A Bank Statement Provided By The Bank Includes

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

Decoding Your Bank Statement: A Comprehensive Guide

A bank statement, that seemingly simple document, holds the key to understanding your financial health. It's a detailed record of all transactions conducted within a specific period, providing invaluable insights into your spending habits, income sources, and overall financial standing. Understanding your bank statement thoroughly is crucial for budgeting, identifying potential errors, and even detecting fraudulent activity. This comprehensive guide will unravel the mysteries of a typical bank statement, empowering you to utilize this document effectively.

Understanding the Components of a Bank Statement

Your bank statement, regardless of whether it's from a physical branch or accessed online, will typically include several key components. These components work together to paint a complete picture of your account activity:

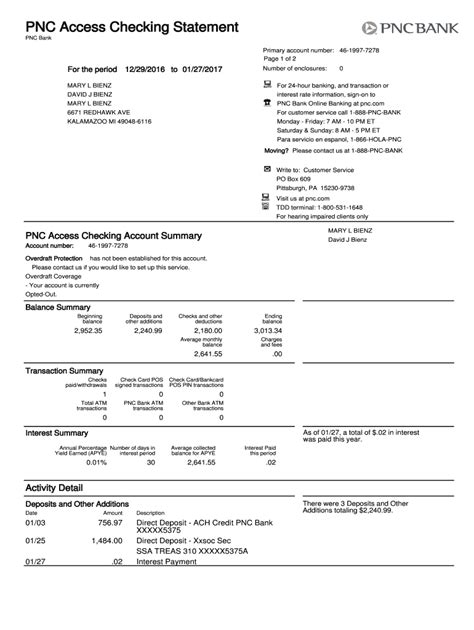

1. Account Information:

- Account Number: Your unique account identifier. Keep this confidential.

- Account Holder Name: The name(s) associated with the account.

- Account Type: Specifies whether it's a checking account, savings account, or another type of account.

- Statement Period: The dates covered by the statement, usually a month.

2. Beginning and Ending Balances:

- Beginning Balance: The amount of money in your account at the start of the statement period.

- Ending Balance: The amount of money in your account at the end of the statement period. This is the balance after all transactions have been processed.

3. Transaction Details:

This is the heart of your bank statement. Each transaction is typically detailed with the following information:

- Transaction Date: The date the transaction occurred.

- Description: A brief description of the transaction, often including the payee or payer name, and sometimes a merchant identifier.

- Debit/Credit: Indicates whether money was withdrawn (debit) or deposited (credit) into your account.

- Amount: The monetary value of the transaction.

- Balance: The account balance after each transaction. This running balance allows you to track your funds throughout the statement period.

4. Fees and Charges:

- Monthly Service Fees: Charges levied by the bank for maintaining the account.

- Overdraft Fees: Charges incurred when you spend more money than you have available in your account.

- Other Fees: Any additional charges, such as ATM fees, returned check fees, or wire transfer fees. Understanding these fees helps you budget effectively and minimize unnecessary charges.

5. Interest Earned (for Savings Accounts):

Savings accounts typically accrue interest. Your statement will show the amount of interest earned during the statement period, reflecting the interest rate applied to your balance.

Deciphering Different Transaction Types

Bank statements can contain a variety of transaction types. Recognizing these will help you analyze your spending effectively. Here are some common types:

- Deposits: Money added to your account, such as direct deposits from your employer, mobile deposits, or cash deposits.

- Withdrawals: Money removed from your account, such as ATM withdrawals, checks written, online transfers, and debit card purchases.

- Transfers: Movement of funds between your accounts (e.g., transferring money from checking to savings).

- ACH Transfers: Automated Clearing House transactions, such as recurring bill payments or direct deposits.

- Debit Card Purchases: Purchases made using your debit card.

- ATM Withdrawals: Cash withdrawals made from an Automated Teller Machine.

- Check Payments: Payments made using checks written from your account.

- Electronic Payments: Payments made online or through other electronic means.

- Interest Paid/Received: Interest earned on savings accounts or paid on loans.

Utilizing Your Bank Statement for Financial Management

Your bank statement is far more than just a record of transactions; it's a valuable tool for managing your finances. Here's how to leverage it:

1. Budgeting and Expense Tracking:

Carefully reviewing your statement allows you to accurately track your expenses. Categorize your spending (e.g., groceries, transportation, entertainment) to identify areas where you might overspend. This detailed analysis forms the basis for creating a realistic budget.

2. Reconciling Your Accounts:

Regularly reconcile your bank statement with your personal records (checkbook, online transaction tracking) to ensure accuracy. This helps catch errors and identify any discrepancies early on. This is crucial for preventing unexpected financial issues.

3. Monitoring Income Sources:

Your bank statement provides a clear picture of your income streams, including direct deposits from employers, freelance payments, or investment returns. This helps you monitor the consistency and stability of your income.

4. Detecting Fraudulent Activity:

Regularly reviewing your bank statement is vital for detecting potential fraudulent activity. Look for unauthorized transactions, unusual activity, or discrepancies between your records and the statement. Report suspicious activity to your bank immediately.

5. Tax Preparation:

Many transactions on your bank statement are relevant for tax preparation. You might find records of tax-deductible expenses, charitable donations, or investment income. Keeping organized bank statements simplifies the tax filing process.

6. Loan Applications and Credit Score:

Your bank statements demonstrate your ability to manage your finances responsibly. They are often required when applying for loans or credit cards and contribute to your creditworthiness. A history of consistent and responsible financial management as reflected in your statements significantly improves your chances of loan approval.

7. Investment Tracking:

If you manage investments through your bank, the statement will show your investment activity, gains, losses, and dividend payments. This allows you to track the performance of your investments and make informed decisions.

Understanding and Addressing Potential Issues

While bank statements are generally accurate, discrepancies can sometimes occur. Understanding how to address these is crucial:

- Unauthorized Transactions: Report any suspicious or unauthorized transactions immediately to your bank.

- Incorrect Transaction Amounts: Contact your bank to report incorrect transaction amounts. Provide supporting documentation, such as receipts or canceled checks.

- Missing Transactions: If transactions are missing from your statement, contact your bank and provide details about the missing activity.

- Fees and Charges Discrepancies: Review your statement carefully and contact your bank if you believe any fees or charges are incorrect or unjustified.

Advanced Tips for Maximizing the Use of Bank Statements

- Download and Save Statements: Download and save electronic copies of your bank statements regularly for future reference.

- Use Budgeting Apps: Many budgeting apps integrate with your bank account to automatically categorize transactions and generate detailed spending reports.

- Set Up Alerts: Set up alerts for low balances, large transactions, or suspicious activity to enhance your financial security.

- Regularly Review Your Statements: Establish a habit of reviewing your bank statements at least once a month to maintain control of your finances.

Conclusion

Your bank statement is a powerful tool that offers much more than a simple record of transactions. By understanding its various components and utilizing the information effectively, you can improve your budgeting, manage your finances more effectively, identify potential fraud, and make informed financial decisions. Taking the time to decode your bank statement is a significant investment in your long-term financial well-being. Embrace its potential, and watch your financial literacy and control flourish.

Latest Posts

Latest Posts

-

Consider The Following Two Mutually Exclusive Projects

Mar 16, 2025

-

Transfer Prices Check All That Apply

Mar 16, 2025

-

Job A3b Was Ordered By A Customer On September 25

Mar 16, 2025

-

Silver Ions React With Thiocyanate Ions As Follows

Mar 16, 2025

-

Supervisory Managers Spend Most Of Their Time On

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about A Bank Statement Provided By The Bank Includes . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.