An Income Statement Would Not Include

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

- An Income Statement Would Not Include

- Table of Contents

- What an Income Statement Would NOT Include: A Comprehensive Guide

- Items Excluded from the Income Statement: A Detailed Breakdown

- 1. Non-Operating Items:

- 2. Financing Activities:

- 3. Investing Activities:

- 4. Balance Sheet Items:

- 5. Qualitative Factors:

- 6. Future Projections:

- 7. Detailed Transactional Data:

- The Importance of Understanding Income Statement Exclusions

- Connecting the Income Statement to Other Financial Statements

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

What an Income Statement Would NOT Include: A Comprehensive Guide

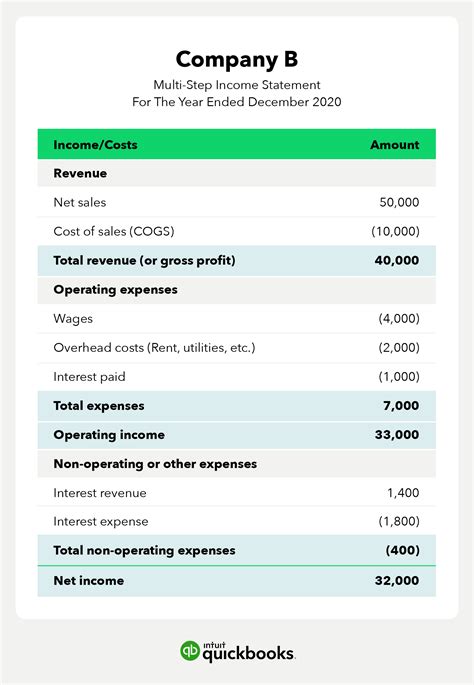

An income statement, also known as a profit and loss (P&L) statement, is a crucial financial statement that summarizes a company's revenues, costs, and expenses over a specific period. It's a snapshot of a company's financial performance, showing whether it generated a profit or loss. While it provides a comprehensive overview of a company's operational activities, several key items are conspicuously absent. Understanding what isn't included in an income statement is just as important as understanding what is. This comprehensive guide will delve into the details of what you won't find on an income statement and why.

Items Excluded from the Income Statement: A Detailed Breakdown

The income statement focuses solely on the company's operating activities during a specific period. Therefore, anything outside this core function won't be included. Let's break down the key exclusions:

1. Non-Operating Items:

The income statement primarily reports on the company's core business operations. Non-operating items, stemming from activities outside the primary business function, are typically excluded from the main body of the income statement, although they may be presented separately in the notes. These include:

- Gains and Losses from the Sale of Assets: Profits or losses realized from selling property, plant, and equipment (PP&E), investments, or other non-current assets are not part of the operating income. These are reported separately.

- Interest Income and Expense: While interest expense related to operational financing might be included in some income statements, significant interest income or expenses, particularly those from non-operating activities, are usually reported separately.

- Dividends Received: Income earned from dividends on investments is not considered part of core operating activities.

- Currency Exchange Gains and Losses: Fluctuations in foreign exchange rates can impact a company's financial position, but these gains or losses are typically not included in the operating income.

- Unrealized Gains and Losses: These relate to changes in the market value of assets that haven't yet been sold. Since they haven't been realized, they are not reported on the income statement.

2. Financing Activities:

The income statement does not reflect the company's financing activities. These are reported separately on the statement of cash flows. Financing activities include:

- Debt Financing: Issuance of bonds, loans, or other debt instruments.

- Equity Financing: Issuance of common stock or preferred stock.

- Repayment of Debt: Principal payments on loans or bonds.

- Repurchase of Stock: Buying back the company's own shares.

- Dividend Payments: Payments to shareholders. While dividends received might be reported (as a non-operating item), dividends paid are not reflected on the income statement.

