Consider The Following Transactions For Thomas Company

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

Analyzing Thomas Company Transactions: A Comprehensive Guide to Financial Statement Impacts

Understanding the financial health of a company requires a thorough analysis of its transactions. This article delves into the impact of various transactions on Thomas Company's financial statements – the balance sheet, income statement, and statement of cash flows. We'll explore how different types of transactions affect assets, liabilities, equity, revenues, expenses, and cash flows, providing a comprehensive framework for financial statement analysis.

I. Understanding the Fundamental Financial Statements:

Before diving into specific transactions, let's briefly review the three core financial statements:

-

Balance Sheet: This statement presents a snapshot of a company's financial position at a specific point in time. It shows the company's assets (what it owns), liabilities (what it owes), and equity (the owners' stake). The fundamental accounting equation always holds true: Assets = Liabilities + Equity.

-

Income Statement: This statement summarizes a company's revenues and expenses over a specific period. The difference between revenues and expenses is the net income (profit) or net loss. The basic formula is: Revenue - Expenses = Net Income (or Net Loss).

-

Statement of Cash Flows: This statement tracks the movement of cash both into and out of the company during a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities.

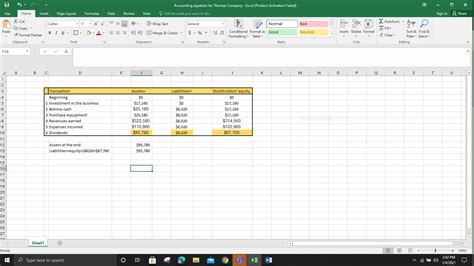

II. Analyzing Transactions for Thomas Company:

Let's consider a series of hypothetical transactions for Thomas Company and examine their impact on the financial statements.

A. Transaction 1: Purchase of Equipment for Cash:

Thomas Company purchases equipment costing $10,000 in cash.

-

Impact on Balance Sheet:

- Assets: Cash decreases by $10,000 (a decrease in current assets). Equipment increases by $10,000 (an increase in non-current assets). The overall effect on total assets is zero.

- Liabilities: No change.

- Equity: No change.

-

Impact on Income Statement: No immediate impact. The cost of the equipment will be depreciated over its useful life, impacting the income statement in future periods.

-

Impact on Statement of Cash Flows: A decrease in cash flow from investing activities of $10,000.

B. Transaction 2: Purchase of Inventory on Credit:

Thomas Company purchases $5,000 worth of inventory on credit from a supplier.

-

Impact on Balance Sheet:

- Assets: Inventory increases by $5,000 (an increase in current assets).

- Liabilities: Accounts payable increases by $5,000 (an increase in current liabilities).

- Equity: No change.

-

Impact on Income Statement: No immediate impact. The cost of the inventory will be recognized as an expense (Cost of Goods Sold) when the inventory is sold.

-

Impact on Statement of Cash Flows: No impact at this time; the cash outflow will occur when the invoice is paid.

C. Transaction 3: Sale of Goods for Cash:

Thomas Company sells goods with a cost of $2,000 for $4,000 in cash.

-

Impact on Balance Sheet:

- Assets: Cash increases by $4,000 (an increase in current assets). Inventory decreases by $2,000 (a decrease in current assets).

- Liabilities: No change.

- Equity: Retained earnings increase by $2,000 (net income).

-

Impact on Income Statement:

- Revenue: Increases by $4,000.

- Cost of Goods Sold: Increases by $2,000.

- Gross Profit: Increases by $2,000 ($4,000 - $2,000). This increase flows through to net income.

-

Impact on Statement of Cash Flows: An increase in cash flow from operating activities of $4,000.

D. Transaction 4: Payment of Salaries:

Thomas Company pays its employees $3,000 in salaries.

-

Impact on Balance Sheet:

- Assets: Cash decreases by $3,000 (a decrease in current assets).

- Liabilities: No change.

- Equity: Retained earnings decrease by $3,000 (due to salary expense).

-

Impact on Income Statement: Salaries expense increases by $3,000, reducing net income.

