Describe The Final Step In The Adjusting Process

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

- Describe The Final Step In The Adjusting Process

- Table of Contents

- The Final Step in the Adjusting Process: Review, Refine, and Report

- Understanding the Importance of the Final Review

- Key Components of the Final Review and Refinement Stage

- 1. Comprehensive Data Verification

- 2. Internal Consistency Check

- 3. External Validation (Where Applicable)

- 4. Documentation and Reporting

- Refining the Adjustment Process Based on Findings

- Reporting and Communication of Adjusted Information

- Practical Examples Across Different Fields

- Accounting:

- Insurance Claims:

- Project Management:

- Conclusion: The Cornerstone of Accuracy and Reliability

- Latest Posts

- Latest Posts

- Related Post

The Final Step in the Adjusting Process: Review, Refine, and Report

The adjusting process, whether in accounting, insurance claims, or even personal life adjustments, is a multi-step journey. While each step is crucial, the final step holds a unique significance: it's where all the hard work culminates, errors are caught, and the final product is presented. This final step is not simply about ticking off a box; it's about ensuring accuracy, consistency, and a clear understanding of the adjustments made. This article will delve into the intricacies of this critical phase, providing actionable strategies for professionals across various fields.

Understanding the Importance of the Final Review

Before diving into the specific tasks, let's highlight why the final review is paramount. A rushed or overlooked final review can lead to several negative consequences:

- Inaccurate Reporting: This can have serious financial ramifications, leading to misrepresentation of financial statements, incorrect claim payouts, or flawed projections.

- Missed Opportunities: A thorough review can reveal hidden patterns, insights, or opportunities that were missed during the initial adjustment process.

- Reputational Damage: Inaccurate or incomplete adjustments can damage credibility and trust, especially in professional fields where accuracy and reliability are paramount.

- Legal Issues: In certain contexts, like insurance claims or financial auditing, inaccurate adjustments can lead to legal repercussions.

Key Components of the Final Review and Refinement Stage

The final step typically involves several interconnected components:

1. Comprehensive Data Verification

This involves meticulously checking all data points used in the adjusting process. This step goes beyond simply verifying numbers; it includes:

- Source Document Verification: Confirming the accuracy and authenticity of all source documents used to support the adjustments. Are the dates correct? Are the amounts consistent across all documents? Are there any missing or contradictory documents?

- Calculation Verification: Double-checking all calculations performed during the adjustment process. Use independent methods or tools to ensure accuracy. Look for inconsistencies and potential mathematical errors.

- Data Consistency: Ensuring consistency across different data sets. Are the figures aligned across various reports and spreadsheets? Are there any discrepancies that need investigation?

2. Internal Consistency Check

Once data verification is complete, the focus shifts to internal consistency within the adjusted information. This entails:

- Logical Flow: Does the adjusted information make logical sense given the context? Are there any unexpected or unusual fluctuations that require further investigation?

- Alignment with Policies & Procedures: Does the adjusted information adhere to all relevant policies, procedures, and regulations? Any deviation needs to be justified and documented.

- Benchmarking & Comparison: Where appropriate, compare the adjusted information to previous periods, industry benchmarks, or similar cases. Significant deviations warrant a deeper examination.

3. External Validation (Where Applicable)

In many professional settings, external validation plays a vital role. This often involves:

- Peer Review: Seeking input from a colleague or peer to review the adjusted information and provide an independent assessment. A fresh set of eyes can often identify overlooked errors or inconsistencies.

- Expert Consultation: In complex situations, consulting with an expert in the relevant field may be necessary to validate the adjustments and ensure accuracy.

- Regulatory Compliance: Ensuring compliance with all relevant regulatory requirements. This is particularly critical in regulated industries like finance, healthcare, and insurance.

4. Documentation and Reporting

Accurate and thorough documentation is essential. This includes:

- Detailed Audit Trail: Maintaining a detailed record of all adjustments made, including dates, reasons, and supporting documentation. This is crucial for transparency and traceability.

