A Firm's Cash Flow From Investing Activities Includes:

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

- A Firm's Cash Flow From Investing Activities Includes:

- Table of Contents

- A Firm's Cash Flow from Investing Activities: A Comprehensive Guide

- What Constitutes Cash Flow from Investing Activities?

- 1. Capital Expenditures (CAPEX):

- 2. Investments in Securities:

- 3. Acquisitions and Divestitures:

- 4. Loan Proceeds to Other Entities:

- 5. Other Investing Activities:

- Analyzing Cash Flow from Investing Activities

- 1. Capital Expenditures (CAPEX) Analysis:

- 2. Analyzing Investment in Securities:

- 3. Evaluating Acquisitions and Divestitures:

- 4. Assessing Loan Proceeds to Other Entities:

- The Importance of Cash Flow from Investing Activities

- Cash Flow from Investing Activities vs. Other Cash Flow Statements

- Interpreting Negative Cash Flow from Investing Activities

- Conclusion: The Significance of a Holistic View

- Latest Posts

- Latest Posts

- Related Post

A Firm's Cash Flow from Investing Activities: A Comprehensive Guide

Cash flow from investing activities represents a crucial aspect of a company's overall financial health. It reflects the cash inflows and outflows resulting from the acquisition and disposal of long-term assets. Understanding this component is vital for investors, creditors, and management alike, offering insights into a firm's strategic direction, growth prospects, and financial stability. This comprehensive guide delves into the intricacies of cash flow from investing activities, exploring its key elements, analysis techniques, and implications for decision-making.

What Constitutes Cash Flow from Investing Activities?

Cash flow from investing activities encompasses all cash transactions related to a company's long-term assets. These assets are typically characterized by their relatively long lifespan and use in generating revenue, rather than immediate consumption. The primary categories included are:

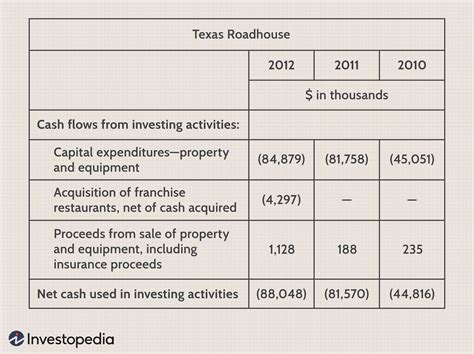

1. Capital Expenditures (CAPEX):

This represents the acquisition or upgrade of physical assets such as:

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, and equipment used in the production process. Purchases of PP&E typically lead to cash outflows, reflecting a significant investment in the company's future.

- Intangible Assets: These assets lack physical substance but still provide future economic benefits, such as patents, copyrights, trademarks, and software licenses. Acquisitions of intangible assets also result in cash outflows.

2. Investments in Securities:

This includes investments in other companies' securities, such as stocks and bonds. Purchases represent cash outflows, while sales generate cash inflows. This section also includes:

- Equity Investments: Investments in the stock of other companies, often for strategic reasons such as gaining market access or technological advantages.

- Debt Investments: Investments in the debt securities (bonds) of other companies.

- Derivatives: Complex financial instruments whose value is derived from an underlying asset. These are often used for hedging purposes, and their cash flows can be complex and vary greatly.

3. Acquisitions and Divestitures:

- Acquisitions: The purchase of another company or a significant portion of its assets. This typically involves a substantial cash outflow.

- Divestitures: The sale of a subsidiary, business unit, or other assets. This generates a cash inflow. This can be part of a restructuring strategy or a response to market changes.

4. Loan Proceeds to Other Entities:

Providing loans or advances to other entities (often subsidiaries or joint ventures) represent a cash outflow. The repayment of these loans results in a cash inflow.

5. Other Investing Activities:

This category covers miscellaneous activities related to investing, such as the purchase or sale of other long-term assets.

Analyzing Cash Flow from Investing Activities

Analyzing cash flow from investing activities requires more than just looking at the total number. A deeper dive reveals valuable information about a company’s strategic direction and financial health. Key analytical aspects include:

1. Capital Expenditures (CAPEX) Analysis:

- CAPEX as a percentage of revenue: This metric reveals the proportion of revenue reinvested in the business. A high percentage could signal growth potential but also higher risk. A consistently low percentage may suggest a lack of investment in future growth.

