A Certificate Of Deposit Usually Has

Holbox

Mar 25, 2025 · 7 min read

Table of Contents

- A Certificate Of Deposit Usually Has

- Table of Contents

- A Certificate of Deposit Usually Has: A Comprehensive Guide

- Key Features of a Certificate of Deposit

- 1. Fixed Interest Rate: The Cornerstone of CDs

- 2. Fixed Term: Commitment and Predictability

- 3. Minimum Deposit Requirements: Getting Started

- 4. Penalties for Early Withdrawal: The Price of Flexibility

- 5. FDIC Insurance (or equivalent): Protecting Your Savings

- 6. Interest Payment Options: How You Receive Your Earnings

- 7. Rollover Options: Extending Your Investment

- 8. Different CD Types: Catering to Various Needs

- Choosing the Right CD: Factors to Consider

- 1. Your Financial Goals: Short-Term or Long-Term?

- 2. Your Risk Tolerance: Balancing Risk and Reward

- 3. Interest Rate Environment: Timing Your Investment

- 4. Fees and Penalties: Understanding the Fine Print

- 5. Your Banking Relationship: Loyalty and Convenience

- Beyond the Basics: Additional Considerations

- Conclusion: Maximizing Your CD Investment

- Latest Posts

- Latest Posts

- Related Post

A Certificate of Deposit Usually Has: A Comprehensive Guide

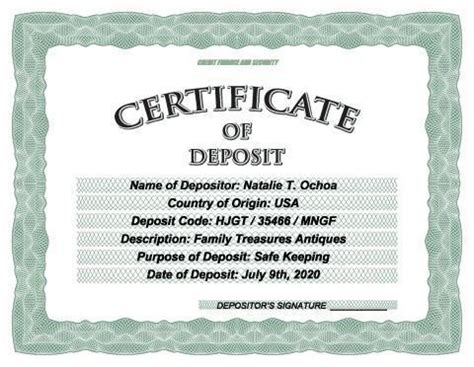

A Certificate of Deposit (CD) is a savings instrument offered by banks and credit unions that provides a fixed interest rate for a specified period. While offering a secure way to grow your savings, understanding the specifics of a CD is crucial before investing. This comprehensive guide will delve into the typical features of a CD, clarifying what you can usually expect when opening one.

Key Features of a Certificate of Deposit

A CD usually possesses several key features that distinguish it from other savings accounts:

1. Fixed Interest Rate: The Cornerstone of CDs

One of the most defining characteristics of a CD is its fixed interest rate. Unlike savings accounts that may adjust their interest rates based on market fluctuations, a CD locks in a specific rate for the entire term. This predictability allows you to accurately calculate your potential earnings and plan your finances accordingly. The rate offered depends on several factors, including the term length and the current market interest rates. Generally, longer terms command higher interest rates due to the increased commitment from the depositor.

2. Fixed Term: Commitment and Predictability

CDs come with a fixed term, also known as a maturity date. This is the length of time you agree to keep your money deposited. Common terms range from a few months to several years. While early withdrawal is usually possible, it often incurs penalties, making it vital to choose a term that aligns with your financial goals and timeline. Understanding the term length is crucial to avoid unforeseen penalties.

3. Minimum Deposit Requirements: Getting Started

Most banks and credit unions set a minimum deposit requirement for opening a CD. This minimum amount varies depending on the financial institution and the specific CD product. Some may have low minimums, making them accessible to a wider range of savers, while others might require larger initial deposits. It's essential to check the minimum deposit amount before applying to ensure it aligns with your financial capabilities.

4. Penalties for Early Withdrawal: The Price of Flexibility

One significant consideration is the penalty for early withdrawal. If you withdraw your money before the maturity date, you'll usually face a penalty, often a reduction in interest earned or a percentage of the principal. The penalty structure can vary, so reviewing the terms and conditions carefully before committing is essential. This penalty acts as an incentive to keep your money invested for the agreed-upon term.

5. FDIC Insurance (or equivalent): Protecting Your Savings

In the US, many CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank, for each account ownership category. This insurance protects your money against bank failure, providing a safety net for your investment. Outside the US, similar government insurance programs often exist, providing the same level of security. Always confirm the insurance coverage before investing your money.

6. Interest Payment Options: How You Receive Your Earnings

CDs usually offer different options for receiving your interest payments. Common options include:

-

Accrual of Interest: The interest earned is added to the principal amount at maturity. This strategy results in a larger sum at the end of the term.

-

Periodic Payments: Interest can be paid out at regular intervals, such as monthly, quarterly, or semi-annually. This option provides a regular stream of income throughout the CD's term. This is particularly attractive for those who need regular income.