- Clear and Concise Reporting: Presenting the adjusted information in a clear, concise, and easily understandable format. Use appropriate visual aids, such as charts and graphs, to enhance understanding.

- Summary of Findings: Providing a clear summary of the adjustments made, including the impact on key figures and overall conclusions.

Refining the Adjustment Process Based on Findings

The final review is not solely about identifying errors; it’s also an opportunity to refine the adjusting process itself. The findings from the final review can lead to:

- Improved Data Collection Methods: If data quality issues were identified, this is an opportunity to improve data collection methods to prevent similar problems in the future.

- Enhanced Procedures & Controls: If weaknesses in the adjustment process were revealed, this is an opportunity to strengthen internal controls and procedures to improve accuracy and efficiency.

- Training and Development: If errors were attributed to a lack of knowledge or skills, this is an opportunity to provide additional training and development to improve the competence of personnel involved in the adjusting process.

Reporting and Communication of Adjusted Information

The final step culminates in the reporting and communication of the adjusted information. This needs to be tailored to the audience and the context:

- Formal Reports: For financial statements, insurance claims, or other formal settings, a formal report is required, adhering to established standards and guidelines.

- Informal Communication: For internal adjustments or less formal settings, a less formal communication method might suffice, but clarity and accuracy remain vital.

- Stakeholder Engagement: Ensure appropriate stakeholders are informed of the adjusted information and any relevant implications. This might involve presentations, meetings, or written correspondence.

Practical Examples Across Different Fields

Let's explore how the final step manifests in different contexts:

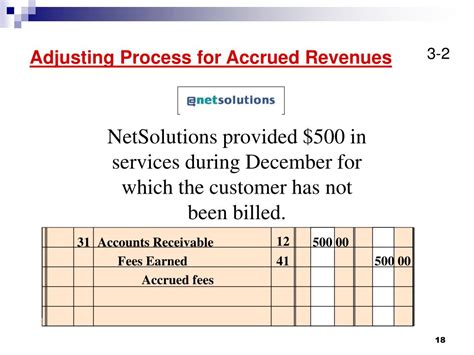

Accounting:

In accounting, the final step involves a thorough review of adjusted trial balances, ensuring all adjustments are correctly posted and reflected in the financial statements. This includes verifying the accuracy of adjusting entries, checking for any mismatches, and ensuring compliance with Generally Accepted Accounting Principles (GAAP). The final step would culminate in the preparation of audited financial statements.

Insurance Claims:

In insurance claims, the final step involves a detailed review of all supporting documentation, verifying the accuracy of the claim amount and ensuring it aligns with the policy terms and conditions. This includes confirming the extent of the damages, reviewing medical reports (if applicable), and ensuring all necessary forms are completed. The final step would be the approval and disbursement of the claim.

Project Management:

In project management, the final step might involve a thorough review of project deliverables, ensuring they meet the specified requirements and quality standards. This includes evaluating project performance against the baseline plan, identifying any variances, and documenting lessons learned. The final step is the project closure report.

Conclusion: The Cornerstone of Accuracy and Reliability

The final step in the adjusting process is not merely a procedural formality; it's the cornerstone of accuracy, reliability, and accountability. A thorough and meticulous final review ensures the integrity of the adjusted information, minimizes the risk of errors, and enhances the overall credibility of the process. By diligently applying the principles outlined in this article, professionals can ensure the final step strengthens their work and fosters trust with stakeholders. Remember, the value of a thorough final review is immeasurable – it's the difference between a job well done and a potentially catastrophic oversight.

Latest Posts

Latest Posts

-

How Tall Is 130 Cm In Feet

May 21, 2025

-

How Much Is 83 Kg In Stones

May 21, 2025

-

183 Cm To Inches And Feet

May 21, 2025

-

22 Lbs Is How Many Kg

May 21, 2025

-

122 Cm To Feet And Inches

May 21, 2025

Related Post

Thank you for visiting our website which covers about Describe The Final Step In The Adjusting Process . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.