Exhibit 12-4 Marginal Tax Rate Lines Quizlet

Holbox

Mar 27, 2025 · 5 min read

Table of Contents

Exhibit 12-4 Marginal Tax Rate Lines: A Comprehensive Guide

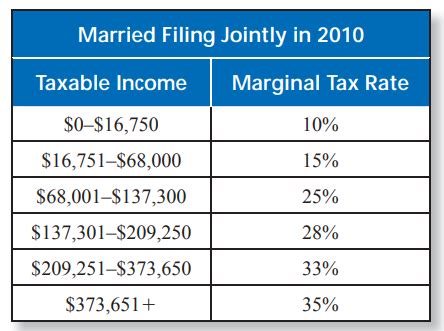

Understanding marginal tax rates is crucial for anyone navigating the complexities of personal finance and taxation. Exhibit 12-4, often found in introductory economics and taxation textbooks (and quizlet study sets!), typically illustrates the relationship between taxable income and the marginal tax rate. This article will delve deep into the concept of marginal tax rates, explain the significance of Exhibit 12-4, and provide a practical understanding of how these rates impact individual financial planning.

What are Marginal Tax Rates?

A marginal tax rate represents the tax rate applied to the last dollar of income earned. It's not the average tax rate you pay across your entire income, but rather the rate on the next increment. Tax systems, particularly progressive systems like those found in many countries, utilize a tiered structure. This means different income brackets are subject to different tax rates.

Understanding the Structure of a Progressive Tax System

A progressive tax system is designed so that higher earners pay a larger percentage of their income in taxes than lower earners. This is achieved through the use of marginal tax rates. Imagine a simplified system with the following brackets:

- 0-10,000: 10% tax rate

- 10,001-30,000: 15% tax rate

- 30,001-50,000: 20% tax rate

- 50,001 and above: 25% tax rate

If you earn $25,000, your marginal tax rate is 15%, because that's the rate applied to the last dollar you earned. However, your average tax rate would be lower because the initial $10,000 was taxed at a lower rate. Calculating your average tax rate involves dividing your total tax liability by your total taxable income.

Exhibit 12-4: A Visual Representation

Exhibit 12-4, as commonly depicted in educational materials, likely uses a graph to visually represent the marginal tax rate schedule. The horizontal axis typically displays taxable income, while the vertical axis represents the marginal tax rate. The graph consists of several horizontal lines, each representing a different tax bracket and its corresponding marginal rate.

Key Features of the Graph (Exhibit 12-4):

-

Step-wise Function: The graph is a step function, not a continuous line. This is because the marginal tax rate remains constant within a specific income bracket. The rate only changes when you move to a higher bracket.

-

Horizontal Lines: Each horizontal line represents a specific marginal tax rate applicable to a particular income range. The length of the horizontal line reflects the width of the income bracket.

-

Points of Discontinuity: The points where the horizontal lines meet indicate the boundaries between income brackets. At these points, the marginal tax rate changes abruptly.

-

Clear Identification of Brackets: The graph clearly illustrates the taxable income range associated with each marginal tax rate. This makes it easy to determine the applicable rate for any given income level.

Interpreting Exhibit 12-4:

To use Exhibit 12-4 effectively, you would locate your taxable income on the horizontal axis. Then, by tracing vertically upwards to the corresponding marginal tax rate line, you can identify your marginal tax rate. Remember, this is the tax rate on the last dollar of your income, not your overall average tax rate.

Calculating Tax Liability Using Marginal Tax Rates:

Let's use the simplified tax brackets mentioned above to illustrate how to calculate tax liability using marginal tax rates:

Suppose your taxable income is $40,000. Here’s the calculation:

- 0-10,000: 10% of $10,000 = $1,000

- 10,001-30,000: 15% of $20,000 = $3,000

- 30,001-40,000: 20% of $10,000 = $2,000

Total tax liability: $1,000 + $3,000 + $2,000 = $6,000

Your average tax rate in this example is $6,000 / $40,000 = 15%. Notice that it's different from your marginal tax rate of 20%.

Importance of Understanding Marginal Tax Rates:

Understanding marginal tax rates is essential for various reasons:

-

Financial Planning: When making financial decisions, such as investing, saving, or taking on debt, knowing your marginal tax rate helps you assess the after-tax implications. For example, you might adjust your investment strategy to minimize your overall tax liability.

-

Tax Optimization: By understanding the structure of marginal tax rates, individuals and businesses can optimize their tax strategies to minimize their tax burden while remaining compliant with the law. Tax professionals use this knowledge extensively.

-

Policy Analysis: Marginal tax rates play a vital role in economic policy debates. Changes to marginal rates can have significant effects on income distribution, economic growth, and investment patterns.

-

Evaluating Tax Reform: Understanding how marginal tax rates are structured is crucial when evaluating proposals for tax reform. Changes to these rates have profound implications on individual taxpayers and the overall economy.

Beyond the Basics: Factors Influencing Marginal Tax Rates

Several factors can influence the marginal tax rate structure:

-

Tax Laws and Regulations: Specific legislation at the national or regional level determines the marginal tax rate structure. These laws are often subject to change.

-

Tax Credits and Deductions: Tax credits and deductions can reduce taxable income, effectively lowering your marginal tax rate. These are vital aspects of tax planning.

-

Tax Brackets: The boundaries of income tax brackets can fluctuate depending on economic conditions, inflation, and government policy.

-

Filing Status: Your filing status (single, married filing jointly, etc.) influences the tax bracket you fall into and your marginal tax rate.

Real-World Applications and Advanced Concepts:

Understanding marginal tax rates extends beyond simple calculations. It's integral to understanding:

-

The Laffer Curve: This economic concept explores the relationship between tax rates and tax revenue. It suggests that extremely high tax rates can actually reduce government revenue by discouraging economic activity.

-

Tax Avoidance vs. Tax Evasion: Knowing the rules surrounding marginal tax rates allows individuals to engage in legitimate tax planning (avoidance) versus illegal activities (evasion).

-

Progressive vs. Regressive Taxation: This highlights the different philosophical approaches to taxation based on their impact on different income levels.

-

Capital Gains Taxes: The tax rates applicable to capital gains (profits from the sale of investments) often differ from ordinary income rates. Understanding these differences is crucial for effective investment strategies.

Conclusion:

Exhibit 12-4, while seemingly a simple graphical representation, serves as a cornerstone for understanding marginal tax rates. Mastering this concept is crucial for anyone seeking to navigate the intricacies of personal finance and taxation effectively. By understanding the structure of marginal tax rates and their impact on financial decisions, individuals can make informed choices, optimize their tax situation, and contribute to a better understanding of economic policy. Remember that tax laws are complex, and consulting a qualified tax professional is highly recommended for personalized advice.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Data Cleansing Activity

Mar 31, 2025

-

Choose The Correct Order Of Steps In The Production Process

Mar 31, 2025

-

Theoretical Basis For Nursing 6th Edition

Mar 31, 2025

-

A Continuing Process Of Identifying Collecting Analyzing

Mar 31, 2025

-

The Entire Principal Of An Interest Only Loan Is The

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Exhibit 12-4 Marginal Tax Rate Lines Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.