A Debit Balance In Manufacturing Overhead Means Overhead Was

Holbox

Mar 13, 2025 · 6 min read

Table of Contents

- A Debit Balance In Manufacturing Overhead Means Overhead Was

- Table of Contents

- A Debit Balance in Manufacturing Overhead Means Overhead Was…Underapplied! Understanding and Addressing the Issue

- Understanding Manufacturing Overhead

- The Mechanics of Applying Overhead

- Why a Debit Balance Occurs: Underapplied Overhead

- 1. Inaccurate Estimation of Overhead Costs:

- 2. Inaccurate Estimation of the Activity Base:

- 3. Unexpected Changes in the Production Process:

- 4. Inefficiencies in Production:

- Addressing an Underapplied Overhead Balance

- 1. Proration Method:

- 2. Allocation to Cost of Goods Sold:

- Preventing Underapplied Overhead in the Future

- Overapplied Overhead: The Opposite Scenario

- Conclusion

- Latest Posts

- Related Post

A Debit Balance in Manufacturing Overhead Means Overhead Was…Underapplied! Understanding and Addressing the Issue

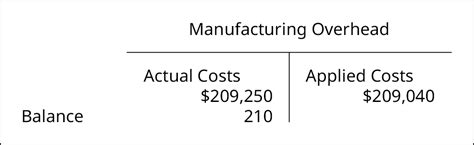

A debit balance in the manufacturing overhead account signifies that manufacturing overhead costs were underapplied. This means the actual overhead costs incurred during a period exceeded the overhead costs applied to production. Understanding why this happens and how to address it is crucial for accurate product costing and overall financial health. This comprehensive guide will delve into the intricacies of manufacturing overhead, explaining what a debit balance represents, the common causes, and the best practices for rectifying this accounting anomaly.

Understanding Manufacturing Overhead

Before we dissect the implications of a debit balance, let's establish a firm grasp on manufacturing overhead itself. Manufacturing overhead encompasses all indirect costs associated with producing goods. Unlike direct materials and direct labor, which are easily traceable to specific products, overhead costs are indirect and must be allocated.

Examples of manufacturing overhead costs include:

- Indirect materials: Consumables like lubricants, cleaning supplies, and small tools not directly incorporated into the final product.

- Indirect labor: Wages paid to factory supervisors, maintenance personnel, and quality control inspectors.

- Factory rent and utilities: Costs associated with the factory building, including electricity, water, and heating.

- Depreciation on factory equipment: The allocation of the cost of equipment over its useful life.

- Factory insurance: Premiums paid for property and liability insurance covering the factory.

The Mechanics of Applying Overhead

Manufacturing overhead is applied to production using a predetermined overhead rate. This rate is calculated at the beginning of an accounting period (usually annually) and is based on estimated overhead costs and an estimated activity base. The activity base is a measure of production volume, such as direct labor hours, machine hours, or direct labor costs.

The formula for calculating the predetermined overhead rate is:

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Activity Base

Throughout the production process, this predetermined overhead rate is then applied to the actual activity base used. This applied overhead is then credited to the manufacturing overhead account.

Why a Debit Balance Occurs: Underapplied Overhead

A debit balance in the manufacturing overhead account means that the actual overhead costs incurred exceeded the overhead costs applied to production. This is known as underapplied overhead. Several factors can contribute to this scenario:

1. Inaccurate Estimation of Overhead Costs:

The most common reason for underapplied overhead is an underestimation of total manufacturing overhead costs at the beginning of the period when the predetermined overhead rate was calculated. If the actual overhead expenses are significantly higher than initially projected, the applied overhead will be insufficient, leading to a debit balance. This could stem from unforeseen circumstances like unexpected equipment repairs, increased utility costs, or inflation impacting material prices.

2. Inaccurate Estimation of the Activity Base:

Similarly, an underestimation of the activity base can also contribute to underapplied overhead. If the actual production volume is higher than anticipated, the predetermined overhead rate will be applied to a larger base than initially projected, resulting in a smaller amount of overhead being applied. If the actual costs remain steady but the production volume increases, the overhead will appear underapplied.

