Assume Expected Inflation Is 4 Per Year

Holbox

Mar 22, 2025 · 5 min read

Table of Contents

- Assume Expected Inflation Is 4 Per Year

- Table of Contents

- Assuming Expected Inflation is 4% per Year: Implications and Strategies

- Understanding the Impact of 4% Inflation

- Erosion of Purchasing Power:

- Impact on Investments:

- Increased Interest Rates:

- Wage-Price Spiral:

- Impact on Government Finances:

- Strategies for Navigating a 4% Inflationary Environment

- Individual Strategies:

- Business Strategies:

- Government Strategies:

- Long-Term Implications and Considerations

- Conclusion

- Latest Posts

- Related Post

Assuming Expected Inflation is 4% per Year: Implications and Strategies

The expectation of a consistent 4% annual inflation rate significantly impacts various economic sectors and individual financial planning. Understanding these implications and adopting appropriate strategies is crucial for navigating this inflationary environment. This article delves into the multifaceted consequences of a 4% annual inflation expectation and outlines strategies for individuals, businesses, and governments to mitigate its effects.

Understanding the Impact of 4% Inflation

A 4% inflation rate means the general price level of goods and services in an economy increases by 4% annually. This seemingly modest figure can have far-reaching consequences over time, eroding purchasing power and impacting investment returns.

Erosion of Purchasing Power:

The most direct impact of 4% inflation is the decline in purchasing power. If your salary remains unchanged, a 4% inflation rate means your money buys 4% less each year. This gradually diminishes your ability to afford the same goods and services over time. A loaf of bread costing $2 today could cost $2.08 next year, $2.16 the year after, and so on. This compounding effect becomes significant over the long term.

Impact on Investments:

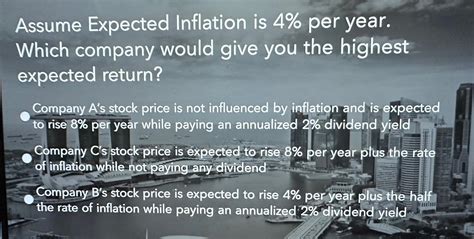

Inflation significantly affects investment returns. A 4% annual inflation rate means that any investment earning less than 4% annually is effectively losing value in real terms. For example, a savings account offering a 2% interest rate experiences a net loss of 2% annually after adjusting for inflation. Investors need to seek higher returns to outpace inflation and maintain the real value of their investments.

Increased Interest Rates:

Central banks typically respond to inflation by increasing interest rates. Higher interest rates make borrowing more expensive, discouraging spending and potentially slowing down economic growth. This can lead to increased costs for businesses and individuals who rely on loans for investments or purchases. The interplay between inflation and interest rates is complex and constantly evolving.

Wage-Price Spiral:

Persistent inflation can trigger a wage-price spiral. As prices rise, workers demand higher wages to maintain their purchasing power. Businesses, in turn, increase prices to cover the higher labor costs, fueling further inflation. This cycle can be difficult to break and can lead to economic instability.

Impact on Government Finances:

Governments face challenges managing their finances in an inflationary environment. Inflation can erode the real value of tax revenues, while increasing the cost of government spending. This can lead to budget deficits and necessitates careful fiscal management to avoid further economic instability.

Strategies for Navigating a 4% Inflationary Environment

Adapting to a 4% inflation environment requires proactive strategies across different sectors.

Individual Strategies:

- Budgeting and Financial Planning: Careful budgeting is paramount. Track expenses, identify areas for savings, and build an emergency fund to cushion against unexpected price increases.

- Diversification of Investments: Diversify investments across various asset classes, including stocks, bonds, real estate, and commodities, to mitigate risks associated with inflation. Consider inflation-protected securities, such as TIPS (Treasury Inflation-Protected Securities).

- Negotiate Salary Increases: Regularly review your salary and negotiate increases to keep pace with inflation. Understand the current market value for your skills and experience.

- Reduce Debt: High-interest debt becomes increasingly burdensome during inflation. Prioritize paying down high-interest debt to minimize its impact on your finances.

- Increase Savings: Consistently saving a portion of your income is crucial to preserve purchasing power and maintain financial stability during inflation.

Business Strategies:

- Pricing Strategies: Businesses need to carefully monitor costs and adjust pricing strategies to maintain profitability. Dynamic pricing models can help respond to fluctuating costs.

- Inventory Management: Effective inventory management is crucial to avoid losses from price fluctuations and potential obsolescence. Just-in-time inventory strategies can be beneficial.

- Investment in Technology and Automation: Investing in technology and automation can enhance efficiency and productivity, helping businesses offset rising labor and other costs.

- Diversification of Supply Chains: Reducing reliance on single suppliers helps mitigate the risk of supply disruptions and price volatility.

- Employee Compensation and Retention: Competitive compensation packages and employee benefits are essential for attracting and retaining skilled workers in a competitive labor market.

Government Strategies:

- Fiscal Policy: Governments can use fiscal policy tools like taxation and government spending to manage inflation. Careful budget management and targeted spending programs can help mitigate inflationary pressures.

- Monetary Policy: Central banks utilize monetary policy tools, primarily interest rate adjustments, to control inflation. Balancing economic growth with inflation control requires careful management of interest rates.

- Regulation: Government regulations can play a role in controlling prices, particularly in essential sectors like energy and food. However, excessive regulation can stifle economic growth.

- Investment in Infrastructure: Investments in infrastructure projects can improve productivity and reduce long-term costs. Such investments can stimulate economic growth while mitigating inflationary pressures.

- Transparency and Communication: Clear communication about economic policies and their impact on inflation is vital to build public trust and manage expectations.

Long-Term Implications and Considerations

A sustained 4% inflation rate has significant long-term implications for individuals, businesses, and the economy as a whole.

- Economic Growth: While moderate inflation can stimulate economic growth, high and persistent inflation can destabilize the economy, leading to uncertainty and reduced investment.

- Income Inequality: Inflation can disproportionately impact lower-income households, exacerbating income inequality. Those with limited savings and fixed incomes are particularly vulnerable.

- Social Unrest: Persistent inflation can lead to social unrest and political instability, as people struggle to afford basic necessities.

- International Trade: Inflation rates in different countries can affect international trade patterns, impacting exports and imports.

Conclusion

Expecting a 4% annual inflation rate requires proactive strategies from individuals, businesses, and governments. While moderate inflation can be managed, sustained high inflation poses significant risks to economic stability and social well-being. Understanding the implications of inflation and adopting appropriate strategies is crucial for navigating this complex economic environment and securing long-term financial security. Regular monitoring of economic indicators and adapting strategies based on evolving economic conditions are essential for weathering the challenges of a persistently inflationary environment. The key to navigating this landscape successfully lies in informed decision-making, proactive planning, and a commitment to long-term financial stability.

Latest Posts

Related Post

Thank you for visiting our website which covers about Assume Expected Inflation Is 4 Per Year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.