Choosing the payment option depends entirely on your individual financial circumstances and goals.

7. Rollover Options: Extending Your Investment

Many CDs offer rollover options at maturity. This allows you to reinvest your principal and accumulated interest into a new CD, often with a new interest rate based on current market conditions. This provides a convenient way to continue your investment without needing to actively seek out a new CD. However, always analyze the prevailing interest rates to make an informed decision.

8. Different CD Types: Catering to Various Needs

The market offers a variety of CD types, catering to diverse financial goals and risk tolerances. These may include:

-

Standard CDs: These are the most common type, offering a fixed interest rate and term.

-

Bump-Up CDs: Allow you to increase the interest rate at specific times during the term, usually in response to market changes. This offers the potential for higher returns but is often dependent on market performance.

-

Step-Up CDs: The interest rate increases periodically throughout the CD's term according to a predetermined schedule. This provides a more predictable increase in returns over time.

-

Callable CDs: These CDs can be called (redeemed) by the issuing bank before maturity, often at a premium. This gives the bank flexibility, but poses a risk to the depositor if called early.

-

Brokered CDs: These are CDs sold through brokers rather than directly from the bank. They may offer higher rates but often involve higher minimum deposit requirements and potentially more complex terms.

Choosing the Right CD: Factors to Consider

Selecting the appropriate CD requires careful consideration of several factors:

1. Your Financial Goals: Short-Term or Long-Term?

Consider your financial objectives. Do you need the money in the short-term, or are you saving for a long-term goal such as retirement? This will significantly influence your choice of CD term. Short-term goals may be better suited to shorter-term CDs, minimizing potential penalties for early withdrawal. Long-term goals can benefit from longer-term CDs, potentially offering higher returns.

2. Your Risk Tolerance: Balancing Risk and Reward

While CDs are generally considered low-risk investments, there is still an element of risk, particularly with callable CDs or CDs in banks that are not well-capitalized. Assess your risk tolerance and opt for a CD that aligns with your comfort level. The interest rate offered should be balanced against the associated risk.

3. Interest Rate Environment: Timing Your Investment

Current interest rates play a crucial role in the attractiveness of a CD. When interest rates are rising, locking into a fixed rate for a longer term may not be the most advantageous strategy. Conversely, when rates are low, a longer-term CD could offer higher returns compared to shorter-term options. Keeping an eye on economic trends is essential for optimal decision-making.

4. Fees and Penalties: Understanding the Fine Print

Carefully review all fees and penalties associated with the CD, including early withdrawal penalties and any account maintenance fees. These costs can significantly impact your overall returns. Transparency is paramount, so don't hesitate to ask for clarification on any unclear terms.

5. Your Banking Relationship: Loyalty and Convenience

Your existing relationship with the financial institution may influence your decision. If you already have a strong relationship with a bank, you might find it convenient to open a CD with them. However, always compare rates and terms offered by different institutions to ensure you're getting the best deal, regardless of your existing relationship.

Beyond the Basics: Additional Considerations

While the features discussed above are common to most CDs, certain nuances can exist:

-

Inflation: The real return on your CD is affected by inflation. While you earn a fixed interest rate, the purchasing power of your money can decrease if inflation outpaces your interest earnings. Consider this when deciding on a CD term and interest rate.

-

Tax Implications: Interest earned on CDs is generally taxable income. Understand the tax implications in your jurisdiction to accurately assess your net returns.

-

Liquidity: While CDs provide a relatively safe and stable investment, they are not as liquid as savings accounts. Consider your need for liquidity when deciding how much money to invest in CDs.

Conclusion: Maximizing Your CD Investment

A Certificate of Deposit, with its features of a fixed interest rate, fixed term, and various options for interest payments, offers a secure and predictable way to grow your savings. However, understanding the nuances of different CD types, fees, penalties, and the current market environment is crucial for maximizing your returns. By carefully considering your financial goals, risk tolerance, and the available options, you can choose the CD that best aligns with your needs and helps you achieve your financial objectives. Remember that seeking advice from a qualified financial advisor can help you make informed decisions regarding your CD investments.

Latest Posts

Latest Posts

-

The Recuperative Functions Of Sleep Do Not Include

Mar 29, 2025

-

What Financial Amount Is Considered Tier 1 Exploitation

Mar 29, 2025

-

Data Is Collected As A Result Of Computer Modeling

Mar 29, 2025

-

Which Theorist Claimed That People Rise

Mar 29, 2025

-

Coenzyme A Nad And Fad Are Coenzymes That Are Necessary

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about A Certificate Of Deposit Usually Has . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.