Best Buy Uses The Lower Of Cost Or Net

Holbox

Mar 30, 2025 · 5 min read

Table of Contents

- Best Buy Uses The Lower Of Cost Or Net

- Table of Contents

- Best Buy and the Lower of Cost or Net Realizable Value (LCNRV) Method: A Deep Dive

- Understanding the Lower of Cost or Net Realizable Value (LCNRV) Method

- What is Cost?

- What is Net Realizable Value (NRV)?

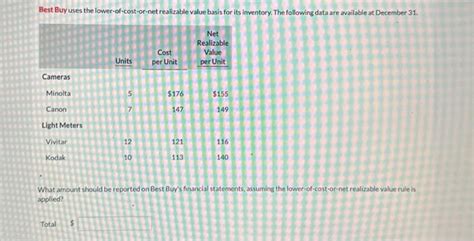

- Applying LCNRV at Best Buy: A Practical Example

- The Impact of LCNRV on Best Buy's Financial Statements

- Factors Influencing NRV at Best Buy

- Best Buy's Inventory Management and LCNRV

- Implications for Investors and Creditors

- Beyond LCNRV: Other Inventory Valuation Methods

- Conclusion: LCNRV – A Cornerstone of Best Buy's Financial Health

- Latest Posts

- Latest Posts

- Related Post

Best Buy and the Lower of Cost or Net Realizable Value (LCNRV) Method: A Deep Dive

Best Buy, a prominent name in consumer electronics retail, employs robust inventory management strategies to ensure profitability and efficient operations. A crucial aspect of this strategy is the application of the Lower of Cost or Net Realizable Value (LCNRV) method for valuing its inventory. This article delves into the intricacies of LCNRV, exploring its application within Best Buy's context, the implications for financial reporting, and the broader impact on its business model.

Understanding the Lower of Cost or Net Realizable Value (LCNRV) Method

The LCNRV method is an accounting principle that mandates the valuation of inventory at the lower of its historical cost or its net realizable value. This conservative approach aims to prevent overstatement of inventory assets on the balance sheet and potential misrepresentation of a company's financial health.

What is Cost?

"Cost," in this context, refers to the original price Best Buy paid to acquire the inventory, encompassing all costs incurred to bring the goods to their present location and condition. This includes:

- Purchase price: The amount paid to the manufacturer or supplier.

- Freight charges: Transportation costs to Best Buy's warehouses or stores.

- Import duties and taxes: Any applicable tariffs or taxes.

- Handling and storage costs: Expenses related to receiving, storing, and managing the inventory.

What is Net Realizable Value (NRV)?

Net Realizable Value (NRV) represents the estimated selling price of the inventory less any costs associated with its completion, sale, and disposal. For Best Buy, this includes:

- Estimated selling price: The expected revenue from selling the inventory. This takes into account market demand, competition, and potential discounts.

- Estimated completion costs: Any additional expenses needed to prepare the inventory for sale (e.g., minor repairs, packaging).

- Estimated selling costs: Expenses directly associated with the sale, such as commissions, advertising, and transportation to the customer.

Applying LCNRV at Best Buy: A Practical Example

Let's illustrate LCNRV with a hypothetical scenario involving a popular gaming console at Best Buy:

Scenario: Best Buy purchased 1000 units of the "Hyperspeed X" gaming console at a cost of $400 per unit. Freight charges amounted to $10 per unit. Therefore, the total cost is $410 per unit.

However, due to the release of a newer, more powerful console, market demand for the Hyperspeed X has declined. Best Buy estimates it can sell the remaining units for $350 each. Estimated selling costs are $15 per unit.

Calculation:

- Cost: $410 per unit

- Net Realizable Value (NRV): $350 (selling price) - $15 (selling costs) = $335 per unit

Conclusion: Since the NRV ($335) is lower than the cost ($410), Best Buy must write down the value of its Hyperspeed X inventory to reflect the NRV. This write-down would impact their financial statements, reducing the value of inventory assets and impacting the cost of goods sold.

