A Firm Has Market Power If It Can

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- A Firm Has Market Power If It Can

- Table of Contents

- A Firm Has Market Power If It Can: Understanding and Analyzing Market Dominance

- Defining Market Power: Beyond Just Setting Prices

- How Firms Achieve Market Power: Building a Fortress

- 1. Barriers to Entry: Building Walls Around the Market

- 2. Product Differentiation: Creating a Unique Offering

- 3. Mergers and Acquisitions: Consolidating Market Share

- 4. Collusion and Cartels: Working Together to Control the Market

- The Implications of Market Power: A Double-Edged Sword

- Potential Benefits:

- Potential Negative Consequences:

- Regulatory Responses to Market Power: Maintaining a Level Playing Field

- Analyzing Market Power: Tools and Techniques

- Conclusion: The Ongoing Debate About Market Dominance

- Latest Posts

- Latest Posts

- Related Post

A Firm Has Market Power If It Can: Understanding and Analyzing Market Dominance

A firm possesses market power if it can influence the price of its output. This seemingly simple statement underpins a complex area of economics and business strategy. It's a critical concept for understanding competition, pricing decisions, and the overall health of a market. This article delves deep into the multifaceted nature of market power, exploring how firms achieve it, the implications for consumers and the economy, and the regulatory responses designed to curb its potentially harmful effects.

Defining Market Power: Beyond Just Setting Prices

While the ability to set prices above marginal cost is a hallmark of market power, the definition extends beyond simple price manipulation. A firm with significant market power can also influence other aspects of the market, including:

- Output levels: A powerful firm might restrict output to artificially create scarcity and drive up prices.

- Product quality: It might choose to offer lower quality goods or services because consumers have limited alternatives.

- Innovation: Lack of competition can stifle innovation, as the firm sees less need to improve its offerings.

- Marketing and advertising: Market power allows firms to invest heavily in branding and advertising, further solidifying their position and potentially influencing consumer perception beyond the inherent value of their product.

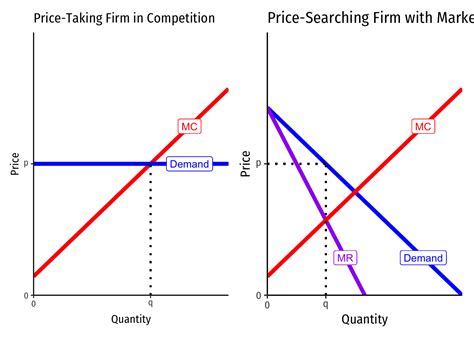

The key characteristic: The ability to act independently of market forces. A perfectly competitive firm is a price taker, accepting the market price as given. A firm with market power is a price maker, able to influence, and to a degree, dictate the price.

How Firms Achieve Market Power: Building a Fortress

Several factors contribute to a firm's ability to exert market power. Understanding these factors is crucial for both businesses aiming for dominance and regulators trying to maintain competitive markets:

1. Barriers to Entry: Building Walls Around the Market

High barriers to entry are perhaps the most significant contributor to market power. These barriers prevent new firms from easily entering the market and challenging the incumbent's dominance. These barriers can be:

- Economies of Scale: Large firms may enjoy lower average costs due to their size, making it difficult for smaller entrants to compete. This can create a natural barrier as new firms struggle to reach the scale needed for profitability.

- Network Effects: The value of a product or service increases as more people use it (e.g., social media platforms). This creates a powerful barrier as users are reluctant to switch to a smaller, less popular alternative.

- Government Regulations: Licenses, permits, and other regulations can limit the number of firms operating in a market. This is often justified on grounds of public safety or environmental protection, but it can also unintentionally create market power.

- Control of Essential Resources: Owning or controlling access to key resources (e.g., raw materials, patents) can prevent competitors from entering the market.

- High Capital Requirements: Industries with high initial investment costs (e.g., pharmaceuticals, aerospace) naturally limit entry due to the significant financial resources required.

- Brand Loyalty: Strong brand recognition and customer loyalty can act as a formidable barrier, making it difficult for new firms to attract customers.

2. Product Differentiation: Creating a Unique Offering

Firms can achieve market power by offering products or services that are perceived as unique or superior to those of their competitors. This can be based on:

- Quality: Offering higher quality goods or services than competitors.

- Features: Including unique features or functionalities.

- Branding: Creating a strong brand identity and customer loyalty.

- Customer Service: Providing exceptional customer service.

Differentiation allows firms to charge premium prices, as consumers are willing to pay more for a product that meets their specific needs or preferences better than alternatives.

3. Mergers and Acquisitions: Consolidating Market Share

Firms can increase their market power through mergers and acquisitions, combining with competitors to eliminate competition and control a larger share of the market. This often leads to significantly reduced competition and increased market concentration, which can lead to higher prices and reduced innovation. Antitrust regulations are designed to monitor and prevent such mergers that would result in excessive market power.