3. Unexpected Changes in the Production Process:

Unforeseen changes in the production process itself can also cause underapplied overhead. These changes might lead to increased usage of indirect materials, higher indirect labor costs due to additional training or adjustments, or necessitate additional expenses not considered in the initial estimation.

4. Inefficiencies in Production:

Inefficiencies in the production process can lead to increased overhead costs. This might include machine downtime, material waste, or increased labor hours due to production bottlenecks. Such inefficiencies are not always easily foreseen and directly contribute to a higher actual overhead.

Addressing an Underapplied Overhead Balance

When a debit balance exists in the manufacturing overhead account, it needs to be addressed at the end of the accounting period. There are two primary methods for adjusting for underapplied overhead:

1. Proration Method:

The proration method distributes the underapplied overhead proportionally across the work-in-process (WIP), finished goods, and cost of goods sold (COGS) inventories. This method recognizes that the underapplied overhead affects all three accounts. The formula for each account is:

- WIP: (WIP/Total) * Underapplied Overhead

- Finished Goods: (Finished Goods/Total) * Underapplied Overhead

- COGS: (COGS/Total) * Underapplied Overhead

Where "Total" is the sum of the WIP, finished goods, and COGS inventory values. This method is generally considered the most accurate because it spreads the impact across multiple inventory accounts, reflecting the actual cost incurred in the production process.

2. Allocation to Cost of Goods Sold:

The simpler method is to allocate the entire underapplied overhead amount directly to the cost of goods sold (COGS) account. This approach is easier to implement, but it might present a less accurate representation of product costs. It is generally favored when the underapplied overhead is relatively small compared to the total cost of goods sold.

Preventing Underapplied Overhead in the Future

Preventing underapplied overhead is a proactive approach focusing on improving cost estimation and production efficiency. Here are some crucial strategies:

-

Accurate Cost Estimation: Employ meticulous budgeting and forecasting processes. Conduct thorough research to anticipate potential changes and fluctuations in material, labor, and utility costs. Consider using historical data, industry benchmarks, and input from experienced personnel for a more comprehensive estimate.

-

Refine the Activity Base: Choose an activity base that accurately reflects the manufacturing process. If machine hours are more indicative of overhead costs than direct labor hours, use machine hours as your activity base. Regularly review and adjust your chosen activity base to maintain alignment with production realities.

-

Improve Production Efficiency: Implement measures to streamline the production process and reduce inefficiencies. This includes preventative maintenance on equipment, better inventory management, employee training and upskilling, and process optimization initiatives.

-

Regular Monitoring and Analysis: Regularly monitor actual overhead costs throughout the accounting period. Compare them to the budgeted amounts and investigate any significant variances. Promptly identify and address the root causes of any unfavorable deviations.

-

Regular Review and Adjustment of the Predetermined Overhead Rate: Consider adjusting the predetermined overhead rate more frequently (e.g., quarterly instead of annually) if there are significant fluctuations in overhead costs or production volume. This allows for quicker adaptation to changing conditions and reduces the likelihood of substantial underapplication or overapplication.

Overapplied Overhead: The Opposite Scenario

While this article focuses on underapplied overhead, it's important to briefly mention its counterpart: overapplied overhead. Overapplied overhead occurs when the actual overhead costs are less than the overhead costs applied to production, resulting in a credit balance in the manufacturing overhead account. The methods for adjusting for overapplied overhead are similar to those for underapplied overhead: it can be prorated across WIP, finished goods, and COGS, or allocated entirely to COGS.

Conclusion

A debit balance in the manufacturing overhead account signifies underapplied overhead – a situation where actual overhead costs surpassed applied overhead. This discrepancy necessitates adjustment at the end of the accounting period using either the proration method or allocation to COGS. Preventing underapplied overhead requires careful cost estimation, a well-chosen activity base, efficient production practices, and continuous monitoring. By implementing these strategies, businesses can enhance cost accuracy, improve financial reporting, and ultimately strengthen their bottom line. Understanding and managing manufacturing overhead is a critical aspect of effective cost accounting and overall business management.

Latest Posts

Related Post

Thank you for visiting our website which covers about A Debit Balance In Manufacturing Overhead Means Overhead Was . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.