A Debit Balance In The Allowance For Doubtful Accounts

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

A Debit Balance in the Allowance for Doubtful Accounts: Understanding the Implications

A debit balance in the allowance for doubtful accounts is a situation that, while not inherently disastrous, warrants immediate attention and careful analysis. It signals a potential miscalculation or a significant shift in a company's credit risk profile. This article delves deep into the meaning, causes, and implications of a debit balance in the allowance for doubtful accounts, offering practical steps to rectify the situation and prevent its recurrence.

Understanding the Allowance for Doubtful Accounts

Before we dive into the complexities of a debit balance, let's establish a firm understanding of the allowance for doubtful accounts itself. This account is a contra-asset account, meaning it reduces the value of accounts receivable on the balance sheet. Its purpose is to reflect the estimated amount of accounts receivable that are unlikely to be collected. Essentially, it's a cushion against potential bad debts.

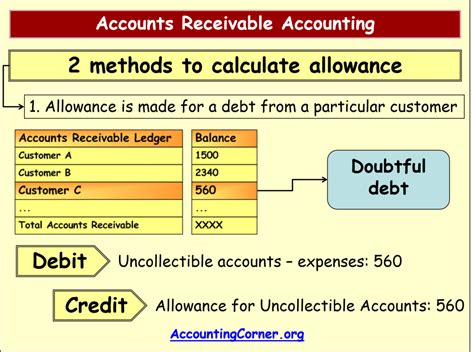

The allowance account is credited when a company estimates potential bad debts. This credit increases the balance of the allowance account, reducing the net realizable value of accounts receivable. When a specific account is deemed uncollectible, it's written off against the allowance account, decreasing its balance. This write-off doesn't affect the overall value of accounts receivable.

In essence, the allowance for doubtful accounts represents management's best estimate of the portion of accounts receivable that will likely become uncollectible. It's a crucial component of accurate financial reporting and a reflection of a company's credit risk management practices.

What Does a Debit Balance Mean?

A debit balance in the allowance for doubtful accounts signifies that the amount written off as bad debt exceeds the amount initially estimated as potentially uncollectible. This means the allowance account, intended to be a credit balance, holds a debit. This discrepancy can stem from several underlying issues, all requiring immediate investigation and corrective action. In short, it indicates that the company has overestimated the collectibility of its receivables. This overestimation is potentially problematic from both an accounting and a business perspective.

Common Causes of a Debit Balance

Several factors can contribute to a debit balance in the allowance for doubtful accounts. Understanding these root causes is vital to developing effective solutions.

1. Inaccurate Estimation of Bad Debts:

This is the most common cause. The company's historical data might be insufficient, its credit policies might be overly lenient, or its estimation methods might be flawed. Overly optimistic projections of collectibility directly lead to an understatement of the allowance and, consequently, a debit balance when actual write-offs surpass the provision. This could be due to insufficient consideration of economic downturns, changes in customer demographics, or the introduction of new credit policies without proper assessment.

2. Improved Credit Collection Practices:

Ironically, exceptionally effective credit collection efforts can also contribute to a debit balance. If a company significantly improves its collection processes, leading to a higher-than-anticipated recovery rate, it might write off fewer accounts than initially estimated. While seemingly positive, this situation requires adjustment to the allowance estimation process to accurately reflect the improved collection efficiency. The allowance estimate should be recalibrated to reflect the new, lower bad debt expectation.

3. Changes in the Business Environment:

Unforeseen changes in the economic climate, industry-specific trends, or competitive pressures can impact a company's ability to collect receivables. A sudden economic downturn, for instance, could lead to a surge in uncollectible accounts, exceeding the previously established allowance. Careful monitoring of macroeconomic indicators and industry-specific risks is crucial to avoid such surprises.

4. Insufficient Aging of Accounts Receivable:

Proper aging of receivables is paramount in accurate bad debt estimation. This involves categorizing accounts based on their outstanding duration. Older accounts typically have a higher probability of becoming uncollectible. Failure to adequately age accounts can lead to an underestimation of bad debts, potentially resulting in a debit balance. Robust aging analysis forms the foundation of effective bad debt management.

