A Favorable Cost Variance Occurs When

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

A Favorable Cost Variance Occurs When: A Deep Dive into Cost Control and Profit Maximization

Understanding cost variances is crucial for businesses of all sizes. Knowing when you're spending less than budgeted is just as important as knowing when you're overspending. A favorable cost variance occurs when actual costs are less than the budgeted or planned costs. This seemingly simple concept has profound implications for profitability, strategic decision-making, and overall financial health. This article delves into the intricacies of favorable cost variances, exploring their causes, implications, and how to leverage them for sustained success.

Understanding Cost Variances: The Basics

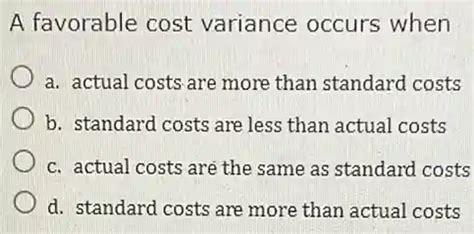

Before we delve into the specifics of favorable cost variances, let's establish a foundational understanding of cost variances in general. A cost variance is simply the difference between the actual cost incurred and the budgeted or standard cost. This difference can be either favorable (positive) or unfavorable (negative).

- Favorable Variance: Actual cost < Budgeted cost

- Unfavorable Variance: Actual cost > Budgeted cost

These variances are vital tools for businesses seeking to control costs and improve profitability. By analyzing variances, companies can identify areas of efficiency, pinpoint inefficiencies, and make informed decisions to optimize resource allocation.

Causes of a Favorable Cost Variance

Several factors contribute to a favorable cost variance. Understanding these underlying causes is key to replicating positive outcomes and preventing negative ones in the future.

1. Efficient Resource Management:

- Improved Procurement: Negotiating better deals with suppliers, leveraging bulk discounts, or finding more cost-effective alternatives can significantly reduce material costs. This is a major driver of favorable cost variances in manufacturing and other production-heavy industries.

- Optimized Production Processes: Streamlining workflows, improving production techniques, minimizing waste, and enhancing employee efficiency all contribute to lower production costs. This might involve implementing lean manufacturing principles or investing in automation technology.

- Reduced Labor Costs: This could be due to improved employee productivity, lower overtime costs, or a decrease in employee turnover, reducing the expense of recruitment and training.

2. Favorable Market Conditions:

- Lower Input Prices: Fluctuations in commodity prices or raw material costs can greatly impact a company's overall expenses. A decrease in these input prices directly translates to a favorable cost variance.

- Increased Supplier Competition: A more competitive market for suppliers can drive down prices, offering businesses better deals and lower procurement costs.

3. Effective Cost-Cutting Measures:

- Strategic Budgeting: A well-planned and realistic budget, developed through thorough analysis and forecasting, forms the bedrock for managing costs effectively. A carefully crafted budget is less likely to lead to significant cost overruns.

- Cost Reduction Initiatives: Proactive measures to reduce expenses, such as implementing energy-saving technologies, reducing waste, or negotiating better terms with service providers, can lead to favorable cost variances.

- Improved Inventory Management: Efficient inventory control minimizes storage costs, reduces waste due to spoilage or obsolescence, and prevents the unnecessary accumulation of stock.

4. Unexpected Positive Events:

- Higher-Than-Expected Productivity: Unexpectedly high productivity from employees or machinery can lead to lower per-unit production costs.

- Favorable Weather Conditions: In industries susceptible to weather conditions (agriculture, construction), favorable weather can reduce costs associated with delays or damage.

Analyzing and Interpreting Favorable Cost Variances

While a favorable cost variance is generally positive, it's crucial to understand the why behind it. A simple observation of lower-than-budgeted costs isn't sufficient. A thorough analysis is needed to determine whether the variance is a result of efficient management or simply a lucky break.

Here's a structured approach to analyzing favorable cost variances:

- Identify the Variance: Quantify the difference between actual and budgeted costs.

- Investigate the Cause: Determine the underlying factors contributing to the favorable variance. Use detailed records and data analysis to pinpoint specific areas of improvement.