3. Investing Activities:

Like financing activities, investing activities are not reflected on the income statement. These activities are detailed in the statement of cash flows and include:

- Purchase and Sale of Long-Term Assets: Acquisitions or disposals of PP&E, investments, or other long-term assets.

- Acquisitions of Other Businesses: The cost of acquiring another company is not directly reflected on the income statement.

- Investments in Securities: The purchase or sale of stocks or bonds in other companies.

4. Balance Sheet Items:

The income statement is a distinct financial statement and doesn't include items from the balance sheet, which provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. Examples include:

- Assets: Cash, accounts receivable, inventory, property, plant, and equipment. While changes in these assets can indirectly impact the income statement (e.g., selling inventory), the assets themselves are not reported on the income statement.

- Liabilities: Accounts payable, loans payable, deferred revenue. The expense associated with liabilities might appear (e.g., interest expense), but the liability itself isn't reported.

- Equity: Common stock, retained earnings. While changes in retained earnings (due to net income) indirectly affect the balance sheet, the equity accounts themselves are not listed on the income statement.

5. Qualitative Factors:

The income statement provides a quantitative view of financial performance. It does not include qualitative factors that are crucial for a complete understanding of a company's financial health, such as:

- Management Quality: The skills and experience of the management team.

- Competitive Landscape: The intensity of competition in the company's industry.

- Economic Conditions: Macroeconomic factors affecting the company's performance.

- Customer Satisfaction: The level of customer loyalty and satisfaction.

- Employee Morale: The overall attitude and productivity of employees.

- Brand Reputation: Public perception and brand image of the company.

6. Future Projections:

The income statement shows past performance. It does not include future projections or forecasts. While management might use the income statement to create future budgets and projections, these projections are not part of the official income statement.

7. Detailed Transactional Data:

The income statement presents a summarized view of a company's financial activity. It doesn't include the detailed transactional data that supports the figures presented. For example, while the income statement shows total revenue, it doesn't list every individual sale.

The Importance of Understanding Income Statement Exclusions

Understanding what an income statement does not include is crucial for several reasons:

- Comprehensive Financial Analysis: Using only the income statement to assess a company's overall financial health is insufficient. It must be analyzed in conjunction with the balance sheet and statement of cash flows for a holistic view.

- Avoiding Misinterpretations: A poorly understood income statement can lead to inaccurate conclusions about a company's profitability and financial stability.

- Informed Decision-Making: Investors, creditors, and management need a complete picture to make informed investment, lending, and operational decisions.

- Detecting Fraudulent Activities: Understanding what shouldn't be on the statement can help detect unusual or suspicious activities.

Connecting the Income Statement to Other Financial Statements

The income statement is intrinsically linked to the balance sheet and the statement of cash flows. Net income from the income statement flows into retained earnings on the balance sheet. Cash flows from operating activities on the statement of cash flows are directly related to the revenue and expenses reported on the income statement. Understanding these interrelationships provides a much clearer picture of a company's financial health and performance.

Conclusion

The income statement is a powerful tool for assessing a company's financial performance, but it's essential to remember its limitations. By understanding what information is excluded from the income statement, you can avoid misinterpretations and gain a more complete and accurate understanding of the company's overall financial position. Always analyze the income statement in conjunction with the balance sheet and the statement of cash flows for a truly comprehensive financial analysis. Remember, a nuanced understanding of financial statements is crucial for making sound financial decisions, whether you're an investor, a creditor, or a business owner. This knowledge enables you to interpret financial data effectively and make informed choices aligned with your financial goals.

Latest Posts

Latest Posts

-

Trade Can Make Everyone Better Off Because It

Apr 01, 2025

-

Which Country Is Credited For The Birth Of Management

Apr 01, 2025

-

Draw A Mechanism For The Following Reaction

Apr 01, 2025

-

State Farm Staff Agreement Assessment Test Answers Pdf

Apr 01, 2025

-

Introduction To Public Health 6th Edition Pdf

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about An Income Statement Would Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.