For Each Market Determine Whether Each Market

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- For Each Market Determine Whether Each Market

- Table of Contents

- Determining Market Structure: A Comprehensive Guide

- What is Market Structure?

- Key Market Structures: A Detailed Analysis

- Determining Market Structure in Practice: A Step-by-Step Approach

- Conclusion: The Importance of Market Structure Analysis

- Latest Posts

- Latest Posts

- Related Post

Determining Market Structure: A Comprehensive Guide

Understanding market structure is crucial for businesses of all sizes. It informs strategic decision-making, from pricing and product development to marketing and competitive analysis. This comprehensive guide will delve into the various market structures, providing clear criteria for determining which structure applies to a specific market. We'll explore the characteristics of each, highlighting key differences and providing real-world examples to solidify understanding.

What is Market Structure?

Market structure refers to the characteristics of a market that influence the behavior of buyers and sellers within that market. These characteristics determine the level of competition, the pricing power of firms, and the overall efficiency of resource allocation. Key factors considered include:

- Number of firms: How many firms operate in the market? A few? Many?

- Market share: Does one firm dominate, or is market share relatively evenly distributed?

- Product differentiation: Are products homogenous (identical) or heterogeneous (differentiated)?

- Barriers to entry: How easy or difficult is it for new firms to enter the market?

- Control over price: Do firms have significant control over the price they charge, or are they price takers?

Key Market Structures: A Detailed Analysis

Let's examine the primary market structures:

1. Perfect Competition:

- Characteristics: Perfect competition is a theoretical model characterized by a large number of buyers and sellers, homogenous products, free entry and exit, and perfect information. Firms are price takers—they have no control over the market price.

- Number of firms: Very large, numerous.

- Market share: Each firm has a tiny market share.

- Product differentiation: None; products are identical.

- Barriers to entry: None.

- Price control: No control; firms are price takers.

- Examples: While perfectly competitive markets are rare in reality, agricultural markets (e.g., wheat, corn) often approximate this model, particularly in large, globalized markets. Even then, slight variations in quality, location, and transportation costs can introduce elements of differentiation.

2. Monopolistic Competition:

- Characteristics: Monopolistic competition involves many firms offering differentiated products. There are relatively low barriers to entry, allowing new firms to enter the market with similar but not identical products. Firms have some degree of price control due to product differentiation.

- Number of firms: Many.

- Market share: Relatively small for each firm.

- Product differentiation: Significant; products are similar but not identical (e.g., branding, features, quality).

- Barriers to entry: Relatively low.

- Price control: Some control due to product differentiation.

- Examples: Restaurants, clothing stores, hair salons, and coffee shops are classic examples of monopolistic competition. Each business offers a slightly different product or service, giving them some control over pricing, but competition remains strong.

3. Oligopoly:

- Characteristics: An oligopoly is characterized by a small number of large firms dominating the market. These firms often have significant market power and can influence prices. Barriers to entry are typically high. The behavior of firms in an oligopoly is often interdependent, meaning that the actions of one firm can significantly impact the others.

- Number of firms: Few.

- Market share: Concentrated among a few dominant firms.

- Product differentiation: Can be homogenous or heterogeneous.

- Barriers to entry: High (e.g., high capital costs, economies of scale, patents, government regulations).

- Price control: Significant control; firms can influence prices, often through collusion or price leadership.

- Examples: The automobile industry, the airline industry, and the telecommunications industry are examples of oligopolies. A few large companies control a significant share of the market.

4. Monopoly:

- Characteristics: A monopoly is a market structure characterized by a single firm dominating the market, supplying a unique product with no close substitutes. Barriers to entry are extremely high, preventing new firms from entering. The monopolist has significant control over price.

- Number of firms: One.

- Market share: 100%.

- Product differentiation: Unique product with no close substitutes.

- Barriers to entry: Extremely high (e.g., government patents, control of essential resources, high start-up costs, network effects).

- Price control: Complete control; the monopolist is a price maker.

