A Taxpayer Can Avoid A Substantial Understatement Of Tax Penalty:

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- A Taxpayer Can Avoid A Substantial Understatement Of Tax Penalty:

- Table of Contents

- A Taxpayer Can Avoid a Substantial Understatement of Tax Penalty: A Comprehensive Guide

- Understanding the Substantial Understatement Penalty

- Who is Affected?

- Key Factors Contributing to Substantial Understatement

- 1. Inaccurate Record Keeping:

- 2. Misunderstanding Tax Laws:

- 3. Lack of Professional Tax Advice:

- 4. Neglecting Tax Planning:

- 5. Failure to File or Amend Returns:

- Avoiding the Substantial Understatement Penalty: A Proactive Approach

- 1. Meticulous Record Keeping:

- 2. Understanding Tax Laws and Regulations:

- 3. Professional Tax Preparation:

- 4. Year-Round Tax Planning:

- 5. Timely Filing and Amendments:

- 6. Reasonable Basis for Tax Positions:

- 7. Utilizing IRS Resources:

- 8. Seeking IRS Help:

- The Importance of Professional Guidance

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

A Taxpayer Can Avoid a Substantial Understatement of Tax Penalty: A Comprehensive Guide

Navigating the complexities of the tax system can be daunting, and even the most diligent taxpayers can inadvertently make mistakes. One potentially costly error is a substantial understatement of tax, which can lead to significant penalties. However, understanding the rules and employing proactive strategies can help taxpayers avoid these penalties. This comprehensive guide explores the intricacies of substantial understatement penalties, outlining preventative measures and highlighting key considerations.

Understanding the Substantial Understatement Penalty

The Internal Revenue Service (IRS) imposes penalties for understatements of tax, designed to encourage accuracy and compliance. A substantial understatement of tax occurs when the amount of tax understated exceeds a certain threshold, generally the greater of 10% of the correct tax or $5,000 for individuals. This threshold can be significantly higher for corporations.

The penalty for a substantial understatement is typically 20% of the underpaid tax. This can quickly escalate into a substantial financial burden. Crucially, this penalty is separate from any interest charged on unpaid taxes. The combination of interest and penalties can severely impact your financial well-being.

Who is Affected?

While anyone can make a mistake, certain groups are more prone to substantial understatements:

- Self-Employed Individuals: Accurate record-keeping and understanding self-employment tax rules are crucial. Overlooking deductions or miscalculating income can easily lead to underpayment.

- High-Income Earners: Complex tax situations with numerous deductions, credits, and investments increase the risk of errors.

- Individuals with Significant Investment Income: Investment income, including capital gains and dividends, often requires specialized knowledge to calculate correctly.

- Those with Multiple Income Streams: Tracking income from various sources can be challenging, increasing the likelihood of omission or miscalculation.

Key Factors Contributing to Substantial Understatement

Several factors contribute to substantial understatements, and understanding these is crucial for preventative action:

1. Inaccurate Record Keeping:

Poor record-keeping is a primary culprit. Without meticulous documentation of income, expenses, and deductions, accurately calculating your tax liability becomes nearly impossible. This is especially true for self-employed individuals or those with complex financial situations. The IRS expects to see supporting documentation for all claims.

Solution: Implement a robust record-keeping system. Use accounting software, maintain detailed spreadsheets, or work with a tax professional to ensure accurate tracking of all financial transactions.

2. Misunderstanding Tax Laws:

Tax laws are intricate and constantly evolving. Misinterpreting or overlooking specific provisions can easily lead to underpayment. For example, failing to claim eligible deductions or credits or miscalculating capital gains taxes are common mistakes.

Solution: Stay updated on current tax laws through reputable sources like the IRS website, trusted financial publications, or consultations with tax professionals. Don't rely on outdated information or assumptions.

3. Lack of Professional Tax Advice:

While not everyone needs a tax professional, seeking expert guidance is highly recommended for complex tax situations. A qualified tax advisor can help navigate intricate tax laws, optimize deductions, and ensure accurate tax preparation.

Solution: Consider engaging a certified public accountant (CPA) or enrolled agent (EA) to help manage your taxes, especially if your tax situation is complicated. The cost of professional advice is often far outweighed by the potential savings from avoiding penalties.

4. Neglecting Tax Planning:

Proactive tax planning is essential to minimize your tax liability legally. This involves strategically planning your financial decisions throughout the year, not just at tax time. This might include optimizing retirement contributions, exploring tax-advantaged investment options, or structuring business transactions effectively.

