Equity Is Composed Of Contributed Capital And .

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

- Equity Is Composed Of Contributed Capital And .

- Table of Contents

- Equity is Composed of Contributed Capital and Retained Earnings: A Deep Dive

- Understanding Equity: The Foundation of a Company's Value

- Contributed Capital: The Initial Investment

- Common Stock: The Backbone of Contributed Capital

- Preferred Stock: A Hybrid Security

- Additional Paid-In Capital (APIC): The Premium

- Treasury Stock: Repurchased Shares

- Retained Earnings: The Accumulated Profits

- Importance of Retained Earnings

- Factors Affecting Retained Earnings

- The Interplay Between Contributed Capital and Retained Earnings

- Analyzing Equity: Key Ratios and Metrics

- Equity and the Financial Statements

- Conclusion: Understanding Equity for Informed Decision-Making

- Latest Posts

- Related Post

Equity is Composed of Contributed Capital and Retained Earnings: A Deep Dive

Equity, the residual interest in the assets of an entity after deducting its liabilities, forms the bedrock of a company's financial structure. Understanding its composition is crucial for investors, analysts, and business owners alike. This article delves into the core components of equity: contributed capital and retained earnings, exploring their individual nuances, interrelationships, and significance in financial reporting and decision-making.

Understanding Equity: The Foundation of a Company's Value

Before we dissect the components, it's vital to grasp the fundamental concept of equity. Simply put, equity represents the ownership stake in a company. It's the difference between what a company owns (assets) and what it owes (liabilities). This residual claim is what belongs to the shareholders or owners. A healthy equity position indicates financial strength and stability, attracting investors and fostering confidence. Conversely, a weak equity position can signal financial distress and raise concerns about the company's long-term viability.

Contributed Capital: The Initial Investment

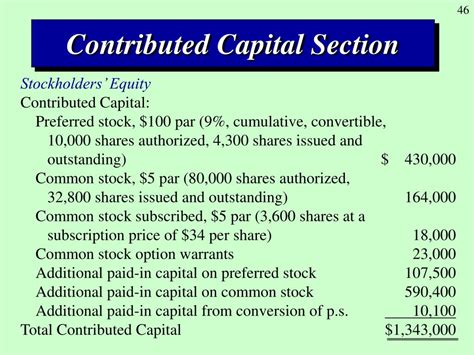

Contributed capital, also known as paid-in capital, represents the funds invested directly into the company by its shareholders. This investment can take various forms, primarily through the issuance of common stock and preferred stock.

Common Stock: The Backbone of Contributed Capital

Common stock is the most prevalent form of equity financing. When a company issues common stock, it's essentially selling a piece of ownership to investors. Common stockholders have voting rights, allowing them to participate in major corporate decisions, such as electing the board of directors and approving mergers and acquisitions. They also share in the company's profits through dividends, although dividends are not guaranteed. The par value of common stock is a nominal value assigned to each share, often a very small amount, primarily for legal and accounting purposes. The actual market value fluctuates based on market forces.

Preferred Stock: A Hybrid Security

Preferred stock occupies a unique position between debt and common equity. It offers features of both. Like debt, preferred stockholders receive a fixed dividend payment, which takes precedence over common stock dividends. However, preferred stock dividends are not legally obligated, similar to common stock dividends. Preferred stockholders also generally have no voting rights, unlike common stockholders. This makes preferred stock a less risky investment than common stock, often attracting investors seeking a stable income stream.

Additional Paid-In Capital (APIC): The Premium

Additional paid-in capital arises when a company issues stock at a price higher than its par value. This excess amount is recorded as APIC, representing the premium investors are willing to pay for the shares. The higher the premium, the more favorable the market perceives the company's prospects. APIC significantly contributes to the overall contributed capital, reflecting investor confidence and the company's perceived value.

Treasury Stock: Repurchased Shares

Treasury stock represents shares that a company has repurchased from its shareholders. This action reduces the number of outstanding shares, potentially increasing earnings per share and boosting the stock price. Treasury stock is a contra-equity account, meaning it reduces the total equity value. While it's technically a reduction in contributed capital, it's a vital element in managing the company's capital structure.

