Ebit Is Another Term For Blank______.

Holbox

Mar 12, 2025 · 6 min read

Table of Contents

EBIT is Another Term for Operating Income: A Deep Dive into Financial Analysis

EBIT, or Earnings Before Interest and Taxes, is another term for operating income. Understanding EBIT is crucial for anyone involved in financial analysis, investing, or business management. It provides a clear picture of a company's profitability from its core operations, independent of financing and tax considerations. This comprehensive guide will explore EBIT in detail, explaining its calculation, significance, limitations, and how it compares to other profitability metrics.

What is EBIT? A Clear Definition

EBIT represents a company's profit from its main business activities before deducting interest expenses (related to debt financing) and income taxes. It focuses solely on the operational efficiency and performance of the company. Think of it as the "pure" profit generated from the company's day-to-day operations. By isolating these factors, EBIT provides a more standardized measure of profitability that can be easily compared across different companies, even those with varying capital structures and tax situations.

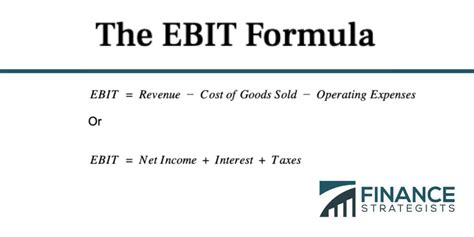

The Formula for Calculating EBIT

The EBIT formula is straightforward:

EBIT = Revenue - Cost of Goods Sold (COGS) - Operating Expenses

Let's break down each component:

-

Revenue: This is the total income generated from the company's primary business activities. It includes sales, service revenue, and any other income directly related to the core operations.

-

Cost of Goods Sold (COGS): This includes the direct costs associated with producing the goods or services sold. For a manufacturer, this would encompass raw materials, direct labor, and manufacturing overhead. For a service company, it might include direct labor and materials costs.

-

Operating Expenses: These are the expenses incurred in running the day-to-day operations of the business. This includes salaries, rent, utilities, marketing expenses, research and development, and administrative costs. It excludes interest expense and taxes.

Example Calculation of EBIT

Let's illustrate with a simple example:

Imagine a company with:

- Revenue: $1,000,000

- COGS: $400,000

- Operating Expenses: $300,000

Using the formula:

EBIT = $1,000,000 - $400,000 - $300,000 = $300,000

This means the company's operating income or EBIT is $300,000.

Why is EBIT Important? Key Applications and Uses

EBIT serves several critical purposes in financial analysis and decision-making:

1. Assessing Operational Performance

EBIT is a powerful tool for evaluating a company's operational efficiency. By excluding interest and taxes, it isolates the performance of the core business. A high EBIT indicates strong operational performance, efficient cost management, and robust revenue generation. Conversely, a low or negative EBIT suggests operational weaknesses requiring attention.

2. Comparing Companies with Different Capital Structures

Companies with varying levels of debt financing will have different interest expenses. EBIT allows for a more equitable comparison of profitability across companies, irrespective of their financing choices. Two companies with similar revenues and operating expenses might have drastically different net income due to different debt levels, but their EBIT will offer a better comparison of operational performance.

3. Evaluating the Effectiveness of Management

EBIT provides a measure of how effectively management is running the core business. It reflects their ability to control costs, generate revenue, and manage operational processes. Analyzing EBIT trends over time can reveal improvements or deteriorations in management's efficiency.

4. Investment Analysis

Investors often use EBIT in valuation models, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and discounted cash flow analysis. EBIT provides a clearer picture of the company's cash-generating potential from its operations, facilitating more informed investment decisions.

5. Creditworthiness Assessment

Lenders and credit rating agencies often use EBIT as a key indicator of a company's creditworthiness. A higher EBIT demonstrates a greater ability to service debt obligations, making the company a lower-risk borrower.

EBIT vs. Net Income: Key Differences

While both EBIT and net income measure profitability, they differ significantly in their scope:

-

EBIT (Operating Income): Focuses on profitability from core operations, excluding interest and taxes. It provides a measure of operational efficiency and performance.

-

Net Income: Represents the company's overall profit after deducting all expenses, including interest, taxes, and other non-operating items. It's the "bottom line" profit, reflecting the company's overall financial health.

The key distinction is that EBIT isolates operational performance, while net income reflects the overall financial outcome after considering financing and taxation.

Limitations of EBIT

While EBIT is a valuable metric, it has some limitations:

-

Non-cash items: EBIT doesn't account for non-cash items like depreciation and amortization. These can significantly impact a company's cash flow and long-term sustainability. EBITDA is often used to address this limitation.

-

Industry variations: The significance of EBIT can vary across industries. Capital-intensive industries might have higher depreciation and interest expenses, making EBIT less relevant compared to industries with lower capital requirements.

-

Potential for manipulation: Aggressive accounting practices can artificially inflate or deflate EBIT. It's crucial to analyze EBIT in conjunction with other financial statements and metrics to identify potential manipulations.

-

Lack of context: EBIT alone doesn't provide a complete picture of a company's financial health. It should be analyzed in conjunction with other profitability ratios, balance sheet information, and cash flow statements.

EBIT and Other Profitability Metrics: A Comparative Analysis

EBIT is often used in conjunction with other profitability metrics to gain a comprehensive understanding of a company's financial health. Here's a comparison with some key metrics:

-

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Adds back depreciation and amortization to EBIT, providing a measure of cash flow from operations. Frequently used in valuation and leveraged buyout analysis.

-

Gross Profit: Revenue minus COGS. Indicates the profitability of the core product or service offerings.

-

Net Income: The company's overall profit after all expenses, including interest and taxes. Reflects the ultimate profitability and financial health of the company.

-

Profit Margin: Expressed as a percentage, profit margin indicates the profitability relative to revenue. Various profit margins exist (gross profit margin, operating profit margin, net profit margin) depending on the profit metric used in the numerator.

By analyzing these metrics together, investors and analysts can gain a more holistic perspective of the company's financial performance.

EBIT: A Powerful Tool for Financial Analysis

EBIT, or operating income, is a crucial metric for assessing a company's operational performance and profitability. While it has limitations, its ability to isolate operational efficiency and facilitate comparison across companies with different capital structures makes it an invaluable tool for financial analysis, investment decisions, and creditworthiness assessments. Remember to always consider EBIT in conjunction with other financial metrics and qualitative factors for a comprehensive understanding of a company's financial health and prospects. Understanding EBIT is a critical step in mastering financial statement analysis and making informed decisions in the world of finance.

Latest Posts

Latest Posts

-

Lokes Was Thrilled When She Found A Low Cost Airfare

Mar 12, 2025

-

Match The Description With The Appropriate Business Process Terms

Mar 12, 2025

-

Question Corndog Draw The Skeletal Structure

Mar 12, 2025

-

The Table Shows The Utility A College Student Obtains

Mar 12, 2025

-

Match Each Description To The Appropriate Xbrl Terms

Mar 12, 2025

Related Post

Thank you for visiting our website which covers about Ebit Is Another Term For Blank______. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.