4. Collusion and Cartels: Working Together to Control the Market

Collusion occurs when firms cooperate to limit competition, often by agreeing on prices or output levels. Cartels are formal agreements between firms to coordinate their actions, effectively creating a monopoly. Collusion is illegal in many countries, but it can still occur in some markets, particularly those with high barriers to entry and limited regulatory oversight. However, the inherent instability of cartels due to the incentive for individual members to cheat (and increase their own profits by undercutting competitors) makes them relatively rare and often short-lived.

The Implications of Market Power: A Double-Edged Sword

Market power has both positive and negative consequences for the economy and consumers:

Potential Benefits:

- Economies of Scale and Scope: Large firms may achieve significant economies of scale and scope, leading to lower average costs and potentially lower prices for consumers. This is especially true in industries with high fixed costs.

- Innovation: In some cases, firms with market power may invest more heavily in research and development, leading to innovation and the development of new products and services. This is especially likely when the firm faces a substantial risk of losing its market dominance to new technologies or innovative competitors.

- Brand Loyalty and Customer Recognition: Brand recognition and strong customer relationships can lead to greater trust and stability in the market.

- Enhanced Efficiency: Internal efficiency gains are possible when consolidating operations within a larger, powerful firm.

Potential Negative Consequences:

- Higher Prices: Firms with market power can charge prices significantly above marginal cost, leading to higher consumer prices and reduced consumer surplus. This effectively transfers wealth from consumers to producers.

- Reduced Output: Market power may lead to reduced output compared to a more competitive market. This is often intentional as firms restrict output to maintain higher prices.

- Reduced Innovation: The lack of competitive pressure can stifle innovation, as firms with market power see less need to improve their products or services. This can lead to stagnation and a slower rate of technological progress.

- Reduced Consumer Choice: Consumers may face a limited range of products or services to choose from, especially with fewer alternatives and reduced competition.

- Inefficient Resource Allocation: Market power can lead to an inefficient allocation of resources, as firms may not produce goods or services in accordance with consumer demand.

- Increased Inequality: The concentration of wealth and power in the hands of a few firms can contribute to increased income inequality.

Regulatory Responses to Market Power: Maintaining a Level Playing Field

Governments use various regulatory mechanisms to curb the potential negative consequences of market power:

- Antitrust Laws: These laws are designed to prevent monopolies and promote competition. They prohibit anti-competitive practices such as price-fixing, bid-rigging, and mergers that significantly reduce competition.

- Regulation of Natural Monopolies: In industries with high barriers to entry, regulators may allow a single firm to operate but regulate its prices and output to prevent exploitation of consumers.

- Deregulation: Reducing government regulation can increase competition in some industries. However, this needs to be carefully managed to avoid unintended consequences such as the emergence of new monopolies.

- Promoting Competition: Governments can take active steps to promote competition, such as reducing barriers to entry and encouraging entrepreneurship.

The effectiveness of these regulatory measures depends on various factors, including the specific market conditions, the enforcement capabilities of regulatory bodies, and the political environment.

Analyzing Market Power: Tools and Techniques

Several tools and techniques can be used to analyze the level of market power in a given industry:

- Concentration Ratios: These measures quantify the market share held by the largest firms in an industry. High concentration ratios suggest a higher degree of market power.

- Herfindahl-Hirschman Index (HHI): A more sophisticated measure of market concentration that gives greater weight to larger firms. High HHI values indicate higher market power.

- Price-Cost Margins: Comparing a firm's prices to its costs can indicate whether it is exercising market power. Wide margins suggest the ability to charge prices well above costs.

- Lerner Index: A direct measure of market power based on the difference between price and marginal cost, expressed as a percentage of the price.

Conclusion: The Ongoing Debate About Market Dominance

The existence and implications of market power are topics of ongoing debate among economists and policymakers. While some argue that market power can lead to innovation and efficiency gains, others emphasize its potential negative consequences for consumers and the economy. Striking the right balance between promoting innovation and preventing exploitation is a constant challenge, requiring a careful consideration of the specific characteristics of each market and the potential trade-offs between different regulatory approaches. The ongoing evolution of technology and globalization only adds complexity to this already multifaceted challenge, highlighting the need for dynamic and adaptive regulatory frameworks capable of addressing the ever-changing dynamics of market power in the modern economy.

Latest Posts

Latest Posts

-

The Agency Relationship In Corporate Finance Occurs

Mar 30, 2025

-

All Foreign Language Results Should Be Rated Fails To Meet

Mar 30, 2025

-

The Correct Order To Present Current Assets Is

Mar 30, 2025

-

Sales Less Sales Discounts Less Sales Returns And Allowances Equals

Mar 30, 2025

-

Which Statement About Repositioning Is Accurate

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about A Firm Has Market Power If It Can . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.