Retained Earnings: The Accumulated Profits

Retained earnings represent the cumulative net income of a company that has not been distributed as dividends to shareholders. It's the portion of profits reinvested back into the business to fuel growth, fund operations, or acquire assets. A healthy level of retained earnings showcases the company's profitability and its ability to generate internal funds for future investments.

Importance of Retained Earnings

Retained earnings are crucial for a company's financial health and future prospects. They provide:

- Internal Funding: Retained earnings offer a readily available source of funding for expansion projects, research and development, equipment upgrades, and other growth initiatives. This reduces reliance on external financing, like debt or equity issuance.

- Financial Stability: A robust retained earnings balance enhances the company's financial stability and resilience against economic downturns or unexpected expenses. It acts as a buffer against potential losses.

- Investor Confidence: High retained earnings demonstrate consistent profitability and responsible financial management, fostering confidence among investors and analysts.

- Dividend Payments: Although retained earnings can be used for various purposes, they represent a potential source of dividend payouts to shareholders, rewarding investors for their investment.

Factors Affecting Retained Earnings

Several factors influence the level of retained earnings:

- Profitability: Higher net income naturally leads to a higher increase in retained earnings. Conversely, losses reduce retained earnings.

- Dividend Policy: The company's dividend policy directly impacts retained earnings. A high dividend payout ratio results in lower retained earnings. A low payout ratio leads to higher retained earnings.

- Stock Repurchases: When a company repurchases its own shares, it reduces the amount available for dividends and subsequently increases retained earnings. However, this is an indirect effect.

- Accounting Adjustments: Errors in prior year's financial statements or accounting changes can necessitate adjustments to retained earnings.

The Interplay Between Contributed Capital and Retained Earnings

Contributed capital and retained earnings are fundamentally intertwined, forming the core components of a company's equity. Contributed capital represents the initial investment in the company, while retained earnings represent the accumulated profits reinvested back into the business. Both contribute to the overall equity value and reflect the company's financial strength and growth potential.

The balance sheet clearly presents this relationship. The equity section distinctly shows contributed capital (common stock, preferred stock, APIC, treasury stock) and retained earnings, highlighting their individual contributions to the overall equity balance.

Analyzing Equity: Key Ratios and Metrics

Analyzing equity involves examining both contributed capital and retained earnings in relation to other financial metrics. Key ratios and metrics include:

- Return on Equity (ROE): This ratio measures a company's profitability relative to its shareholder equity. It indicates how effectively the company is utilizing its equity to generate profits.

- Debt-to-Equity Ratio: This ratio compares a company's debt to its equity, indicating the proportion of financing from debt versus equity. A high ratio suggests higher financial risk.

- Earnings Per Share (EPS): This metric shows a company's profit attributable to each outstanding share of common stock. It is often used to evaluate a company's profitability and growth potential.

- Book Value per Share: This represents the net asset value of a company per share, calculated by dividing shareholder equity by the number of outstanding shares.

Equity and the Financial Statements

Equity is prominently featured on the balance sheet, a critical financial statement providing a snapshot of a company's financial position at a specific point in time. The equity section clearly details the components of contributed capital and retained earnings, offering a transparent view of the company's ownership structure and financial health. Changes in equity are also reflected in the statement of changes in equity, detailing the impact of net income, dividends, and other equity transactions.

Conclusion: Understanding Equity for Informed Decision-Making

Understanding the composition of equity, encompassing contributed capital and retained earnings, is essential for all stakeholders. Investors use this information to assess a company's financial health, growth potential, and investment attractiveness. Analysts rely on equity data to evaluate performance, forecast future trends, and make informed recommendations. Business owners utilize this knowledge to make strategic decisions regarding capital structure, dividend policy, and long-term growth plans. A thorough understanding of equity, its components, and their interplay, empowers informed decision-making, fostering financial success and sustainability. By carefully analyzing contributed capital and retained earnings, stakeholders can gain valuable insights into a company's financial position, strength, and future prospects. This detailed understanding underpins sound investment decisions, effective financial management, and sustainable business growth.

Latest Posts

Related Post

Thank you for visiting our website which covers about Equity Is Composed Of Contributed Capital And . . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.