Economic Surplus Is Maximized In A Competitive Market When

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- Economic Surplus Is Maximized In A Competitive Market When

- Table of Contents

- Economic Surplus is Maximized in a Competitive Market When…

- Understanding Economic Surplus

- Consumer Surplus

- Producer Surplus

- Total Economic Surplus

- Competitive Markets and Surplus Maximization: The Equilibrium Point

- Conditions for Maximum Economic Surplus in a Competitive Market

- 1. Perfect Competition: The Ideal Scenario

- 2. Absence of Market Failures

- 3. Role of Government Intervention

- Beyond the Theoretical Ideal: Real-World Implications

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Economic Surplus is Maximized in a Competitive Market When…

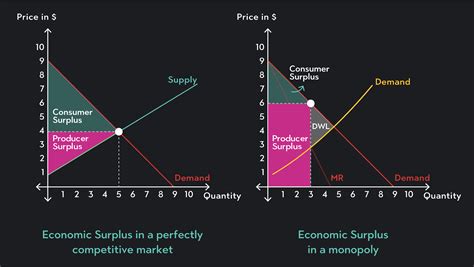

Economic surplus, a cornerstone concept in microeconomics, represents the overall benefit society receives from a market transaction. It's the sum of consumer surplus and producer surplus. A competitive market, characterized by many buyers and sellers, free entry and exit, and homogenous products, is often cited as the ideal environment for maximizing this economic surplus. But when exactly is this maximization achieved? The answer lies in understanding the interplay of supply and demand, the role of perfect information, and the absence of market failures. This article delves into the conditions necessary for a competitive market to achieve maximum economic surplus.

Understanding Economic Surplus

Before diving into the conditions for maximization, let's clarify what constitutes economic surplus.

Consumer Surplus

Consumer surplus is the difference between the maximum price a consumer is willing to pay for a good or service and the actual price they pay. Essentially, it represents the extra value consumers receive beyond what they're paying. For example, if a consumer is willing to pay $10 for a coffee but only pays $5, their consumer surplus is $5.

Factors influencing Consumer Surplus:

- Demand Curve: The downward-sloping demand curve illustrates the inverse relationship between price and quantity demanded. Each point on the curve represents a consumer's willingness to pay for a specific quantity.

- Market Price: The market price determines the actual price paid by consumers. A lower market price leads to a larger consumer surplus.

- Consumer Preferences: Individual preferences and tastes influence a consumer’s willingness to pay and, consequently, their surplus.

Producer Surplus

Producer surplus is the difference between the minimum price a producer is willing to accept for a good or service and the actual price they receive. It represents the profit earned by producers beyond their costs. If a producer is willing to sell a widget for $2 but receives $5, their producer surplus is $3.

Factors influencing Producer Surplus:

- Supply Curve: The upward-sloping supply curve shows the positive relationship between price and quantity supplied. Each point on the curve represents the minimum price a producer needs to supply a specific quantity.

- Market Price: The market price determines the revenue received by producers. A higher market price leads to a larger producer surplus.

- Production Costs: Production costs, including raw materials, labor, and capital, affect the minimum price a producer is willing to accept.

Total Economic Surplus

Total economic surplus is simply the sum of consumer surplus and producer surplus. It's a measure of the overall societal benefit derived from the market transaction. A larger economic surplus indicates greater efficiency and welfare gains.

Competitive Markets and Surplus Maximization: The Equilibrium Point

The magic happens at the equilibrium point – where the supply and demand curves intersect. This point represents the market-clearing price and quantity. In a perfectly competitive market, the equilibrium price and quantity lead to the maximization of total economic surplus.

Why Equilibrium Maximizes Surplus:

At the equilibrium price, the quantity demanded equals the quantity supplied. Any deviation from this point results in a loss of surplus.

-

Prices above Equilibrium: If the price is above equilibrium, quantity demanded falls below quantity supplied, leading to a surplus of goods. This reduces both consumer and producer surplus. Consumers pay more than they're willing to, and producers are unable to sell all they've produced.

-

Prices below Equilibrium: If the price is below equilibrium, quantity demanded exceeds quantity supplied, creating a shortage. This also reduces both consumer and producer surplus. Consumers are unable to purchase the quantity they desire, and producers are potentially leaving money on the table by selling at a price below their willingness to accept.

