Corinne Needs To Record A Customers Payment

Holbox

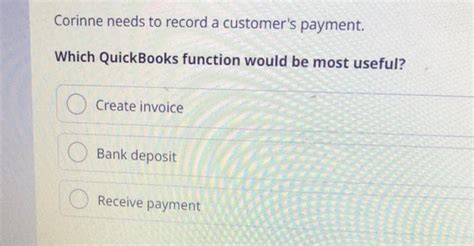

Mar 21, 2025 · 6 min read

Table of Contents

- Corinne Needs To Record A Customers Payment

- Table of Contents

- Corinne Needs to Record a Customer's Payment: A Deep Dive into Efficient Payment Processing

- Understanding the Importance of Accurate Payment Recording

- Methods Corinne Can Use to Record Customer Payments

- 1. Manual Recording in a Ledger or Spreadsheet

- 2. Using Accounting Software

- 3. Point of Sale (POS) Systems

- 4. Online Payment Gateways

- 5. Invoice Payment Systems

- Best Practices for Recording Customer Payments

- Choosing the Right Payment Recording Method for Corinne

- Latest Posts

- Latest Posts

- Related Post

Corinne Needs to Record a Customer's Payment: A Deep Dive into Efficient Payment Processing

Corinne, a small business owner, just received a payment from a valued customer. This seemingly simple event highlights a crucial aspect of running a successful business: efficient and accurate payment processing. Recording customer payments correctly is not just about tracking revenue; it's about maintaining accurate financial records, ensuring smooth accounting processes, and fostering strong customer relationships. This comprehensive guide delves into the various methods Corinne can utilize, the importance of accurate record-keeping, and best practices for streamlining the entire process.

Understanding the Importance of Accurate Payment Recording

Before diving into the methods, let's underscore the critical importance of accurate payment recording. For Corinne, this means more than just noting down the payment amount. It encompasses:

-

Accurate Financial Reporting: Accurate records are the bedrock of sound financial reporting. They are crucial for tax preparation, loan applications, investor presentations, and internal financial analysis. Inaccurate records can lead to penalties, missed opportunities, and flawed business decisions.

-

Improved Cash Flow Management: Knowing exactly when and how much money is coming in is essential for managing cash flow. This allows Corinne to predict expenses, plan for investments, and avoid cash shortages. Inaccurate records can result in unexpected financial shortfalls and hinder business growth.

-

Enhanced Customer Relationships: Prompt and accurate payment acknowledgment builds trust and strengthens customer relationships. It demonstrates professionalism and ensures customers feel valued. Conversely, delays or errors in payment processing can damage relationships and lead to customer dissatisfaction.

-

Preventing Fraud and Errors: A well-organized payment recording system helps prevent both internal and external fraud. It provides an audit trail, making it easier to identify and rectify errors or inconsistencies.

Methods Corinne Can Use to Record Customer Payments

Corinne has a range of options for recording customer payments, each with its own advantages and disadvantages. The best method will depend on the size and nature of her business, her technological capabilities, and her customer preferences.

1. Manual Recording in a Ledger or Spreadsheet

This traditional method involves manually recording each payment in a physical ledger or a spreadsheet. While simple and requiring minimal technology, it's prone to errors and can be time-consuming, especially as the business grows. Corinne needs to be meticulous about accurately entering all details, including the date, amount, payment method, customer name, and invoice number. Regular reconciliation with bank statements is crucial to identify any discrepancies.

Pros: Simple, inexpensive, requires minimal technological expertise. Cons: Prone to human error, time-consuming, difficult to scale, limited reporting capabilities.

2. Using Accounting Software

Accounting software packages, ranging from simple to sophisticated, offer a streamlined approach to payment recording. These programs often integrate with other business tools, automating several steps and minimizing errors. Corinne can input payment details directly into the software, which will automatically update her financial records. Many options are available, from cloud-based solutions suitable for small businesses to more comprehensive enterprise resource planning (ERP) systems.

Pros: Automated processes, reduced errors, improved accuracy, enhanced reporting capabilities, integration with other business tools. Cons: Can be costly, requires learning curve, may need technical support.

