An Annuity Is A Series Of Blank______ Deposits.

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- An Annuity Is A Series Of Blank______ Deposits.

- Table of Contents

- An Annuity Is a Series of Guaranteed Deposits: Understanding the Power of Predictable Income

- What Makes Annuity Deposits Guaranteed?

- Insurance Company's Financial Stability:

- Contractual Obligations:

- Different Types of Guarantees:

- Types of Annuities and Their Guaranteed Deposits

- Fixed Annuities:

- Fixed-Indexed Annuities (FIAs):

- Variable Annuities:

- Immediate Annuities:

- Factors Affecting Annuity Guarantees

- Insurance Company Rating:

- Contractual Terms:

- Market Conditions:

- Inflation:

- Fees and Expenses:

- Are Annuity Guarantees Truly Unbreakable?

- When are Annuities a Good Fit?

- When are Annuities Not a Good Fit?

- Conclusion: Understanding the Nuances of Guaranteed Deposits

- Latest Posts

- Latest Posts

- Related Post

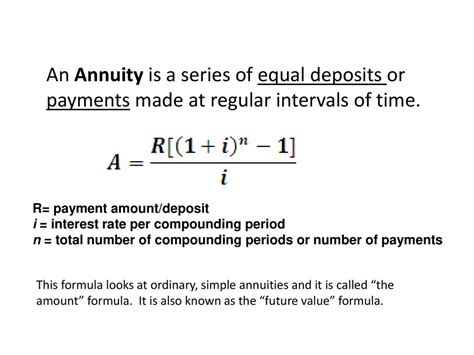

An Annuity Is a Series of Guaranteed Deposits: Understanding the Power of Predictable Income

An annuity is a financial product that provides a series of guaranteed deposits, or payments, over a specified period. This predictability is its core strength, offering financial security and stability that many other investment vehicles can't match. Understanding the nature of these guaranteed deposits is crucial to determining if an annuity is the right fit for your financial goals. This comprehensive guide delves deep into the world of annuities, explaining their intricacies and helping you assess their suitability for your personal circumstances.

What Makes Annuity Deposits Guaranteed?

The "guaranteed" aspect of annuity deposits stems from the contract between the annuity owner and the insurance company issuing the annuity. Unlike investments in the stock market, which are subject to market fluctuations, annuity payments are backed by the insurance company's financial strength and reserves. This doesn't mean they are entirely risk-free; the insurance company itself could face financial difficulties, but this risk is generally mitigated by regulatory oversight and the company's overall financial health.

Several factors contribute to the perceived guarantee:

Insurance Company's Financial Stability:

Reputable insurance companies maintain substantial reserves to ensure they can meet their contractual obligations. Independent rating agencies like A.M. Best, Moody's, and Standard & Poor's assess the financial strength of insurance companies, providing valuable insights for potential annuity buyers. Choosing an annuity from a highly-rated company significantly reduces the risk of non-payment.

Contractual Obligations:

The annuity contract is a legally binding agreement. Once the terms are established and premiums are paid, the insurance company is obligated to make the specified payments according to the contract's stipulations. This contractual guarantee forms the foundation of the annuity's security.

Different Types of Guarantees:

It's important to understand that "guaranteed" doesn't always mean the same thing across all annuity types. Different annuities offer different levels of guarantees:

- Death Benefit Guarantee: Many annuities offer a death benefit guarantee, ensuring a minimum payout to your beneficiaries even if your annuity's value has decreased.

- Minimum Accumulation Guarantee: Some annuities guarantee a minimum accumulation of funds, protecting your principal investment from significant losses.

- Withdrawal Guarantee: Certain annuities provide guaranteed minimum withdrawal amounts, allowing you to access your funds at a predetermined rate regardless of market conditions.

- Income Guarantee: This is the core guarantee of many annuities. This guarantees a regular stream of income for a specific period or for life. This is often the most attractive feature for retirees seeking financial security.

Types of Annuities and Their Guaranteed Deposits

Understanding the different types of annuities is vital to grasping the nuances of their guaranteed deposits:

Fixed Annuities:

These are the most straightforward type of annuity. They offer a fixed interest rate for a specified period, guaranteeing a predictable return. Your deposits grow at a predetermined rate, and the payments are also fixed and predictable. The risk is minimal, as the principal is protected, but the return might be lower than other investment options.

