A Large Underground Economy Results In An

Holbox

Mar 20, 2025 · 7 min read

Table of Contents

A Large Underground Economy Results in an Inefficient and Unstable Economy: A Deep Dive

A thriving underground economy, often characterized by unreported transactions and activities, casts a long shadow over a nation's economic health. While it might seem to offer a lifeline for some, its long-term consequences are overwhelmingly negative, leading to inefficiency, instability, and a cascade of related problems. This article delves into the multifaceted repercussions of a large shadow economy, exploring its impact on various sectors and offering potential solutions.

H2: Defining the Underground Economy: A Complex Landscape

The underground economy, also known as the shadow economy or informal economy, encompasses a wide range of economic activities that operate outside the formal regulatory framework. This includes everything from unreported income from small businesses and freelance work to large-scale tax evasion and illegal activities like drug trafficking and human smuggling. The key characteristic uniting these diverse activities is their deliberate avoidance of official monitoring and taxation. The size and nature of the shadow economy vary considerably across countries, influenced by factors like regulatory burdens, corruption levels, and economic development.

H3: Key Components of a Large Underground Economy:

-

Tax Evasion and Avoidance: This is arguably the most significant aspect, where individuals and businesses deliberately fail to declare income or use loopholes to minimize their tax burden. This directly reduces government revenue, impacting public services and infrastructure.

-

Unreported Employment: Millions work in the informal sector, often without contracts, benefits, or legal protections. This impacts labor market statistics, making accurate assessments of unemployment and wage growth incredibly difficult.

-

Illegal Activities: Crimes like drug trafficking, human trafficking, and illegal gambling significantly contribute to the underground economy. These activities not only generate illicit profits but also undermine social stability and security.

-

Unregulated Businesses: Many small businesses operate outside the formal regulatory framework, avoiding licensing fees, safety inspections, and other compliance costs. This can lead to safety hazards, unfair competition, and a lack of consumer protection.

-

Informal Financial Systems: The underground economy often relies on informal financial systems, including cash transactions, money laundering, and unregulated lending. These systems impede the efficiency of the formal financial sector and can be exploited for illicit activities.

H2: The Negative Consequences of a Large Underground Economy:

A substantial shadow economy carries significant economic and social costs. The consequences ripple across various sectors, hindering overall growth and development.

H3: Reduced Government Revenue and Public Spending:

The most direct impact is the loss of government revenue through tax evasion. This revenue shortfall forces governments to either cut public spending, leading to deteriorating public services like healthcare and education, or to increase taxes on the formal sector, further stifling economic activity. This creates a vicious cycle of reduced revenue and constrained public services. The lack of funding for essential social programs directly impacts the well-being of citizens.

H3: Inefficient Resource Allocation:

Resources are not allocated efficiently in economies with a large underground sector. Businesses operating outside the formal economy may not invest in innovation, technology, or employee training, hindering productivity gains. Furthermore, the lack of regulatory oversight can lead to environmental damage and unsafe working conditions. The economy suffers from a misallocation of resources, as investments are driven by short-term gains rather than long-term sustainability.

H3: Increased Economic Instability:

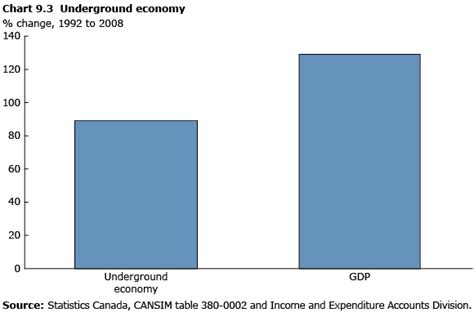

A large underground economy makes it difficult to accurately measure economic activity and forecast future trends. The lack of reliable data hinders effective policymaking and increases economic volatility. Unforeseen shocks, like a sudden crackdown on illegal activities, can disrupt the entire economy.

H3: Weakened Rule of Law and Corruption:

A thriving underground economy often fosters corruption. Officials may be bribed to overlook illegal activities, further eroding trust in the government and undermining the rule of law. This weakens the foundations of a stable and prosperous society. The prevalence of corruption discourages foreign investment and damages the country's international reputation.

