According To The Efficient Markets Hypothesis

Holbox

Apr 05, 2025 · 6 min read

Table of Contents

- According To The Efficient Markets Hypothesis

- Table of Contents

- According to the Efficient Markets Hypothesis: A Deep Dive into Market Behavior

- The Core Tenets of the Efficient Markets Hypothesis

- The Three Forms of the Efficient Markets Hypothesis

- 1. Weak Form Efficiency

- 2. Semi-Strong Form Efficiency

- 3. Strong Form Efficiency

- Evidence Supporting the EMH

- Criticisms and Limitations of the EMH

- The EMH in the Context of Modern Finance

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

According to the Efficient Markets Hypothesis: A Deep Dive into Market Behavior

The Efficient Markets Hypothesis (EMH) is a cornerstone of modern financial theory, asserting that asset prices fully reflect all available information. This seemingly simple statement has profound implications for investment strategies, portfolio management, and our understanding of market behavior. While not without its critics and limitations, the EMH provides a valuable framework for analyzing market dynamics and informing investment decisions. This article will delve deep into the EMH, exploring its different forms, its implications, its criticisms, and its enduring relevance in today's complex financial landscape.

The Core Tenets of the Efficient Markets Hypothesis

At its heart, the EMH posits that it's impossible to "beat the market" consistently through superior analysis because market prices already incorporate all publicly accessible information. This means that any perceived mispricing is quickly corrected by the actions of numerous market participants seeking profit. This constant price adjustment leads to a market that's remarkably efficient in reflecting information.

The EMH is built upon several key assumptions:

-

Rationality of Investors: The EMH assumes, to varying degrees depending on the specific form, that investors are largely rational and act in their own self-interest to maximize returns. While acknowledging some irrationality, the collective actions of numerous investors tend to negate individual biases.

-

Information Availability: The hypothesis assumes that relevant information is readily available to all market participants. While this information may be interpreted differently, its availability ensures a relatively level playing field.

-

Fast Price Adjustment: The EMH stresses the speed at which prices react to new information. Any deviation from the "true" price is swiftly corrected as investors capitalize on arbitrage opportunities.

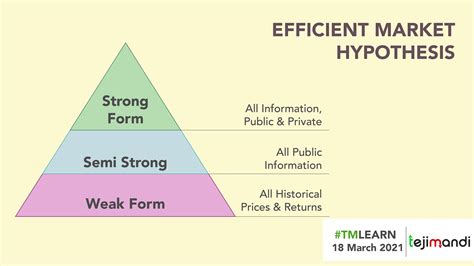

The Three Forms of the Efficient Markets Hypothesis

The EMH isn't a monolithic concept. Instead, it's often categorized into three distinct forms, each representing a different level of market efficiency:

1. Weak Form Efficiency

This is the most basic form of EMH. It states that current market prices fully reflect all past market data, such as historical prices and trading volume. Technical analysis, which relies on identifying patterns in past price movements to predict future price movements, is therefore considered ineffective in generating abnormal returns under weak form efficiency. While past price trends might offer some insights, they are already factored into the current price.

Implications: Investors cannot consistently outperform the market by employing technical analysis strategies. Fundamental analysis, however, may still offer potential for outperformance.

2. Semi-Strong Form Efficiency

This more stringent form asserts that current market prices reflect not only past market data but also all publicly available information, including company announcements, economic reports, and news articles. Therefore, even fundamental analysis, which involves assessing a company's intrinsic value based on publicly available information, is unlikely to generate consistent excess returns.

Implications: Both technical and fundamental analysis are rendered largely ineffective. Only access to private, non-public information (insider information) could potentially lead to sustained outperformance.

3. Strong Form Efficiency

This is the most extreme version of the EMH. It argues that current market prices reflect all information, including private or insider information. This implies that nobody, regardless of their access to information, can consistently beat the market. Even insider trading would be fruitless as the market already anticipates and incorporates any insights derived from privileged information.

Implications: No form of analysis, be it technical, fundamental, or based on insider information, can lead to consistent abnormal returns. This is the most controversial form of the EMH, as it's difficult to empirically test and widely disputed.

