A Business Uses A Credit To Record

Holbox

Mar 14, 2025 · 5 min read

Table of Contents

When a Business Uses Credit to Record Transactions: A Comprehensive Guide

Understanding how credit entries affect your business's financial records is crucial for accurate accounting and informed financial decision-making. This comprehensive guide delves into the various scenarios where businesses utilize credit entries, exploring their impact on the accounting equation and providing practical examples. We'll also touch upon the importance of accurate record-keeping and the potential pitfalls of neglecting proper credit entry procedures.

Understanding the Accounting Equation: Assets = Liabilities + Equity

Before diving into the specifics of credit entries, it's essential to grasp the fundamental accounting equation: Assets = Liabilities + Equity. This equation represents the basic structure of a balance sheet, showcasing the relationship between a company's assets (what it owns), liabilities (what it owes), and equity (the owners' stake). Every transaction affects at least two of these accounts, ensuring the equation remains balanced.

What is a Credit Entry?

A credit entry, in simple terms, is a bookkeeping entry that increases liability, equity, and revenue accounts while decreasing asset and expense accounts. This might seem counterintuitive at first, but understanding the nature of each account type clarifies the logic. Think of it as increasing what you owe (liabilities) or what others owe you (revenue) while decreasing what you own (assets) or what you spend (expenses).

Common Scenarios Where Businesses Use Credit to Record Transactions

Let's explore various business scenarios where credit entries are essential:

1. Purchasing Goods or Services on Credit

When a business buys goods or services on credit from a supplier, it incurs an account payable—a liability. The transaction is recorded with a debit to the asset account (e.g., Inventory or Supplies) and a credit to the liability account (Accounts Payable).

Example: A bakery purchases $500 worth of flour on credit from a supplier.

- Debit: Inventory $500 (Increase in assets - we now have more flour)

- Credit: Accounts Payable $500 (Increase in liabilities - we owe the supplier money)

2. Receiving Loans

Securing a loan increases a business's liabilities (the loan amount) and increases its assets (the cash received). The accounting entries reflect this:

Example: A business receives a $10,000 loan from a bank.

- Debit: Cash $10,000 (Increase in assets - we have more cash)

- Credit: Loans Payable $10,000 (Increase in liabilities - we owe the bank money)

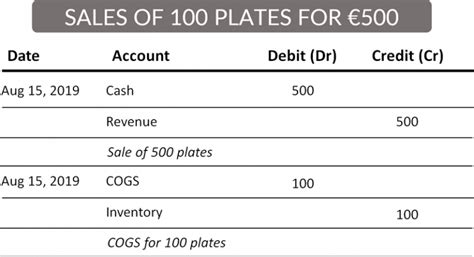

3. Recording Revenue from Sales on Credit

When a business sells goods or services on credit, it generates revenue but doesn't immediately receive cash. This increases Accounts Receivable (an asset representing money owed to the business) and increases revenue.

Example: A clothing store sells $200 worth of merchandise to a customer on credit.

- Debit: Accounts Receivable $200 (Increase in assets - customer owes us money)

- Credit: Sales Revenue $200 (Increase in revenue - we made a sale)

4. Making Payments on Accounts Payable

When a business pays off its outstanding accounts payable, it decreases its liabilities and decreases its assets (cash).

Example: The bakery from the first example pays its $500 flour bill.

- Debit: Accounts Payable $500 (Decrease in liabilities - we no longer owe the supplier)

- Credit: Cash $500 (Decrease in assets - we paid the bill)

5. Receiving Payments on Accounts Receivable

When a customer pays their outstanding balance, the business's assets (cash) increase, while its assets (accounts receivable) decrease.

Example: The clothing store receives payment for the $200 sale.

- Debit: Cash $200 (Increase in assets - we received the payment)

- Credit: Accounts Receivable $200 (Decrease in assets - the customer no longer owes us)

6. Owner's Contributions

When the owner invests additional capital into the business, the equity increases and the assets (usually cash) increase.

Example: The owner invests an additional $5,000 into the business.

- Debit: Cash $5,000 (Increase in assets)

- Credit: Owner's Equity $5,000 (Increase in equity)

7. Recording Expenses

While expenses typically involve debits (increasing expense accounts), some situations might require a credit entry. For instance, prepaid expenses that are used up over time are initially debited. When the expense is recognized, the asset account (prepaid expense) is credited, and the expense account is debited.

Example: A business prepaid $1,200 for insurance for one year. After three months, $300 of the prepaid insurance needs to be expensed.

- Debit: Insurance Expense $300 (Increase in expenses)

- Credit: Prepaid Insurance $300 (Decrease in assets - portion of the prepaid insurance has been used)

The Importance of Accurate Credit Entries

Maintaining accurate credit entries is paramount for several reasons:

- Accurate Financial Statements: Incorrect entries lead to inaccurate balance sheets, income statements, and cash flow statements, hindering informed decision-making.

- Tax Compliance: Errors in credit entries can lead to incorrect tax filings, resulting in penalties and legal issues.

- Investor Confidence: Accurate financial records build trust with investors and lenders, attracting capital and securing favorable financing terms.

- Effective Budgeting and Forecasting: Reliable financial data is crucial for accurate budgeting, forecasting, and strategic planning.

- Fraud Prevention: Careful credit entry practices help identify and prevent fraudulent activities.

Potential Pitfalls of Neglecting Proper Credit Entry Procedures

Ignoring proper credit entry procedures can result in several negative consequences:

- Inaccurate Financial Reporting: Leading to flawed business decisions and potentially misleading investors.

- Increased Risk of Errors: Manual entry increases the chance of human errors, causing discrepancies and inaccuracies.

- Difficulty in Auditing: Poor record-keeping makes audits more complex and time-consuming.

- Legal and Tax Issues: Inaccurate records can lead to significant legal and tax problems.

- Loss of Business Credibility: Erroneous financial data can severely damage the reputation and credibility of a business.

Utilizing Accounting Software

Modern accounting software greatly simplifies the process of managing credit entries. These programs automate many aspects of bookkeeping, reducing errors and ensuring accuracy. Features like automated journal entries, real-time reporting, and robust data security make accounting software an invaluable tool for businesses of all sizes.

Conclusion: The Crucial Role of Credit Entries

Credit entries are an integral part of double-entry bookkeeping, ensuring the balance of the accounting equation and the accuracy of financial statements. Understanding their role in various business transactions is crucial for accurate financial record-keeping, informed decision-making, and overall business success. By implementing proper credit entry procedures and leveraging accounting software, businesses can minimize errors, improve efficiency, and build a strong foundation for sustainable growth. Regular review of these entries and reconciliation with bank statements is crucial to maintain accuracy and identify any discrepancies early. Diligence in this area ultimately contributes to the long-term financial health and success of any business.

Latest Posts

Latest Posts

-

Suppose A New Technology Is Discovered Which Increases Productivity

Mar 14, 2025

-

Managers Must Recognize That Motivating Individuals Today Requires

Mar 14, 2025

-

Drag Each Label To The Appropriate Location On The Flowchart

Mar 14, 2025

-

The Manufacturing Overhead Account Is Debited When

Mar 14, 2025

-

Test Your Basic Knowledge About Clotting Factors And Anticoagulants

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about A Business Uses A Credit To Record . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.