Solution: Engage in year-round tax planning. Consult a tax professional to explore strategies to minimize your tax liability while complying with all regulations.

5. Failure to File or Amend Returns:

Failing to file your tax return on time or neglecting to file an amended return to correct errors can trigger penalties, including the substantial understatement penalty. Even unintentional errors can lead to severe consequences.

Solution: File your tax return by the deadline. If you discover errors after filing, file an amended return (Form 1040-X) promptly to correct the mistakes.

Avoiding the Substantial Understatement Penalty: A Proactive Approach

Preventing the substantial understatement penalty requires a proactive and organized approach:

1. Meticulous Record Keeping:

Maintain detailed and organized records of all financial transactions. This includes income statements, expense receipts, investment records, and any other relevant documentation. Digital record-keeping, using cloud-based solutions, offers advantages in terms of accessibility and security.

2. Understanding Tax Laws and Regulations:

Stay informed about current tax laws and regulations. Utilize reputable resources like the IRS website and consult with tax professionals when necessary. Don't hesitate to seek clarification on aspects you find confusing.

3. Professional Tax Preparation:

Consider using a qualified tax professional. A CPA or EA can help navigate complex tax issues, identify potential deductions and credits, and ensure accurate tax preparation. This is especially beneficial for those with intricate financial situations or significant investments.

4. Year-Round Tax Planning:

Engage in tax planning throughout the year, not just during tax season. This includes strategic financial decisions that can minimize your tax liability. Examples include maximizing retirement contributions, making tax-advantaged investments, and structuring business transactions effectively.

5. Timely Filing and Amendments:

File your tax returns on time and promptly amend any errors. Failing to file or amending returns can lead to penalties, even if the errors were unintentional. Utilize available resources and seek professional help if needed.

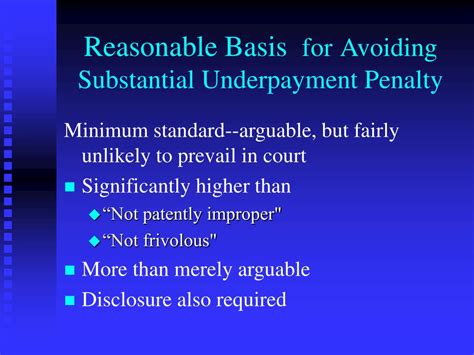

6. Reasonable Basis for Tax Positions:

When claiming deductions or credits, ensure you have a reasonable basis for your positions. This means having sufficient documentation and evidence to support your claims. The IRS scrutinizes tax returns, and lacking a reasonable basis can lead to penalties.

7. Utilizing IRS Resources:

The IRS offers numerous resources to help taxpayers understand their responsibilities and avoid errors. Explore the IRS website for publications, forms, and guidance. Utilize the IRS's online tools and services to access information and manage your tax obligations.

8. Seeking IRS Help:

If you have questions or encounter difficulties, don't hesitate to contact the IRS. They have dedicated professionals who can assist you in understanding the rules and resolving issues.

The Importance of Professional Guidance

While this guide provides valuable insights, navigating the tax system's complexities can be challenging. Seeking professional assistance from a qualified tax professional offers numerous advantages:

- Expert Knowledge: Tax professionals possess in-depth knowledge of tax laws and regulations, ensuring accurate tax preparation and compliance.

- Risk Mitigation: They help minimize the risk of errors and penalties by identifying potential issues and implementing proactive strategies.

- Time Savings: They handle the complexities of tax preparation, saving you valuable time and effort.

- Peace of Mind: Knowing that your taxes are handled correctly provides peace of mind and reduces stress.

Conclusion

Avoiding a substantial understatement of tax penalty requires careful planning, meticulous record-keeping, and a thorough understanding of tax laws. While mistakes can happen, proactive measures, including seeking professional assistance when needed, significantly reduce the risk. By embracing a proactive approach and understanding the potential consequences, taxpayers can protect themselves from the significant financial burdens associated with understatement penalties and maintain compliance with the IRS. Remember, the cost of prevention is far less than the cost of correction.

Latest Posts

Latest Posts

-

Refers To The Soil Removed From An Excavation

Apr 01, 2025

-

A Batch Level Activity Will Vary With The

Apr 01, 2025

-

You Market Many Different Types Of Insurance

Apr 01, 2025

-

Posterosuperior Boundary Of The Oral Cavity

Apr 01, 2025

-

Which Is True Concerning A Variable Universal Life Policy

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about A Taxpayer Can Avoid A Substantial Understatement Of Tax Penalty: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.