A Company's Balance Sheet Has Total Assets Of $400 000

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

Decoding a Company's Balance Sheet: A Deep Dive into $400,000 in Total Assets

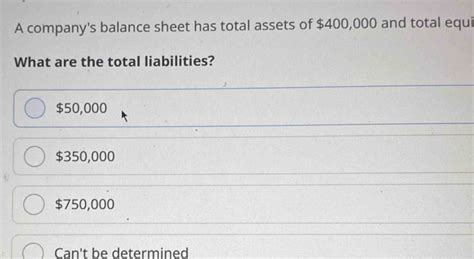

A company's balance sheet is a fundamental financial statement providing a snapshot of its financial health at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. Knowing that a company boasts total assets of $400,000 offers a starting point for analysis, but a comprehensive understanding requires a deeper dive into the composition of those assets, along with the liabilities and equity that balance them. This article will explore the various possibilities, interpretations, and implications of a $400,000 total asset figure, considering different industry contexts and business models.

Understanding the Balance Sheet Equation

Before we dissect the $400,000 figure, let's reinforce the core principle of the balance sheet. The equation, Assets = Liabilities + Equity, means that everything a company owns (assets) is funded either by what it owes to others (liabilities) or by the investments made by its owners (equity). This equation always balances. Any change on one side must be matched by an equal change on the other side.

Assets represent what a company owns – things of value that can be converted into cash. These are typically categorized as:

- Current Assets: Assets expected to be converted into cash within one year (e.g., cash, accounts receivable, inventory).

- Non-Current Assets: Assets expected to provide benefits for more than one year (e.g., property, plant, and equipment (PP&E), intangible assets like patents).

Liabilities represent what a company owes to others. These are categorized as:

- Current Liabilities: Debts due within one year (e.g., accounts payable, short-term loans).

- Non-Current Liabilities: Debts due in more than one year (e.g., long-term loans, mortgages).

Equity represents the residual interest in the assets of the company after deducting liabilities. This is essentially the owners' stake in the business. For corporations, this is often called shareholders' equity. For sole proprietorships and partnerships, it's often called owner's equity.

Dissecting the $400,000 Total Assets

With $400,000 in total assets, numerous scenarios are possible depending on how those assets are allocated and how they are financed (liabilities and equity). Let's explore a few plausible examples:

Scenario 1: A Small Retail Business

Imagine a small retail store with $400,000 in total assets. A possible breakdown could be:

- Current Assets:

- Cash: $20,000

- Accounts Receivable: $10,000

- Inventory: $150,000

- Prepaid Expenses: $5,000

- Total Current Assets: $185,000

- Non-Current Assets:

- Property, Plant & Equipment (Store building & Fixtures): $180,000

- Other Assets (e.g., delivery vehicles): $35,000

- Total Non-Current Assets: $215,000

- Total Assets: $400,000

In this scenario, the business's assets are heavily invested in physical assets like the store building and inventory. The relatively low cash balance might indicate tight cash flow, requiring careful management of working capital. The composition of liabilities and equity would significantly influence the overall financial health assessment. A high level of debt could signify risk, while substantial equity suggests financial strength.

Scenario 2: A Young Technology Startup

A technology startup with $400,000 in total assets could present a very different picture:

- Current Assets:

- Cash: $100,000 (significant cash reserves from seed funding)

- Accounts Receivable: $15,000

- Prepaid Expenses: $5,000

- Total Current Assets: $120,000

- Non-Current Assets:

- Intellectual Property (Software, Patents): $200,000 (a valuable intangible asset)

- Equipment (Computers, servers): $80,000

- Total Non-Current Assets: $280,000

- Total Assets: $400,000

This scenario highlights the importance of intangible assets in certain industries. The substantial cash reserves suggest a healthy financial position, at least temporarily. However, the high valuation of intellectual property requires careful consideration of its true market value and potential for future revenue generation.

Scenario 3: A Service-Based Business

A service-based business, such as a consulting firm, might have a lower concentration of physical assets:

- Current Assets:

- Cash: $50,000

- Accounts Receivable: $100,000 (significant receivables from clients)

- Prepaid Expenses: $10,000

- Total Current Assets: $160,000

- Non-Current Assets:

- Office Equipment: $20,000

- Other Assets (e.g., software licenses): $220,000

- Total Non-Current Assets: $240,000

- Total Assets: $400,000

Here, the dominant asset is accounts receivable, reflecting the nature of the business. The high level of accounts receivable necessitates close monitoring of client payment habits to mitigate the risk of bad debts. The lower level of tangible assets compared to other scenarios highlights the differences in business models.

The Importance of Context: Liabilities and Equity

The total assets figure alone is insufficient for a thorough analysis. Understanding the composition of liabilities and equity is crucial. Let's consider some possibilities:

-

High Debt, Low Equity: This could indicate a financially risky situation, potentially making the business vulnerable to economic downturns or interest rate hikes. While leveraging debt can be beneficial for growth, excessive reliance on debt can lead to financial instability.

-

Low Debt, High Equity: This suggests a strong financial foundation and reduced financial risk. The business is less reliant on external funding, providing greater financial flexibility and stability.

-

Balanced Debt and Equity: A balanced approach can offer a good compromise between leveraging debt for growth and maintaining financial stability.

-

Negative Equity: This is a serious situation indicating that the company's liabilities exceed its assets. This often points towards insolvency and potential bankruptcy.

Analyzing the Financial Health: Beyond Total Assets

To comprehensively assess the financial health of a company with $400,000 in total assets, additional financial ratios and analyses are necessary:

-

Liquidity Ratios: These ratios assess the ability of the company to meet its short-term obligations. Examples include the current ratio and quick ratio. A high ratio indicates good liquidity, while a low ratio might signal potential liquidity problems.

-

Profitability Ratios: These ratios evaluate the company's ability to generate profits. Examples include gross profit margin, net profit margin, and return on assets (ROA). Strong profitability ratios are a sign of a healthy business.

-

Solvency Ratios: These ratios measure the company's ability to meet its long-term obligations. Examples include the debt-to-equity ratio and times interest earned ratio. High solvency ratios might suggest a higher level of risk.

-

Efficiency Ratios: These ratios assess how effectively the company utilizes its assets. Examples include inventory turnover and accounts receivable turnover. High turnover ratios generally signify efficient operations.

Conclusion: A Holistic Approach to Financial Analysis

A company's balance sheet with $400,000 in total assets provides a starting point for financial analysis but not a complete picture. To obtain a thorough understanding, one must analyze the composition of assets, liabilities, and equity, considering the specific industry context and business model. Further analysis using various financial ratios and comparative data is essential for a comprehensive assessment of the company's financial health and stability. Ignoring any of these elements would result in an incomplete and potentially misleading interpretation of the company's financial position. Remember, a strong financial position requires a balanced approach, effective management of resources, and a clear understanding of the company's financial goals and strategies.

Latest Posts

Latest Posts

-

Shiraz Needs To Record Receipt Of A Vendor Invoice

Mar 20, 2025

-

Managers Can Use An Action Plan To

Mar 20, 2025

-

A Customer Associate Is Assisting A Customer

Mar 20, 2025

-

The Main Workspace Of A Windows Computer Is Called The

Mar 20, 2025

-

Using The Formula You Obtained In B 11

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about A Company's Balance Sheet Has Total Assets Of $400 000 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.