3. Point of Sale (POS) Systems

For businesses with in-person transactions, a POS system is invaluable. These systems automatically record payments made through various methods (cash, credit cards, debit cards, etc.), generating detailed sales reports. The data can be easily integrated with accounting software, streamlining the entire payment processing workflow. POS systems also offer features like inventory management and customer relationship management (CRM) capabilities.

Pros: Automated payment recording, real-time sales data, inventory management, CRM integration, various payment options. Cons: Can be expensive, requires technical setup and maintenance.

4. Online Payment Gateways

Online payment gateways like PayPal, Stripe, and Square allow customers to make payments securely online. These platforms integrate with Corinne's website or online store, providing a seamless payment experience for customers. The transactions are automatically recorded, and the data can be downloaded or integrated with accounting software. They offer a range of payment options, including credit cards, debit cards, and digital wallets.

Pros: Seamless online payments, secure transactions, automated recording, integration with accounting software, various payment options. Cons: Transaction fees, requires website integration, potential technical issues.

5. Invoice Payment Systems

These systems generate and send invoices to customers, providing multiple payment options. Customers can pay online through various methods, and the system automatically records the payments, sends payment confirmations, and integrates with accounting software. Invoice payment systems improve payment tracking and reduce the need for manual follow-ups.

Pros: Automated invoice generation, multiple payment options, automated payment recording, reduced manual follow-ups. Cons: Subscription fees, requires integration with accounting software.

Best Practices for Recording Customer Payments

Regardless of the chosen method, Corinne should follow these best practices for efficient and accurate payment recording:

-

Maintain a Clear and Consistent System: A consistent system ensures accuracy and prevents confusion. This includes using standardized formats for recording payment details and maintaining a well-organized filing system.

-

Reconcile Regularly: Regular reconciliation with bank statements and other financial records is crucial to identify discrepancies and prevent errors from accumulating.

-

Use Unique Identifiers: Assigning unique identifiers to each transaction, such as invoice numbers or transaction IDs, helps track payments efficiently.

-

Securely Store Payment Data: Protecting sensitive customer data is crucial. Corinne should comply with all relevant data privacy regulations and employ security measures to prevent data breaches.

-

Implement a Backup System: A backup system safeguards against data loss due to technical failures or other unforeseen circumstances.

-

Use Automated Reminders and Follow-Ups: Automated reminders and follow-ups help ensure timely payments and reduce the risk of overdue invoices.

-

Invest in Training: Investing in staff training ensures everyone understands the payment recording system and their responsibilities.

-

Regularly Review and Update Processes: As the business evolves, Corinne should regularly review and update her payment recording processes to maintain efficiency and adapt to changing needs.

Choosing the Right Payment Recording Method for Corinne

The ideal method for Corinne depends on her specific business needs. If she is a sole proprietor with limited transactions, a simple spreadsheet might suffice. However, as her business grows and transactions increase, she should consider investing in accounting software or a POS system. For online businesses, online payment gateways and invoice payment systems are essential.

Corinne should consider factors like:

- Transaction volume: The number of payments she receives daily or weekly.

- Payment methods: The types of payments she accepts (cash, credit cards, checks, online payments).

- Business size and complexity: The size of her business and the complexity of her financial operations.

- Budget: The amount she's willing to invest in payment processing solutions.

- Technical expertise: Her comfort level with technology and software.

By carefully considering these factors and implementing the best practices outlined above, Corinne can establish an efficient and accurate payment recording system that supports her business growth and strengthens her customer relationships. Accurate payment recording isn't just a task; it's a cornerstone of financial health and sustainable business success. Investing the time and resources in this area will yield significant long-term benefits for Corinne's business.

Latest Posts

Latest Posts

-

The Term Double Taxation Refers To Which Of The Following

Mar 28, 2025

-

Write 1 2 3 10 Using Sigma Notation

Mar 28, 2025

-

Porths Essentials Of Pathophysiology 5th Edition Ebook

Mar 28, 2025

-

In Viewing A Microscopic Specimen Oil Is Used To

Mar 28, 2025

-

In Order To Prevent Pest Infestations It Is Important To

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Corinne Needs To Record A Customers Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.