- CAPEX trends over time: Examining CAPEX trends helps identify patterns and assess the company’s long-term investment strategy. Increasing CAPEX might suggest expansion or modernization plans, while decreasing CAPEX could indicate reduced investment or a mature business model.

2. Analyzing Investment in Securities:

- Purpose of investment: Understanding the reasons behind investments in securities is crucial. Are they for strategic reasons (acquiring a stake in a competitor or supplier), for financial returns (diversification), or for other purposes?

- Performance of investments: Analyzing the returns on these investments helps assess the effectiveness of the company's investment strategy. Consistent losses might indicate poor investment choices.

3. Evaluating Acquisitions and Divestitures:

- Rationale for acquisitions and divestitures: Understanding the reasons behind these transactions is crucial for assessing their strategic implications. Were acquisitions undertaken to achieve synergy, expand market share, or access new technologies? Were divestitures conducted to streamline operations, focus on core competencies, or eliminate underperforming assets?

- Impact on profitability and cash flow: Assessing how acquisitions and divestitures affect the overall profitability and cash flow is important. Synergies from acquisitions should ideally lead to improved profitability and cash flow, while divestitures should free up resources and improve the financial position of the company.

4. Assessing Loan Proceeds to Other Entities:

- Credit risk: Analyzing the creditworthiness of the entities receiving loans helps assess the potential risks associated with these investments. Default risk could lead to a loss of invested capital.

- Relationship with parent company: Understanding the relationship between the lending entity and the recipient helps understand the strategic importance of such loans.

The Importance of Cash Flow from Investing Activities

Understanding the cash flow from investing activities provides several crucial insights:

- Growth potential: Significant capital expenditures often indicate a company's plans for expansion and future growth.

- Financial health: Consistent positive cash flow from investing activities suggests a healthy and well-managed business.

- Risk assessment: High capital expenditures relative to cash flow from operations can indicate financial risk.

- Strategic direction: Analyzing investment choices reveals the company's long-term strategic priorities and its commitment to innovation and growth.

- Valuation: Cash flow from investing activities is a crucial component in several valuation models, helping investors determine a company's intrinsic value.

Cash Flow from Investing Activities vs. Other Cash Flow Statements

It's vital to understand how cash flow from investing activities relates to the other sections of the statement of cash flows:

-

Operating Activities: This section focuses on the cash generated from the core business operations. It's crucial to analyze the relationship between operating cash flow and investing cash flow. A company might have strong operating cash flow but negative investing cash flow due to substantial capital expenditures. This might signal future growth potential but also increased short-term financial risk.

-

Financing Activities: This section examines cash flows related to debt, equity, and dividends. A company might use cash from financing activities to fund capital expenditures. The interplay between these sections helps understand the overall financial health and funding strategy of the company.

Interpreting Negative Cash Flow from Investing Activities

Negative cash flow from investing activities doesn't automatically indicate a problem. It often reflects investments in growth opportunities. However, consistently large negative cash flows should be analyzed carefully, considering:

- Level of debt: High levels of debt used to finance investments could indicate significant financial risk.

- Return on investment: The returns generated from these investments should justify the outflows.

- Industry benchmarks: Comparing the company's investing cash flows to its industry peers helps determine if the levels are normal or excessive.

Conclusion: The Significance of a Holistic View

Analyzing cash flow from investing activities is not an isolated exercise. It's crucial to consider it within the broader context of the entire statement of cash flows and the company's overall financial position. By thoroughly examining this section, investors, creditors, and management gain valuable insights into a company’s strategic direction, growth potential, financial health, and overall risk profile. A comprehensive and insightful analysis is essential for making sound financial decisions. Understanding the interplay between CAPEX, investments in securities, acquisitions and divestitures, and loan proceeds provides a complete picture of how a firm is deploying its capital to achieve its long-term objectives. Remember that consistent monitoring and analysis of this critical aspect of financial performance are essential for informed decision-making and strategic planning.

Latest Posts

Latest Posts

-

Which Of The Following Describes The Plasma Membrane

Apr 01, 2025

-

Draw The Product Of The Hydration Of 2 Butene

Apr 01, 2025

-

Which Of The Following Best Describes A Component Of Consent

Apr 01, 2025

-

Big Data Is Processed Using Relational Databases

Apr 01, 2025

-

Use Or To Compare The Following Numbers

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about A Firm's Cash Flow From Investing Activities Includes: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.