducing consumer spending power. This creates a self-feeding cycle of decreased demand.

Example: Imagine you need a new refrigerator. If you hear prices are consistently dropping, you'll likely wait to buy it, hoping to snag a better deal next month. This delay in purchasing, multiplied across millions of consumers, significantly reduces demand for refrigerators, impacting manufacturers and retailers.

2. Business Investment Plunge: Falling Profits and Debt Burden:

Falling prices severely impact businesses' profitability. Reduced consumer demand means lower sales, squeezing profit margins. Companies struggle to maintain their revenue streams, forcing them to cut costs, often through layoffs and reduced investment in new projects or equipment. This further contributes to the decline in aggregate demand. Moreover, deflation increases the real value of debt. When prices fall, the real value of a company's debt increases, making it harder to service loans and potentially leading to bankruptcies.

Example: A clothing manufacturer sees a significant drop in sales due to falling prices. Unable to maintain profitability, it lays off workers, reduces production, and postpones planned investments in new machinery. Simultaneously, the real value of its existing loans increases, further straining its financial position.

3. The Debt Deflation Trap: A Vicious Circle of Debt and Deflation:

Irving Fisher's debt-deflation theory highlights a particularly insidious aspect of deflation. As mentioned earlier, deflation increases the real value of debt. This makes it more difficult for businesses and individuals to repay loans. This leads to increased bankruptcies and defaults, which further reduces aggregate demand and exacerbates deflation. This is a classic example of a self-reinforcing negative feedback loop. The increased debt burden restricts spending, impacting consumer and business confidence, leading to further deflation and even more debt burden.

Example: A small business owner took out a loan to expand operations. Due to deflation, the real value of the loan increases significantly. The business struggles to make payments and eventually defaults, leading to further economic contraction.

4. The Wage-Price Spiral in Reverse: Deflationary Wage Cuts:

In an inflationary environment, we often see a wage-price spiral: rising wages lead to higher production costs, leading to higher prices, and then even higher wages to compensate for increased costs. Deflation reverses this, creating a deflationary wage-price spiral. Falling prices often lead to downward pressure on wages as businesses try to cut costs. Lower wages reduce consumer purchasing power, reinforcing the cycle of falling demand and prices. The vicious cycle intensifies as this downward pressure on wages further reduces aggregate demand, leading to more job losses and even lower wages.

Example: Faced with falling demand and shrinking profit margins, a company implements wage cuts for its employees. This leads to reduced consumer spending, further depressing demand and creating a downward spiral.

5. The Liquidity Trap: Monetary Policy Ineffectiveness:

Central banks typically combat deflation by lowering interest rates. However, during severe deflation, this strategy can become ineffective. This is known as the liquidity trap. When interest rates are already near zero, further reductions have little impact on borrowing and investment. Businesses and consumers are reluctant to borrow even at very low interest rates because they expect future prices to fall further, eroding the value of their investments. This is compounded by the fact that the low rates can't entice people to borrow, which further shrinks the money supply. This further intensifies the deflationary pressures.

Example: Even with interest rates near zero, businesses and consumers remain hesitant to borrow and invest due to deflationary expectations, rendering monetary policy ineffective.

Breaking the Cycle: Strategies to Combat Deflation

Escaping the deflationary spiral requires coordinated efforts from governments and central banks. The strategies often involve a combination of fiscal and monetary policies.

Fiscal Policy Interventions: Government Spending and Tax Cuts:

Governments can stimulate demand by increasing government spending on infrastructure projects, social programs, or direct cash transfers to consumers. These measures directly inject money into the economy, increasing aggregate demand and helping to counteract the deflationary pressures. Tax cuts can also boost consumer spending and business investment. These measures should be targeted and carefully designed to avoid increasing the national debt excessively.

Example: Governments might invest in infrastructure projects like roads and bridges, creating jobs and stimulating economic activity. Similarly, direct payments to citizens can boost their spending and confidence.

Monetary Policy Adjustments: Beyond Lowering Interest Rates:

While lowering interest rates is a traditional approach, during a severe deflation, central banks may need to consider unconventional measures. These include:

-

Quantitative Easing (QE): This involves central banks purchasing assets, such as government bonds, to increase the money supply and lower long-term interest rates.

-

Negative Interest Rates: While controversial, some central banks have experimented with negative interest rates on commercial bank reserves to incentivize lending.

-

Forward Guidance: Central banks can provide clear communication about their future monetary policy intentions to influence expectations and boost confidence.

Example: Central banks can engage in QE by purchasing government bonds, injecting liquidity into the financial system and potentially lowering long-term borrowing costs.

Structural Reforms: Addressing Underlying Economic Issues:

Addressing deflationary pressures might also require structural reforms to improve the long-term health of the economy. These could include measures to increase competition, reduce regulatory burdens, and improve labor market flexibility. These reforms aim to create a more efficient and resilient economy, less susceptible to deflationary shocks.

Example: Governments could implement reforms to streamline regulations for businesses, promoting entrepreneurship and investment.

Conclusion: Preventing the Spiral Before It Begins

Deflation is a serious economic threat that can lead to a self-reinforcing downward spiral, causing significant economic hardship. The key to mitigating the impact of deflation lies in early identification and proactive policy interventions. By understanding the mechanisms driving the deflationary spiral, governments and central banks can develop and implement effective policies to stimulate demand, manage debt, and prevent the economy from falling into a prolonged recession. While monetary and fiscal policies play a critical role, structural reforms aimed at improving long-term economic efficiency are equally crucial for building a resilient economy that can weather deflationary storms. The earlier these interventions are implemented, the greater the chances of preventing the deflationary spiral from taking hold and causing widespread economic damage. Early warning signs and proactive responses are critical to avoid the devastating consequences of a deflationary vicious cycle.

Latest Posts

Latest Posts

-

Kings Catering Will Need A Bigger Kitchen

Apr 01, 2025

-

All Of The Following Are True About A Corporation Except

Apr 01, 2025

-

What Are Stabilization Exercises Particularly Good For

Apr 01, 2025

-

Karen Believes In Cause Related Programs

Apr 01, 2025

-

A Perfectly Competitive Industry Is Characterized By

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about How Does Deflation Lead To A Vicious Cycle . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.