A High Degree Of Operating Leverage Means

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- A High Degree Of Operating Leverage Means

- Table of Contents

- A High Degree of Operating Leverage Means: Understanding its Implications for Your Business

- What is Operating Leverage?

- What Does a High Degree of Operating Leverage Mean?

- Advantages of High Operating Leverage

- Disadvantages of High Operating Leverage

- Managing High Operating Leverage

- Comparing High and Low Operating Leverage

- Conclusion: Understanding the Implications of High Operating Leverage

- Latest Posts

- Latest Posts

- Related Post

A High Degree of Operating Leverage Means: Understanding its Implications for Your Business

Operating leverage is a crucial concept in financial management that describes the relationship between a company's fixed and variable costs. A high degree of operating leverage means a company has a higher proportion of fixed costs compared to variable costs. Understanding this concept is vital for businesses of all sizes, as it significantly impacts profitability, risk, and overall financial health. This article delves deep into the meaning of high operating leverage, exploring its advantages and disadvantages, and offering strategies for managing it effectively.

What is Operating Leverage?

Operating leverage is a measure of how a company's operating income changes in response to changes in revenue. It reflects the sensitivity of a company's profits to fluctuations in sales. Companies with high operating leverage experience larger swings in operating income for a given change in sales compared to companies with low operating leverage. This is primarily due to the proportion of fixed and variable costs.

Fixed costs remain constant regardless of the production volume, such as rent, salaries, and depreciation. Variable costs, on the other hand, fluctuate directly with production, including raw materials, direct labor, and sales commissions.

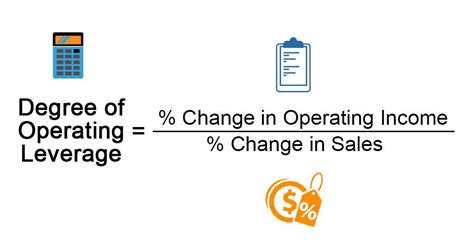

The degree of operating leverage (DOL) is calculated using the following formula:

DOL = Percentage Change in Operating Income / Percentage Change in Sales

Alternatively, it can be calculated using this formula at a specific level of sales:

DOL = Contribution Margin / Operating Income

The contribution margin is the difference between revenue and variable costs. A high DOL indicates that a small percentage increase in sales will lead to a larger percentage increase in operating income. Conversely, a low DOL shows that changes in sales will have a proportionally smaller effect on operating income.

What Does a High Degree of Operating Leverage Mean?

A high degree of operating leverage signifies that a significant portion of a company's total costs are fixed. This means that even with a small decrease in sales, operating income can drop dramatically. Conversely, a small increase in sales can translate into a substantial increase in operating income.

Think of it this way: a company with high operating leverage is like a seesaw with a heavy weight on one side (fixed costs). A small change in the other side (sales) creates a large swing in the balance (operating income).

Examples of industries with high operating leverage:

- Manufacturing: Companies with large factories and expensive equipment will have substantial fixed costs.

- Airlines: High fixed costs include aircraft maintenance, airport fees, and salaries of pilots and flight attendants.

- Pharmaceuticals: Significant R&D investment and manufacturing facility costs contribute to high fixed costs.

- Telecommunications: Building and maintaining network infrastructure represents a substantial fixed cost.

Advantages of High Operating Leverage

While risky, high operating leverage offers some significant advantages:

- High Profit Potential: During periods of strong sales growth, companies with high operating leverage can experience a disproportionately large increase in profits. This can lead to rapid growth and market dominance.

- Economies of Scale: High fixed costs are often associated with economies of scale. Once a certain level of production is reached, the fixed costs are spread over a larger volume, leading to lower per-unit costs. This can enhance profitability.

Disadvantages of High Operating Leverage

The significant downside of high operating leverage is the increased risk:

- High Financial Risk: During economic downturns or periods of reduced sales, companies with high operating leverage face a greater risk of losses. A small decline in sales can lead to a substantial drop in operating income, potentially resulting in losses or even insolvency.

- Vulnerability to Economic Fluctuations: Businesses with high operating leverage are more sensitive to changes in the overall economy. Recessions or industry-specific downturns can significantly impact their profitability.

- Difficulty in Adapting to Changes: Because a significant portion of the cost structure is fixed, companies with high operating leverage may find it difficult to adjust quickly to changes in market demand. Cutting back on fixed costs often involves significant time and expense.

- Challenges in Securing Financing: Lenders may be hesitant to provide financing to companies with high operating leverage, considering the increased risk. The high fixed costs can make it difficult to meet debt obligations during periods of low sales.

Managing High Operating Leverage

Companies with high operating leverage need to implement strategies to mitigate the associated risks:

- Accurate Forecasting and Planning: Precise sales forecasting is crucial for companies with high operating leverage. This helps anticipate potential downturns and adjust production accordingly.

- Diversification: Diversifying product offerings or markets can reduce dependence on a single product or customer base, thereby lessening the impact of sales fluctuations.

- Cost Control: While reducing fixed costs may be challenging in the short term, implementing cost-effective strategies for variable costs is crucial. Negotiating favorable terms with suppliers and optimizing production processes can improve profitability.

- Financial Flexibility: Maintaining a strong financial position with sufficient cash reserves and access to credit lines is essential to withstand periods of low sales. This allows companies to meet their obligations even during downturns.

- Strategic Pricing: Careful pricing strategies are vital for balancing profitability and maintaining sales volume.

- Hedging Strategies: Using financial instruments like futures and options to hedge against price fluctuations of raw materials can help stabilize costs.

Comparing High and Low Operating Leverage

To further illustrate the differences, let's consider a hypothetical example:

Company A (High Operating Leverage):

- Sales: $1,000,000

- Fixed Costs: $600,000

- Variable Costs: $200,000

- Operating Income: $200,000

- DOL: 3 (calculated as ($1,000,000 - $200,000)/$200,000)

A 10% increase in sales would result in a 30% increase in operating income. Conversely, a 10% decrease in sales would cause a 30% decrease in operating income.

Company B (Low Operating Leverage):

- Sales: $1,000,000

- Fixed Costs: $200,000

- Variable Costs: $600,000

- Operating Income: $200,000

- DOL: 1.25 (calculated as ($1,000,000 - $600,000)/$200,000)

A 10% increase in sales would result in a 12.5% increase in operating income, while a 10% decrease in sales would cause a 12.5% decrease in operating income.

This example clearly demonstrates how a high DOL amplifies both gains and losses, while a low DOL results in smaller changes in profitability in response to sales fluctuations.

Conclusion: Understanding the Implications of High Operating Leverage

A high degree of operating leverage presents both opportunities and risks. The potential for high profits during periods of growth is significant, but so is the vulnerability to substantial losses during downturns. Understanding the implications of high operating leverage is crucial for effective financial management. By implementing appropriate strategies for forecasting, cost control, and financial planning, businesses can mitigate the risks associated with high operating leverage and harness its potential for growth. Ultimately, the optimal level of operating leverage depends on a company's specific industry, competitive landscape, and risk tolerance. Careful analysis and strategic planning are essential to navigate this complex aspect of business finance.

Latest Posts

Latest Posts

-

Developing Person Through Childhood And Adolescence

Apr 01, 2025

-

The Following Picture Would Be Best Described As

Apr 01, 2025

-

Match Each Term With The Correct Definition

Apr 01, 2025

-

Match These Prefixes Suffixes And Roots To Their Meanings

Apr 01, 2025

-

Match The Bone With The Region It Comes From

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about A High Degree Of Operating Leverage Means . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.