Amina Discovers Its Very Unlikely That An Angel Investor

Holbox

Mar 12, 2025 · 7 min read

Table of Contents

- Amina Discovers Its Very Unlikely That An Angel Investor

- Table of Contents

- Amina Discovers It's Very Unlikely an Angel Investor Will Fund Her Startup

- The Allure of Angel Investors

- The Reality Check: Amina's First Encounters

- Beyond Angel Investors: Exploring Alternative Funding Options

- Bootstrapping: Self-Funding the Early Stages

- Crowdfunding: Engaging the Community

- Grants and Incubators: Leveraging External Support

- Redefining Success: Amina's New Perspective

- The Long Game: Building Sustainable Growth

- Embracing Failure as a Learning Opportunity

- The Power of Networking: Building Strategic Partnerships

- The Continued Journey: Amina's Lessons Learned

- Key Takeaways for Aspiring Entrepreneurs:

- Latest Posts

- Related Post

Amina Discovers It's Very Unlikely an Angel Investor Will Fund Her Startup

Amina, a bright-eyed entrepreneur with a revolutionary app idea, had spent months crafting the perfect pitch deck. She'd poured over market research, meticulously detailed her financial projections, and even practiced her elevator pitch until she could deliver it flawlessly in her sleep. Her startup, "ConnectKind," aimed to revolutionize community engagement through a hyper-local social network focused on acts of kindness and mutual support. She was convinced she had a winning formula, a billion-dollar idea waiting to be unleashed. But her journey to secure funding, specifically from angel investors, proved to be far more challenging than she'd anticipated. This is the story of Amina's disillusionment and her subsequent journey to redefine her funding strategy.

The Allure of Angel Investors

Amina, like many early-stage startups, initially focused on angel investors as her primary funding source. The allure was understandable. Angel investors, high-net-worth individuals who invest their personal capital in early-stage companies, often provide not just funding but also valuable mentorship and industry connections. The narrative surrounding angel investors often paints a picture of benevolent, experienced individuals eager to nurture the next big thing. Amina envisioned a scenario where an angel investor would be captivated by her vision, providing the seed funding necessary to launch ConnectKind and guide her through the treacherous waters of the startup world.

The Reality Check: Amina's First Encounters

Amina's initial attempts to secure angel investment were met with a series of rejections. While some investors expressed interest in her app's concept, most cited concerns that hindered their investment decision. These concerns, often unspoken, revolved around several key areas:

-

Market Validation: Despite her thorough market research, many investors questioned the size and viability of her target market. They demanded more concrete evidence demonstrating a clear and significant demand for ConnectKind's unique features. The intangible nature of "kindness" as a core value presented a particular challenge in quantifying market potential.

-

Team Experience: While Amina possessed a strong vision and technical skills, she lacked substantial experience in building and scaling a tech startup. Investors looked for a team with a proven track record, a mix of expertise that complemented each other. Amina's solo journey, while impressive, lacked the perceived strength of a seasoned team.

-

Financial Projections: Even with meticulously crafted financial models, many investors felt Amina's projections were overly optimistic, lacking a realistic assessment of potential challenges and market saturation. The inherent difficulty in predicting user engagement and revenue generation for a social-impact-driven app contributed to investor skepticism.

-

Exit Strategy: Investors, ultimately driven by financial returns, scrutinized Amina's exit strategy. They needed a clear path to a potential acquisition or IPO, a route that wasn't immediately apparent for a social impact startup. ConnectKind's mission, while noble, didn't readily translate into a compelling exit narrative for some investors.

-

The Competition: The landscape of social networking is fiercely competitive. Amina's idea, while innovative, faced an uphill battle against established giants and numerous other startups vying for market share. Investors were wary of entering a crowded and unpredictable market.

Beyond Angel Investors: Exploring Alternative Funding Options

The repeated rejections left Amina disheartened but not defeated. She realized that her initial reliance on angel investors had been overly simplistic. The world of startup funding is far more nuanced and diverse, and focusing solely on one avenue had severely limited her options. She began to explore alternative funding streams, realizing that a multi-pronged approach would be more effective.

Bootstrapping: Self-Funding the Early Stages

Amina embraced bootstrapping, using her personal savings and freelance income to fund the initial development of ConnectKind. This approach allowed her to maintain greater control over her company's direction and avoid the dilution of equity that often comes with external investment. While slow and challenging, bootstrapping allowed her to validate her assumptions, build a minimal viable product (MVP), and gather valuable user feedback. This grassroots approach proved crucial in strengthening her business model and providing concrete evidence of market demand.