H3: Social Inequality and Injustice:

The informal sector often concentrates low-wage and precarious jobs. Workers in the underground economy lack access to social security, healthcare benefits, and legal protections, leading to greater social inequality and injustice. This creates a two-tiered system, where those in the formal economy enjoy a higher standard of living, while those in the informal economy struggle to make ends meet.

H3: Impact on International Trade and Investment:

A large underground economy can hinder a country's ability to participate effectively in international trade and attract foreign investment. The lack of transparency and the prevalence of illegal activities can deter foreign investors and make it challenging to negotiate fair trade agreements. International investors often prefer jurisdictions with a strong rule of law and transparency, avoiding countries known for extensive shadow economies.

H2: Addressing the Challenge: Strategies for Reducing the Underground Economy:

Reducing the size of the underground economy requires a multifaceted approach that addresses both the supply and demand sides of the problem. This involves a combination of economic policies, regulatory reforms, and social initiatives.

H3: Simplifying Tax Regulations and Improving Tax Compliance:

Reducing the complexity of tax regulations can increase compliance. User-friendly tax systems and improved digital infrastructure can make it easier for businesses to comply with tax laws. Enhanced tax administration, including rigorous audits and effective enforcement, is crucial to deter tax evasion.

H3: Strengthening Regulatory Frameworks and Enforcement:

Effective regulation and enforcement are key to reducing the number of businesses operating outside the formal sector. This includes streamlining business registration processes, reducing bureaucratic hurdles, and ensuring effective enforcement of existing regulations. A robust legal system is essential to deter illegal activities and punish offenders.

H3: Promoting Formalization of Businesses and Employment:

Incentivizing businesses to formalize their operations and workers to join the formal labor market is essential. Governments can offer various subsidies, tax breaks, and access to credit for businesses that register and comply with regulations. Making it easier to obtain licenses, permits, and other necessary documents can also encourage formalization. Support programs can help informal workers to acquire skills and transition to formal employment.

H3: Combating Corruption and Promoting Good Governance:

Addressing corruption is essential to creating a fairer and more transparent economic environment. This requires strengthening anti-corruption agencies, promoting transparency in government operations, and implementing strict measures against bribery and other forms of corruption. Promoting good governance and strengthening the rule of law are essential to deterring illegal activities and encouraging compliance with the law.

H3: Improving Social Safety Nets and Access to Financial Services:

Extending social safety nets can help reduce the incentives for individuals to participate in the underground economy. Expanding access to affordable healthcare, education, and other social services can provide a safety net for those working in the informal sector. Expanding access to formal financial services, such as bank accounts and microfinance loans, can reduce reliance on informal financial systems.

H3: Investing in Education and Skills Development:

Investing in education and skills development can improve productivity and employment opportunities. Providing quality education and training programs can empower individuals to participate more effectively in the formal economy. Empowered individuals are less likely to resort to the informal sector due to lack of opportunity.

H2: Conclusion: Building a More Efficient and Stable Economy

A large underground economy poses a serious threat to economic efficiency, stability, and social equity. Addressing this challenge requires a comprehensive and multi-pronged strategy that involves simplifying tax regulations, strengthening regulatory frameworks, combating corruption, improving social safety nets, and investing in education and skills development. By tackling the root causes of the underground economy, nations can create a more inclusive, sustainable, and prosperous future for all. The ultimate goal is not merely to shrink the shadow economy, but to build a strong and resilient formal economy that provides opportunities for all citizens to participate fully and fairly. This requires sustained commitment from governments, businesses, and civil society. A healthy and transparent formal economy is a cornerstone of a well-functioning and equitable society.

Latest Posts

Latest Posts

-

Two Spacecraft Are Following Paths In Space Given By

Mar 21, 2025

-

When Consumers Decide To Purchase A Particular Product They

Mar 21, 2025

-

Refer To Figure 4 17 At A Price Of

Mar 21, 2025

-

For A Company Providing Services As Opposed To Products

Mar 21, 2025

-

Online Buying In Organizational Markets Is Prominent Because Internet Technology

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about A Large Underground Economy Results In An . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.