- Assess Sustainability: Evaluate whether the factors causing the favorable variance are likely to persist. A variance caused by a temporary drop in input prices might not be sustainable in the long run.

- Evaluate Impact on Profitability: Determine the overall impact of the favorable variance on the company's profitability.

- Develop Actionable Insights: Use the analysis to refine future budgets, improve operational efficiency, and create strategies for sustaining positive variances.

Implications of Favorable Cost Variances

A favorable cost variance is generally a positive indicator of efficient operations and strong financial performance. However, it's essential to avoid complacency.

- Improved Profitability: Lower costs directly translate to higher profits, assuming revenue remains consistent.

- Enhanced Competitive Advantage: Lower costs can allow businesses to offer more competitive pricing, increasing market share.

- Increased Cash Flow: Lower expenses lead to improved cash flow, providing greater financial flexibility.

- Improved Return on Investment (ROI): Reduced costs enhance the return on investment for projects and initiatives.

However, it's crucial to remember that consistently favorable cost variances may indicate an overly optimistic budget. The budget may not adequately reflect the true cost of production or operations. Therefore, regular budget reviews and adjustments are necessary.

Sustaining Favorable Cost Variances: Strategies for Long-Term Success

A single instance of a favorable cost variance is positive, but creating a consistent pattern of cost efficiency requires strategic planning and ongoing effort.

- Continuous Improvement: Implement a culture of continuous improvement, encouraging employees to identify and implement cost-saving measures. Regular process reviews and audits can identify areas for optimization.

- Technology Adoption: Embrace technology to automate tasks, improve efficiency, and reduce manual labor costs.

- Employee Training and Development: Invest in employee training to enhance skills, improve productivity, and reduce errors.

- Data-Driven Decision Making: Utilize data analytics to identify trends, predict potential cost issues, and make informed decisions.

- Regular Performance Monitoring: Continuously monitor performance against budget and identify any potential deviations early on. Proactive adjustments can prevent small issues from escalating into significant cost overruns.

- Strategic Supplier Relationships: Cultivate strong relationships with suppliers to negotiate favorable terms and secure reliable supply chains.

- Benchmarking: Compare performance against industry benchmarks to identify areas for improvement and adopt best practices.

Differentiating Favorable Cost Variances from Other Positive Financial Indicators

It's important to distinguish favorable cost variances from other positive financial indicators. While a favorable cost variance reflects lower-than-budgeted costs, other indicators such as increased sales or improved pricing strategies contribute to overall profitability in different ways. A comprehensive financial analysis requires examining all relevant indicators holistically.

Potential Pitfalls to Avoid

While a favorable cost variance is generally positive, it's crucial to avoid potential pitfalls.

- Overly Optimistic Budgeting: Consistently favorable variances might suggest that the budget is unrealistically low. A more accurate budget allows for a more realistic assessment of performance.

- Compromising Quality: Cost-cutting measures shouldn't compromise product quality or service standards.

- Ignoring Underlying Issues: Favorable variances might mask underlying inefficiencies that need addressing to prevent future problems.

Conclusion: Embracing a Culture of Cost Efficiency

A favorable cost variance is a strong indicator of sound financial management and operational efficiency. By understanding the underlying causes, analyzing variances thoroughly, and implementing effective strategies for sustained cost control, businesses can unlock significant opportunities for increased profitability and long-term success. The key lies in fostering a culture of cost consciousness, continuous improvement, and data-driven decision-making. This proactive approach not only ensures that favorable cost variances become the norm but also strengthens the company's overall financial resilience and competitiveness. Remember, consistent cost efficiency isn't just about saving money; it's about optimizing resources to achieve strategic goals and maximize value for stakeholders.

Latest Posts

Latest Posts

-

Two Spacecraft Are Following Paths In Space Given By

Mar 21, 2025

-

When Consumers Decide To Purchase A Particular Product They

Mar 21, 2025

-

Refer To Figure 4 17 At A Price Of

Mar 21, 2025

-

For A Company Providing Services As Opposed To Products

Mar 21, 2025

-

Online Buying In Organizational Markets Is Prominent Because Internet Technology

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about A Favorable Cost Variance Occurs When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.