The Impact of LCNRV on Best Buy's Financial Statements

Applying the LCNRV method directly affects Best Buy's financial statements in several ways:

- Balance Sheet: The inventory account will reflect the lower value (NRV), resulting in a lower reported asset value. This leads to a more conservative and potentially less optimistic view of the company's financial position.

- Income Statement: The write-down from cost to NRV is recognized as an expense (Loss on Inventory Write-Down) on the income statement, reducing net income for the period. This impacts profitability metrics and could potentially affect investor sentiment.

- Cash Flow Statement: While the write-down itself doesn't directly affect cash flow, the reduced net income will indirectly impact cash flow from operations.

Factors Influencing NRV at Best Buy

Several factors dynamically influence the NRV of Best Buy's inventory:

- Market demand: Fluctuations in consumer preferences and technological advancements directly impact the demand for electronics, affecting selling prices.

- Competition: Intense competition from other retailers can pressure selling prices downwards.

- Obsolescence: Electronics are susceptible to rapid obsolescence. Older models quickly lose value as newer technologies emerge.

- Economic conditions: Recessions or economic downturns generally reduce consumer spending, impacting demand and potentially lowering NRV.

- Promotional activities: Best Buy's sales, discounts, and promotions influence the realized selling price and consequently the NRV.

Best Buy's Inventory Management and LCNRV

Best Buy's effective inventory management strategy is deeply intertwined with the application of LCNRV. Their approach involves:

- Demand forecasting: Sophisticated forecasting models help predict sales and anticipate potential inventory obsolescence.

- Supply chain optimization: Efficient supply chains ensure timely replenishment of in-demand products while minimizing the risk of excess inventory.

- Pricing strategies: Dynamic pricing models adjust prices based on demand, competition, and inventory levels.

- Markdown management: Strategic markdown strategies help liquidate excess inventory while minimizing losses.

- Regular inventory reviews: Frequent inventory reviews help identify products nearing obsolescence and allow for timely write-downs, preventing significant losses.

Implications for Investors and Creditors

The consistent application of LCNRV provides valuable insights for investors and creditors:

- Credibility: It demonstrates a commitment to accurate and conservative financial reporting.

- Risk assessment: The write-downs provide insights into potential inventory obsolescence and market risks.

- Predictive capabilities: Tracking write-downs over time can offer clues about the efficiency of Best Buy's inventory management and demand forecasting.

Beyond LCNRV: Other Inventory Valuation Methods

While LCNRV is the predominant method used by Best Buy, other inventory valuation methods exist, including:

- First-In, First-Out (FIFO): Assumes that the oldest inventory is sold first.

- Last-In, First-Out (LIFO): Assumes that the newest inventory is sold first.

- Weighted-Average Cost: Calculates the average cost of inventory items over a period.

The choice of method can significantly affect reported profits and financial ratios. Best Buy's selection of LCNRV reflects a preference for conservatism and a focus on preventing overstatement of assets.

Conclusion: LCNRV – A Cornerstone of Best Buy's Financial Health

The Lower of Cost or Net Realizable Value method is a cornerstone of Best Buy's robust inventory management system. By employing this conservative approach, Best Buy ensures its financial statements accurately reflect its inventory valuation, providing a reliable picture of its financial health to investors, creditors, and other stakeholders. The consistent application of LCNRV, coupled with its sophisticated inventory management strategies, underscores Best Buy's commitment to efficiency, profitability, and responsible financial reporting in the dynamic consumer electronics market. Understanding this method is critical for anyone analyzing Best Buy's financial performance and evaluating its long-term prospects. The interplay between market forces, internal management decisions, and the application of accounting principles like LCNRV ultimately shape Best Buy's success and its position within the highly competitive retail landscape.

Latest Posts

Latest Posts

-

The Function Requires That Management Evaluate Operations Against Some Norm

Apr 01, 2025

-

Select The Two Primary Characteristics That Define Advertising

Apr 01, 2025

-

Trade Can Make Everyone Better Off Because It

Apr 01, 2025

-

Which Country Is Credited For The Birth Of Management

Apr 01, 2025

-

Draw A Mechanism For The Following Reaction

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Best Buy Uses The Lower Of Cost Or Net . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.