Fixed-Indexed Annuities (FIAs):

FIAs offer a balance between security and potential growth. They provide a minimum guaranteed interest rate, but the potential for higher returns is linked to the performance of a market index (like the S&P 500). The upside is capped, but your principal is protected from market downturns. The guarantee here primarily protects the principal and provides a base rate of return. The indexed portion is not guaranteed but still offers potential for above-average returns.

Variable Annuities:

Unlike fixed annuities, variable annuities offer no guaranteed rate of return. Instead, the investment grows based on the performance of underlying sub-accounts, which are often invested in mutual funds. While there's no guarantee on growth, the death benefit and other rider guarantees can still provide a safety net. The guarantee here is typically a minimum death benefit or other rider options, not the growth of the investment itself.

Immediate Annuities:

Immediate annuities begin paying out immediately after your initial investment. The payments are generally guaranteed for a specified period or for life. This type is ideal for those needing an immediate and guaranteed stream of income, like retirees. The guarantee here is the consistent and timely payment of income.

Factors Affecting Annuity Guarantees

While annuities offer guaranteed deposits, several factors can influence the strength and extent of these guarantees:

Insurance Company Rating:

As mentioned earlier, the financial health of the issuing insurance company directly impacts the reliability of the guarantee. Lower-rated companies pose a higher risk of non-payment.

Contractual Terms:

Carefully review the fine print of your annuity contract. Pay close attention to the specific terms and conditions defining the guarantees.

Market Conditions:

While guaranteed annuity payments are unaffected by market downturns, the overall value of your annuity and potential for future growth might be impacted. This is particularly relevant for FIAs and variable annuities.

Inflation:

Inflation can erode the purchasing power of your guaranteed payments over time. This means that while the nominal amount remains constant, the real value may decrease.

Fees and Expenses:

Annuities carry various fees and expenses. These costs can reduce the overall return and the actual value of your guaranteed deposits.

Are Annuity Guarantees Truly Unbreakable?

While the term "guaranteed" evokes a strong sense of security, it's crucial to understand that no financial product offers absolute certainty. Although annuities offer strong guarantees compared to other investments, there's still a small amount of risk involved:

- Insurance Company Insolvency: Although rare, the issuing insurance company could become insolvent. However, state guaranty associations typically protect policyholders from significant losses in such situations, up to a certain limit.

- Changes in Contractual Terms: Although unlikely, changes to the contract could potentially impact the guarantees, especially in the case of some rider guarantees.

When are Annuities a Good Fit?

Annuities can be a valuable tool for specific financial goals:

- Retirement Income: Annuities provide a reliable stream of guaranteed income during retirement, helping mitigate the risk of outliving your savings.

- Legacy Planning: Death benefit guarantees ensure a minimum payout to beneficiaries, even if the annuity's value declines.

- Principal Protection: Annuities offer principal protection in various forms, providing a safety net for your investment.

- Tax-Deferred Growth: Many annuities offer tax-deferred growth, allowing your investment to grow tax-free until withdrawal.

When are Annuities Not a Good Fit?

Annuities aren't suitable for everyone. Consider these factors:

- High Fees: Annuities often come with high fees, which can significantly reduce your returns over time.

- Limited Liquidity: Accessing your funds before the contract's maturity can result in penalties and reduced returns.

- Complexity: The terms and conditions of annuity contracts can be complex and difficult to understand.

- Alternative Investment Options: Other investments, such as bonds or mutual funds, may offer comparable returns with lower fees and greater liquidity.

Conclusion: Understanding the Nuances of Guaranteed Deposits

An annuity is indeed a series of guaranteed deposits, offering a unique level of security and predictability. However, the nature of these guarantees varies depending on the annuity type, the issuing company's financial strength, and the specific contractual terms. Careful research, understanding your personal financial goals, and seeking professional advice are crucial before investing in an annuity. Remember to always compare different annuities from reputable insurance companies, carefully review the contracts, and assess whether the guaranteed deposits align with your long-term financial strategy. Don't let the promise of "guaranteed" payments blind you to the importance of understanding all aspects of the contract and the potential risks involved. With careful planning and a comprehensive understanding of the product, annuities can serve as a valuable tool for securing your financial future.

Latest Posts

Latest Posts

-

The Anticodon Of A Particular Trna Molecule Is

Apr 01, 2025

-

The Term Interpretive Framework Can Be Defined As

Apr 01, 2025

-

Locking Out Tagging Out Refers To

Apr 01, 2025

-

When Society Requires That Firms Reduce Pollution There Is

Apr 01, 2025

-

Generally Accepted Accounting Principles Gaap Wants Information To Have

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about An Annuity Is A Series Of Blank______ Deposits. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.