5. Errors in Accounting Processes:

Human error in recording transactions, applying write-offs, or calculating the allowance can also lead to a debit balance. This highlights the importance of accurate record-keeping, regular internal audits, and robust internal controls to minimize the risk of accounting errors. Careful review of accounting procedures and reconciliation of accounts are crucial for accuracy.

Rectifying a Debit Balance

Discovering a debit balance necessitates immediate action. Simply ignoring it is not an option, as it misrepresents the company's financial position. Here's how to address the problem:

1. Comprehensive Analysis:

Begin with a thorough analysis of the accounts receivable. Identify the factors contributing to the high number of write-offs. Analyze historical data, compare it to industry benchmarks, and assess current economic conditions. This step is crucial in understanding the root cause of the debit balance.

2. Adjust the Allowance for Doubtful Accounts:

Based on the analysis, reassess the allowance for doubtful accounts. Determine the appropriate level for the allowance based on factors like the aging of receivables, historical bad debt experience, and current economic conditions. This typically involves a credit entry to increase the allowance to a positive balance, offsetting the existing debit.

3. Review and Improve Credit Policies:

Evaluate the company's credit policies and procedures. Are they too lenient? Are there gaps in the credit approval process? Are there opportunities to improve the collection process? Improving credit policies and collection procedures can significantly mitigate future bad debt risks.

4. Implement Stronger Internal Controls:

Robust internal controls are essential to prevent accounting errors and ensure the accuracy of financial reporting. Regular internal audits, proper segregation of duties, and appropriate authorization levels can minimize the likelihood of future discrepancies.

5. Enhance Credit Risk Assessment:

Refine the methods for assessing creditworthiness. Consider incorporating more sophisticated credit scoring models or utilizing external credit reporting agencies. This can lead to more accurate predictions of potential bad debts and better management of credit risk.

The Implications of a Debit Balance

A debit balance in the allowance for doubtful accounts has several important implications:

-

Misstated Financial Statements: It directly impacts the accuracy of the balance sheet, potentially understating expenses and overstating net income. This misrepresentation can mislead investors, creditors, and other stakeholders.

-

Tax Implications: The allowance for doubtful accounts affects tax calculations. A debit balance could lead to an overstatement of taxable income.

-

Credit Rating Impact: Credit rating agencies consider the quality of accounts receivable when assessing a company's creditworthiness. A significant debit balance might negatively affect a company's credit rating.

-

Management Concerns: A persistent debit balance signals potential weaknesses in credit management, accounting practices, and overall financial controls. This warrants serious attention from management.

Preventing Future Debit Balances

Preventing future debit balances involves proactive measures:

-

Regular Review of the Allowance: Periodically review and adjust the allowance based on current conditions and updated forecasts.

-

Improved Credit Scoring: Invest in more sophisticated credit scoring models to accurately predict the likelihood of default.

-

Enhanced Collection Procedures: Streamline and improve the collection procedures to reduce the number of outstanding accounts.

-

Robust Internal Controls: Implement strong internal controls to prevent errors and ensure accurate reporting.

-

Regular Monitoring of Economic Conditions: Stay informed about macroeconomic trends and their potential impact on the company's ability to collect receivables.

Conclusion

A debit balance in the allowance for doubtful accounts is not a trivial matter. It indicates a potential problem with the estimation of bad debts, collection processes, or accounting procedures. Addressing this issue requires a thorough investigation, adjustments to the allowance, improved credit policies, and enhanced internal controls. By taking proactive steps to understand the root cause and implement corrective measures, companies can prevent future debit balances, maintain accurate financial reporting, and manage their credit risk effectively. The key takeaway is proactive monitoring, accurate estimations, and a robust internal control system to ensure the long-term financial health of the business.

Latest Posts

Latest Posts

-

Steven Roberts Oregon Mental Health Counselor

Mar 20, 2025

-

Manager Must Not Interpert Variances In Isolation From Each Other

Mar 20, 2025

-

W E B Du Bois Encouraged Black Americans To

Mar 20, 2025

-

Which Two Statements Are True Of Product Positioning

Mar 20, 2025

-

Sort These Nucleotide Building Blocks By Their Name Or Classification

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about A Debit Balance In The Allowance For Doubtful Accounts . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.