Evidence Supporting the EMH

While the EMH is not universally accepted, there's considerable empirical evidence supporting its tenets, particularly the weak and semi-strong forms:

-

Studies of Mutual Fund Performance: Numerous studies have shown that the majority of actively managed mutual funds fail to consistently outperform passively managed index funds over the long term. This suggests that active managers struggle to identify and exploit mispriced assets, supporting the idea that markets are relatively efficient.

-

Event Studies: Research examining market reactions to announcements like earnings reports or mergers and acquisitions shows that prices adjust rapidly and efficiently to new information. This quick price adjustment supports the idea of efficient markets.

-

Random Walk Hypothesis: The observation that stock prices tend to follow a random walk, meaning that future price movements are unpredictable based on past movements, aligns with the weak form of the EMH.

Criticisms and Limitations of the EMH

Despite the supporting evidence, the EMH has faced substantial criticism and challenges:

-

Behavioral Finance: This field of study emphasizes the role of psychological biases and emotional factors in investor decision-making. Behavioral biases, such as overconfidence, herd behavior, and anchoring, can lead to market inefficiencies and create opportunities for skilled investors to exploit mispricings.

-

Market Anomalies: Certain market phenomena, such as the January effect (higher returns in January), the size effect (small-cap stocks outperforming large-cap stocks), and the value effect (value stocks outperforming growth stocks), appear to contradict the EMH. These anomalies suggest that markets aren't perfectly efficient.

-

Information Asymmetry: The EMH's assumption of equal information access is unrealistic. Some investors inevitably have access to better information than others, creating an uneven playing field. Insider trading, for example, directly challenges the strong form of the EMH.

-

Transaction Costs: The EMH often overlooks the role of transaction costs, which can significantly impact the profitability of exploiting even small market inefficiencies. The costs associated with buying and selling assets can outweigh any potential gains from market arbitrage.

-

Liquidity and Market Depth: The EMH doesn't fully account for the impact of liquidity and market depth on asset pricing. In illiquid markets, prices may not always reflect true value due to limited trading opportunities.

The EMH in the Context of Modern Finance

The EMH remains a significant theoretical framework, even with its limitations. While it doesn't perfectly describe market behavior, its core principles—the importance of information, the role of competition, and the tendency of prices to reflect available data—continue to be relevant.

Implications for Investors:

-

Passive Investing: The EMH provides a strong rationale for passive investment strategies, such as investing in index funds or ETFs. These strategies aim to match the market's overall performance, accepting that consistently outperforming the market is exceedingly difficult.

-

Diversification: The EMH underscores the importance of diversification to reduce risk. By spreading investments across a variety of assets, investors can mitigate the impact of unforeseen events or individual stock underperformance.

-

Long-Term Perspective: The EMH suggests that investors should adopt a long-term perspective rather than attempting to time the market. Short-term market fluctuations are often unpredictable and unlikely to consistently generate above-average returns.

Conclusion

The Efficient Markets Hypothesis offers a powerful, if not completely accurate, model for understanding market behavior. While its assumptions are not always perfectly met in practice, its core tenets – the importance of information dissemination, competitive pressures, and the rapid adjustment of prices – provide a valuable framework for assessing market efficiency and guiding investment decisions. The ongoing debate surrounding the EMH underscores the complexity of financial markets and the need for continuous research and refinement of our understanding of market dynamics. By acknowledging both the strengths and limitations of the EMH, investors can develop more informed and effective strategies for navigating the ever-evolving world of finance. The enduring relevance of the EMH lies not in its absolute truth but in its ability to stimulate critical thinking and informed investment practices.

Latest Posts

Latest Posts

-

A Bank Reconciliation Reconciles The Bank Statement With The Companys

Apr 10, 2025

-

Which Is Darker The Anterior Or Posterior Forearm

Apr 10, 2025

-

When A Company Adopts A Low Cost Provider Strategy

Apr 10, 2025

-

The Company Purchases Equipment On Credit

Apr 10, 2025

-

Suppose That The Economy Of El Paso

Apr 10, 2025

Related Post

Thank you for visiting our website which covers about According To The Efficient Markets Hypothesis . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.