Conditions for Maximum Economic Surplus in a Competitive Market

While the equilibrium point inherently points towards surplus maximization, several crucial conditions must be met for a competitive market to truly achieve this optimal outcome. These conditions relate to the market structure itself and the absence of market failures.

1. Perfect Competition: The Ideal Scenario

A perfectly competitive market is characterized by:

- Many Buyers and Sellers: No single buyer or seller has the power to influence the market price. Each participant is a price taker.

- Homogenous Products: Goods and services offered are identical, preventing differentiation and price competition based on features or branding.

- Free Entry and Exit: Firms can easily enter and exit the market based on profit opportunities, preventing excessive profits or losses in the long run.

- Perfect Information: Buyers and sellers have complete information about prices, product quality, and market conditions. This transparency is crucial for efficient allocation of resources.

- No Externalities: There are no external costs or benefits imposed on third parties not directly involved in the transaction. For example, pollution from production isn't factored into the market price.

The Importance of Perfect Competition:

Perfect competition ensures that resources are allocated efficiently. The free entry and exit of firms, along with the price-taking behavior of both buyers and sellers, guarantee that prices reflect the true marginal cost of production and the true marginal benefit to consumers. This alignment ensures the equilibrium price maximizes total economic surplus.

2. Absence of Market Failures

Market failures prevent the competitive market from achieving maximum economic surplus. Key market failures include:

-

Monopolies: A single seller controls the market, allowing them to restrict output and charge higher prices, reducing consumer surplus and increasing producer surplus, but leading to a net loss of total surplus compared to perfect competition.

-

Oligopolies: A few large firms dominate the market, often engaging in collusive behavior that restricts competition and reduces total economic surplus.

-

Externalities: External costs (like pollution) or benefits (like vaccinations) not reflected in the market price lead to inefficient allocation of resources and a divergence from maximum economic surplus.

-

Information Asymmetry: When one party has more information than the other, it can lead to inefficient outcomes and reduced economic surplus. For instance, a seller knowing more about product quality than a buyer can exploit this informational advantage.

-

Public Goods: Non-excludable and non-rivalrous goods (like national defense) are under-provided by the free market due to the free-rider problem, leading to a lower than optimal level of economic surplus.

3. Role of Government Intervention

In cases of market failures, government intervention may be necessary to correct the inefficiencies and restore maximum economic surplus. Such interventions can include:

- Antitrust laws: To prevent monopolies and promote competition.

- Regulations: To address negative externalities like pollution.

- Subsidies: To encourage the production of goods with positive externalities.

- Public provision: To supply public goods.

Beyond the Theoretical Ideal: Real-World Implications

While the concept of perfect competition provides a useful benchmark for maximizing economic surplus, real-world markets rarely achieve this ideal. However, understanding the conditions for maximum surplus allows policymakers and businesses to strive toward more efficient and welfare-enhancing outcomes. Policy interventions aimed at reducing market failures, promoting competition, and ensuring information transparency can help move markets closer to the ideal of maximizing total economic surplus.

Factors influencing real-world market outcomes:

- Transaction Costs: The costs associated with searching for information, negotiating prices, and enforcing contracts can affect the efficiency of resource allocation.

- Government Regulations: While some regulations improve market efficiency, others can hinder competition and reduce total surplus.

- Technological Change: Innovation and technological advancements can significantly alter market structures and potentially affect the maximization of economic surplus.

Conclusion

Economic surplus is maximized in a competitive market when the market operates under conditions of perfect competition, and market failures are minimized. The equilibrium price and quantity at the intersection of supply and demand curves represent this optimal outcome. While perfect competition is a theoretical ideal, understanding its characteristics, along with the types of market failures that can prevent surplus maximization, provides a framework for improving market efficiency and creating better outcomes for society as a whole. Striving for conditions that are closer to perfect competition, even if never fully attainable, ultimately promotes economic welfare and maximizes the overall societal benefits derived from market transactions.

Latest Posts

Latest Posts

-

Iso Certification Is Similar To The Baldrige Award

Apr 01, 2025

-

Which Of The Following Is A Function Of A Protein

Apr 01, 2025

-

Your Internet Is Out And Devices

Apr 01, 2025

-

Which Equation Represents The Function Graphed On The Coordinate Plane

Apr 01, 2025

-

Explain What The Credit Terms Of 2 10 N 30 Mean

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Economic Surplus Is Maximized In A Competitive Market When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.