Days Sales Uncollected Is Computed By

Holbox

Mar 29, 2025 · 5 min read

Table of Contents

- Days Sales Uncollected Is Computed By

- Table of Contents

- Days Sales Outstanding (DSO): A Comprehensive Guide to Calculation and Interpretation

- Understanding the Components of the DSO Calculation

- How to Compute Days Sales Outstanding (DSO)

- Example Calculation of DSO

- Interpreting the DSO

- Improving DSO

- DSO vs. Other Key Metrics

- Conclusion: Mastering DSO for Enhanced Financial Performance

- Latest Posts

- Latest Posts

- Related Post

Days Sales Outstanding (DSO): A Comprehensive Guide to Calculation and Interpretation

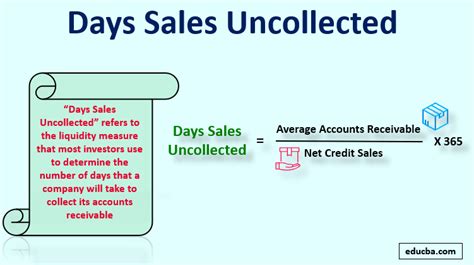

Days Sales Outstanding (DSO), also known as Days Receivable Outstanding, is a vital key performance indicator (KPI) that measures the effectiveness of a company's credit and collection process. It represents the average number of days it takes a company to collect payment after a sale has been made on credit. A lower DSO indicates efficient credit management and quicker cash flow, while a higher DSO suggests potential problems with outstanding receivables and potentially strained cash flow. Understanding how DSO is computed, interpreted, and improved is crucial for businesses of all sizes.

Understanding the Components of the DSO Calculation

Before delving into the calculation itself, let's clarify the key components:

-

Accounts Receivable (AR): This represents the total amount of money owed to a company by its customers for goods or services sold on credit. This figure is typically found on the balance sheet.

-

Net Credit Sales: This refers to the total revenue generated from credit sales during a specific period, excluding sales tax and any returns or allowances. This data is usually found in the income statement. It's crucial to use net credit sales, as gross sales would inflate the DSO calculation.

-

Number of Days in the Period: This is simply the number of days in the period for which you're calculating the DSO (e.g., 30 days for a monthly calculation, 365 days for an annual calculation).

How to Compute Days Sales Outstanding (DSO)

The basic formula for calculating DSO is:

DSO = (Average Accounts Receivable / Net Credit Sales) x Number of Days in the Period

Let's break this down further:

1. Calculate Average Accounts Receivable:

To obtain the average accounts receivable, you typically use the beginning and ending accounts receivable balances for the period. The formula is:

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

For more accurate results, especially for businesses with fluctuating receivables, you might consider averaging accounts receivable over multiple periods or using a weighted average. However, the simple average method is often sufficient for initial analysis.

2. Determine Net Credit Sales:

This involves identifying the total revenue generated from credit sales within the chosen period. Carefully review your financial statements to isolate credit sales and subtract any returns, allowances, or discounts.

3. Apply the DSO Formula:

Once you have the average accounts receivable and net credit sales figures, plug them into the main DSO formula along with the number of days in the period.

Example Calculation of DSO

Let's illustrate with a hypothetical example:

Suppose a company has the following figures for the month of August:

- Beginning Accounts Receivable (August 1st): $50,000

- Ending Accounts Receivable (August 31st): $60,000

- Net Credit Sales (August): $200,000

- Number of Days in the Period (August): 31 days

1. Calculate Average Accounts Receivable:

Average Accounts Receivable = ($50,000 + $60,000) / 2 = $55,000

2. Apply the DSO Formula:

DSO = ($55,000 / $200,000) x 31 days = 8.58 days

Therefore, the company's DSO for August is approximately 8.58 days. This means, on average, it takes the company about 8.58 days to collect payment after making a credit sale.

Interpreting the DSO

The interpretation of the DSO depends heavily on industry benchmarks and the company's own historical data. A low DSO is generally favorable, indicating efficient collection practices. However, an excessively low DSO might suggest overly restrictive credit policies that could hinder sales growth.

Conversely, a high DSO suggests potential issues:

- Slow-paying customers: The company may have a significant number of customers who consistently delay payments.

- Inefficient collection processes: The collection department may lack effective strategies or resources.

- Poor credit risk assessment: The company might be extending credit to customers with a high risk of default.

- Accounting errors: Inaccuracies in recording or tracking receivables can lead to an inflated DSO.

Benchmarking your DSO against industry averages is essential for context. Industry-specific DSO benchmarks can be found through industry reports, financial analysis websites, and professional networking groups.

Improving DSO

Addressing a high DSO requires a multi-pronged approach focusing on several key areas:

1. Strengthen Credit Policies:

- Implement stricter credit checks: Thoroughly assess the creditworthiness of potential customers before extending credit.

- Set clear payment terms: Establish and communicate clear payment deadlines to customers.

- Offer discounts for early payment: Incentivize prompt payment by offering discounts to customers who pay within a specified timeframe.

2. Enhance Collection Procedures:

- Develop a robust collection process: Establish clear procedures for following up on overdue payments, including automated reminders and personalized communication.

- Utilize technology: Implement accounting software and collection management tools to streamline processes and track receivables efficiently.

- Assign dedicated collection personnel: Designate individuals or teams specifically responsible for managing the collection process.

3. Improve Customer Communication:

- Maintain open communication: Regularly communicate with customers about outstanding invoices and offer support to resolve any payment issues.

- Proactive follow-up: Reach out to customers before invoices become overdue to address potential payment delays.

- Establish clear channels for payment: Offer multiple convenient payment options to facilitate timely payments.

4. Regularly Monitor and Analyze DSO:

- Track DSO over time: Monitor DSO trends to identify potential issues early on.

- Analyze aging receivables: Regularly review the age of outstanding invoices to identify slow-paying customers.

- Conduct root cause analysis: Investigate the underlying reasons for a high DSO to implement targeted improvements.

DSO vs. Other Key Metrics

DSO is not the only indicator of a company's financial health. It's crucial to consider it alongside other key metrics, such as:

- Days Payable Outstanding (DPO): This metric measures the average number of days it takes a company to pay its own suppliers.

- Cash Conversion Cycle (CCC): This represents the time it takes to convert raw materials into cash from sales. It's calculated as DSO + DIO (Days Inventory Outstanding) – DPO.

- Working Capital: This is the difference between a company's current assets and current liabilities, representing its short-term liquidity.

Conclusion: Mastering DSO for Enhanced Financial Performance

Days Sales Outstanding is a critical metric for assessing the effectiveness of a company's credit and collection processes. By accurately calculating, interpreting, and proactively improving DSO, businesses can significantly enhance their cash flow, optimize their working capital, and ultimately, bolster their overall financial performance. Regular monitoring, coupled with a strategic approach to credit management and collection practices, is key to maintaining a healthy and sustainable DSO. Understanding and managing DSO effectively is not just about improving numbers; it's about building stronger customer relationships and fostering a more efficient, profitable business.

Latest Posts

Latest Posts

-

The Function Requires That Management Evaluate Operations Against Some Norm

Apr 01, 2025

-

Select The Two Primary Characteristics That Define Advertising

Apr 01, 2025

-

Trade Can Make Everyone Better Off Because It

Apr 01, 2025

-

Which Country Is Credited For The Birth Of Management

Apr 01, 2025

-

Draw A Mechanism For The Following Reaction

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Days Sales Uncollected Is Computed By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.