-

Impact on Statement of Cash Flows: A decrease in cash flow from operating activities of $3,000.

E. Transaction 5: Borrowing Money from a Bank:

Thomas Company borrows $10,000 from a bank, signing a note payable.

-

Impact on Balance Sheet:

- Assets: Cash increases by $10,000 (an increase in current assets).

- Liabilities: Notes payable increases by $10,000 (an increase in current or long-term liabilities, depending on the loan terms).

- Equity: No change.

-

Impact on Income Statement: No immediate impact. Interest expense on the loan will impact the income statement in future periods.

-

Impact on Statement of Cash Flows: An increase in cash flow from financing activities of $10,000.

F. Transaction 6: Depreciation Expense:

Thomas Company records depreciation expense of $1,000 on its equipment.

-

Impact on Balance Sheet:

- Assets: Accumulated Depreciation (a contra-asset account) increases by $1,000, reducing the net book value of the equipment.

- Liabilities: No change.

- Equity: Retained earnings decrease by $1,000 (due to depreciation expense).

-

Impact on Income Statement: Depreciation expense increases by $1,000, reducing net income.

-

Impact on Statement of Cash Flows: No impact; depreciation is a non-cash expense.

G. Transaction 7: Payment of Accounts Payable:

Thomas Company pays $3,000 of its accounts payable.

-

Impact on Balance Sheet:

- Assets: Cash decreases by $3,000 (a decrease in current assets).

- Liabilities: Accounts payable decreases by $3,000 (a decrease in current liabilities).

- Equity: No change.

-

Impact on Income Statement: No impact.

-

Impact on Statement of Cash Flows: A decrease in cash flow from operating activities of $3,000.

III. Advanced Considerations:

The examples above illustrate basic transaction analysis. More complex scenarios involve:

-

Accruals and Deferrals: Accruals recognize expenses or revenues before cash changes hands (e.g., accrued salaries), while deferrals recognize expenses or revenues after cash changes hands (e.g., prepaid insurance). These require careful attention to the matching principle in accounting.

-

Inventory Valuation Methods: Different methods (FIFO, LIFO, weighted-average cost) impact the cost of goods sold and ending inventory balance, ultimately affecting the income statement and balance sheet.

-

Long-Term Assets and Depreciation: The choice of depreciation method (straight-line, declining balance) affects the expense recognized each period and the net book value of the asset.

-

Intangible Assets and Amortization: Intangible assets, such as patents and trademarks, are amortized over their useful lives, similar to depreciation for tangible assets.

-

Equity Transactions: Issuing stock, repurchasing shares, and paying dividends all directly impact the equity section of the balance sheet.

IV. Importance of Accurate Transaction Recording:

Accurate and timely recording of transactions is crucial for producing reliable financial statements. Errors in recording transactions can lead to misstated financial information, affecting decisions made by investors, creditors, and management. Implementing strong internal controls and utilizing accounting software can help minimize errors and ensure the integrity of financial reporting. Regular reconciliation of bank statements and accounts receivable/payable balances are also essential.

V. Conclusion:

Analyzing transactions and understanding their impact on the financial statements is a fundamental aspect of financial accounting. This detailed analysis provides a strong foundation for evaluating Thomas Company's financial health. By carefully examining the effects of each transaction on the balance sheet, income statement, and statement of cash flows, we can gain valuable insights into the company's performance and financial position. This knowledge is invaluable for making informed business decisions and ensuring long-term financial stability. Remember to consult with accounting professionals for complex scenarios or when preparing official financial statements.

Latest Posts

Latest Posts

-

Reference Cell A1 From Alpha Worksheet

Apr 02, 2025

-

Professional Practice Use Of The Theories Concepts Presented In The Article

Apr 02, 2025

-

Ordinary Repairs And Maintenance Costs Should Be

Apr 02, 2025

-

Trina Is Trying To Decide Which Lunch Combination

Apr 02, 2025

-

Which Statement Best Describes A Command Economy

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Consider The Following Transactions For Thomas Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.