- Examples: While pure monopolies are rare, examples might include utility companies (in certain geographic areas before deregulation) or companies that have successfully secured patents on crucial technologies for a considerable period. However, even these are subject to varying degrees of government regulation.

5. Duopoly:

- Characteristics: A duopoly is a specific type of oligopoly where only two firms dominate the market. The interactions between these two firms are particularly significant, leading to strategic decision-making heavily influenced by the anticipated actions of the competitor.

- Number of firms: Two.

- Market share: Highly concentrated between the two firms.

- Product differentiation: Can be homogenous or heterogeneous.

- Barriers to entry: High.

- Price control: Significant control, potentially leading to collusive behavior or intense price competition.

- Examples: Historically, Coca-Cola and PepsiCo have often been cited as examples of a duopoly in the cola market, although numerous other beverage companies exist.

Determining Market Structure in Practice: A Step-by-Step Approach

Applying these theoretical models to real-world markets requires careful consideration and analysis. Here's a step-by-step approach:

-

Identify the relevant market: Clearly define the product or service being considered and the geographic area. For example, the market for "soft drinks" is different from the market for "cola" or the market for "diet cola." Geographic boundaries also matter; a local market may have a different structure than a national or global market.

-

Determine the number of firms: How many firms operate within the defined market? A simple count isn't always sufficient. Consider market share concentration – are a few firms responsible for the vast majority of sales? Use measures like the Herfindahl-Hirschman Index (HHI) to quantify market concentration.

-

Analyze product differentiation: Are the products sold by different firms identical, or do they differ in terms of features, branding, quality, or other characteristics? Consider whether these differences are significant enough to affect consumer choices and pricing power.

-

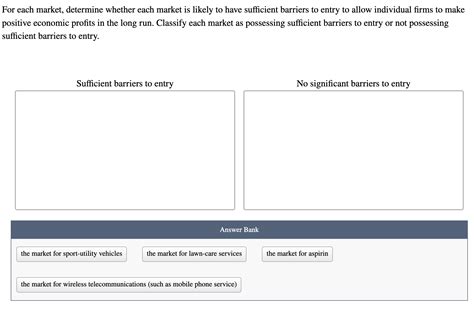

Assess barriers to entry: Evaluate the factors that make it difficult for new firms to enter the market. These can include high start-up costs, economies of scale, patents, government regulations, network effects, or control over essential resources.

-

Examine price control: Do firms in the market have significant control over pricing, or are they price takers? Analyze pricing strategies and responses to competitive actions to assess the level of price control.

-

Consider firm interdependence: In oligopolies, the actions of one firm significantly affect the others. Observe whether firms engage in strategic behavior, such as collusion, price wars, or non-price competition.

-

Evaluate information availability: Perfect information is a key assumption of perfect competition. In reality, information is rarely perfect. Assess the level of information asymmetry among firms and consumers.

By systematically analyzing these factors, you can effectively determine the market structure of a given market. Remember that market structures are not static; they can evolve over time due to technological advancements, changes in consumer preferences, government regulations, and mergers and acquisitions. Continuous monitoring and analysis are essential for a comprehensive understanding.

Conclusion: The Importance of Market Structure Analysis

Understanding market structure is essential for businesses to develop effective strategies. By correctly identifying the market structure, firms can better predict competitor behavior, optimize pricing and output decisions, and ultimately enhance their competitiveness and profitability. While the theoretical models provide a framework, applying these concepts to real-world markets requires careful analysis and consideration of the specific factors at play. This guide provides the necessary tools and steps to make informed assessments, leading to better strategic planning and decision-making. Regular review and adaptation of this analysis are crucial to navigating the ever-evolving landscape of the marketplace.

Latest Posts

Latest Posts

-

Productivity Growth Is Also Closely Linked To

Apr 01, 2025

-

When Sugar Is Mixed With Water Equilibrium Is Reached When

Apr 01, 2025

-

Check In Check Out Managing Hotel Operations Vallen

Apr 01, 2025

-

A Company Sold A Machine For 15000 In Cash

Apr 01, 2025

-

Which Of The Following Is A Value Added Activity

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about For Each Market Determine Whether Each Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.