Crowdfunding: Engaging the Community

Amina launched a crowdfunding campaign on Kickstarter, tapping into the power of her community. Her heartfelt pitch resonated with many who believed in her vision. The campaign not only secured crucial funding but also built a loyal base of users and early adopters, generating invaluable feedback and organic marketing. The success of the crowdfunding campaign provided further validation of her business model and boosted her credibility.

Grants and Incubators: Leveraging External Support

Amina researched and applied for grants specifically designed to support social impact startups. She also explored incubators and accelerators, organizations that provide mentorship, resources, and networking opportunities to early-stage companies. These initiatives provided not only funding but also access to a supportive network and valuable guidance. Her improved pitch, honed by the challenges faced in securing angel investment, resonated more effectively with these specialized funding sources.

Redefining Success: Amina's New Perspective

Amina's journey revealed a valuable lesson: the path to success in the startup world is rarely linear. While angel investors might be a desirable source of funding, focusing solely on them ignores the rich tapestry of alternative options. Her experience underscored the importance of a diversified funding strategy, one that leverages bootstrapping, crowdfunding, grants, and incubators to build a sustainable and resilient business.

The Long Game: Building Sustainable Growth

Amina shifted her focus from securing a large upfront investment to building sustainable, organic growth. She understood that the ultimate measure of success wasn't simply securing funding, but building a valuable and impactful company. ConnectKind's mission of fostering kindness and community engagement became her north star, guiding her decisions and shaping her long-term strategy. This shift in perspective allowed her to approach challenges with resilience and creativity.

Embracing Failure as a Learning Opportunity

The rejections from angel investors were initially painful, but Amina learned to view them as opportunities for growth. Each "no" provided valuable feedback, highlighting areas for improvement in her pitch, business model, and overall strategy. She meticulously analyzed her shortcomings, using the lessons learned to refine her approach and enhance her chances of securing future funding. This growth mindset proved essential in navigating the inherent uncertainties of the startup world.

The Power of Networking: Building Strategic Partnerships

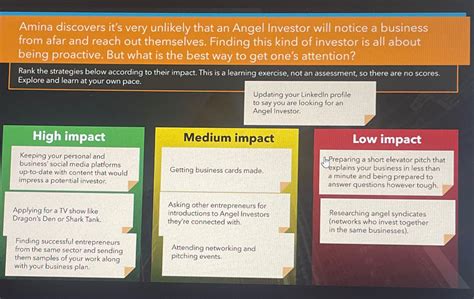

Amina actively cultivated relationships with other entrepreneurs, mentors, and industry experts. She attended networking events, joined relevant online communities, and sought out mentorship opportunities. These connections proved invaluable, providing not only access to information and resources but also a supportive community to navigate the challenges of entrepreneurship. Her expanded network broadened her funding possibilities and enriched her overall understanding of the startup ecosystem.

The Continued Journey: Amina's Lessons Learned

Amina's story isn't about a grand success achieved overnight. It's a testament to the resilience, adaptability, and determination required to navigate the complexities of entrepreneurship. Her initial disillusionment with the angel investor landscape spurred her to explore a more diversified funding approach, strengthening her company's foundation and ultimately leading to a more sustainable growth path.

Key Takeaways for Aspiring Entrepreneurs:

-

Diversify your funding sources: Don't put all your eggs in one basket. Explore bootstrapping, crowdfunding, grants, incubators, and other avenues to reduce your dependence on a single funding source.

-

Develop a strong narrative: Your story matters. Clearly articulate your vision, mission, and the problem you're solving. Connect with investors and potential funders on an emotional level.

-

Continuous iteration and improvement: Embrace feedback, learn from your mistakes, and constantly refine your business model and pitch. The startup journey is one of continuous learning and adaptation.

-

Build a strong network: Cultivate relationships with mentors, advisors, and other entrepreneurs. Networking is crucial for access to resources, guidance, and potential funding opportunities.

-

Focus on sustainable growth: Prioritize building a strong foundation and creating a sustainable business model. Short-term gains should not overshadow the long-term vision.

Amina's journey serves as a powerful reminder that the path to entrepreneurial success is seldom straightforward. It's a journey marked by setbacks, pivots, and the courage to redefine success on one's own terms. Her story underscores the importance of a flexible, adaptable strategy that embraces diverse funding options and prioritizes sustainable growth, ultimately revealing that the true measure of success extends far beyond securing a single angel investor. Amina's persistence and unwavering belief in her vision ultimately proved more valuable than any single investment.

Latest Posts

Related Post

Thank you for visiting our website which covers about Amina Discovers Its Very Unlikely That An Angel Investor . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.